The U.S. recently announced tax credits for electric vehicle (EV) buyers. And Justin Trudeau isn’t happy about it.

Trudeau’s Finance Minister Chrystia Freeland said that Canada was considering sanctions against the U.S. for the EV tax credit policy. The tax credit, which is worth up to $12,500 per EV purchased, is thought to be a disincentive to buying gas-powered cars. Much of Canada’s auto industry consists of manufacturing gas cars. Because of this, Freeland alleged that the U.S. credit would amount to a 34% tax on Canadian made vehicles.

So far, it’s not clear what retaliatory tariffs Canada will impose on the United States. As Canada’s largest trade partner, the U.S. supplies many goods to Canada which could have taxes imposed on them. We won’t be able to tell which companies will win and lose from these tariffs until we have more details. However, we do know which stocks will lose and which will gain from the U.S. tariffs. In this article I will explore some stocks that are likely to gain (or lose) from the Biden administration’s tax credits.

Stocks that lose

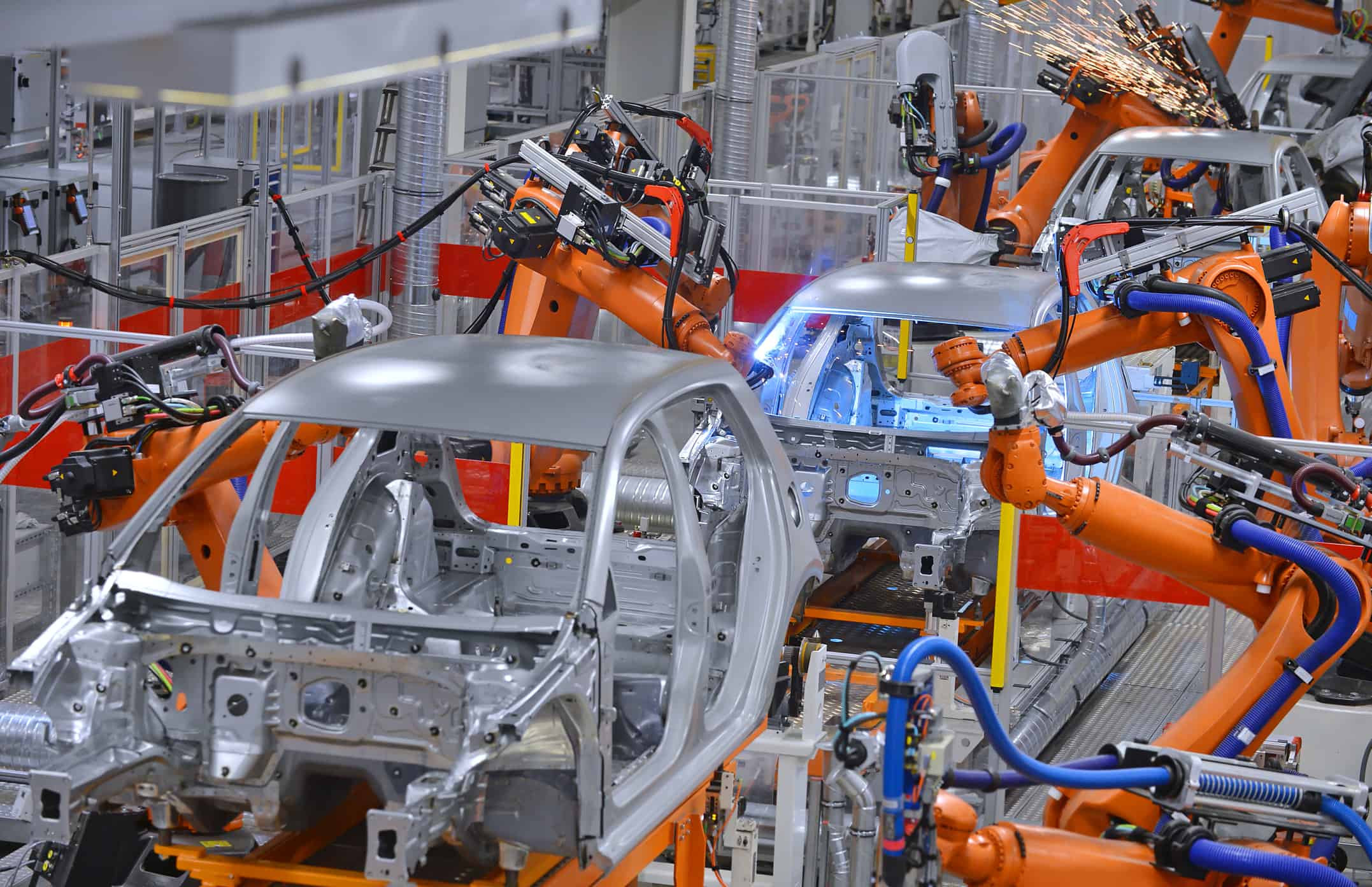

The most obvious losers from Biden’s EV tax credits are manufacturers of gas-powered cars. The generous credit on EV purchases makes these companies’ cars more expensive relative to EVs. This is part of the reason why Canada is upset about the credits. Canada’s car industry is mostly outsourced manufacturing for U.S. traditional automakers. Some examples of such companies include:

- Ford.

- GM.

- Chrysler.

All of these companies are aiming to transition to EV eventually. For now, though, the overwhelming majority of their cars are gas powered. If Biden’s EV tax credit succeeds, then their revenue would decline, as more people would be buying cars made by EV companies. Canada might also miss out on 34% of its car exports, according to Freeland’s economists.

Stocks that benefit

Although Canada’s car industry could lose money to Biden’s EV tax credit, other Canadian companies could benefit from it.

BlackBerry Inc (TSX:BB)(NYSE:BB) is one example. It’s a car software company that has a lot of EV companies among its clients. It’s particularly popular with Chinese EV companies, like WM Motor. BlackBerry’s QNX car software is used by 175 million companies worldwide. Many of them are EV companies. The software is not exclusive to EV cars by any means, but many of BlackBerry’s newly acquired clients have been EV companies. So there is some possibility that BlackBerry could see increased revenue as Biden’s tax credits increase demand for its clients’ cars.

A bit more of a long shot is Magna International (TSX:MG)(NYSE:MGA). Magna International is a traditional auto parts company that just recently branched out into EV parts. It launched a Joint Venture (JV) with LG Electronics that will see it make EV motors and other vital parts for EVs. Many traditional car companies want to get into EVs but lack the expertise needed to make all the parts themselves. Magna already does business with many of these companies, so its EV motors seem like a natural sell. Assuming its JV with LG takes off, then it could potentially gain from Biden’s new tax credits. On the flipside, its contract manufacturing of traditional cars could suffer, so the net effect is ambiguous for now.