It is interesting to consider that the S&P/TSX Composite Index is only down 4.2% over the past month. I don’t know about you, but it sure seems like many TSX stocks in my portfolio are down far more than that this December.

Frankly, the index does not seemingly reflect the carnage that has occurred in the broader Canadian market. That is especially true for small-cap stocks and technology stocks. That is because the index is heavily anchored by financials, real estate investment trusts, and telcos. These stocks have largely not budged during the recent market pullback.

It just speaks to the importance of having a diversified portfolio. When one sectors swings down (which, one always does), another may be holding the line or moving higher. Keeping this in mind, here are two diverse stocks that should each outperform the TSX in 2022 and likely beyond.

A top TSX infrastructure stock with a great dividend

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is the perfect dividend stock for diverse exposure to reliable, high-yielding real assets. Its broad portfolio of pipelines, export terminals, ports, railroads, cell towers, and data centres capture very stable cash flow yields. Most of these assets are regulated or contracted for the long term, so it is able to provide a very predictable income stream.

If inflation persists, this is a great stock to hold as a portfolio anchor. 70% of its assets have inflation-indexed contracts. Likewise, Brookfield Infrastructure also gets the added benefit of higher volume margins when the economy is hot. As a result, this TSX stock has attractive upside, with reasonably limited downside risk.

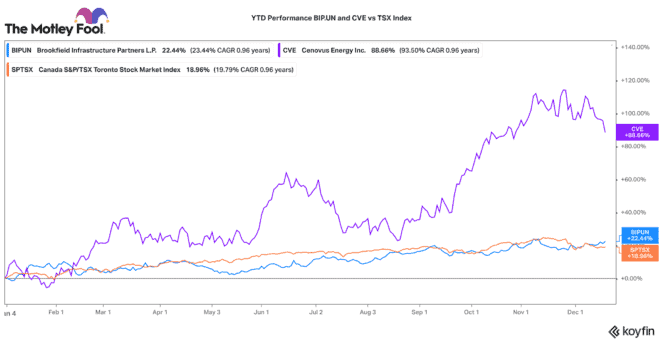

In 2021, BIP outperformed the TSX by about four percentage points (including dividends). Right now, it pays an attractive 3.5% dividend. It has raised its dividend very consistently in the mid- to high single digits for years. Chances are good this dividend growth should continue going forward. For income and stable growth, this is a great TSX stock to own in 2022 and for years to come.

An energy stock with significant upside

Although TSX energy stocks are very cyclical, the recent pullback could be an opportunity. Stocks like Cenovus (TSX:CVE)(NYSE:CVE) look to have significant upside, especially if the Omicron variant is not as severe as predicted. Cenovus has been doing all the right things lately.

It just agreed to sell off its Husky gas stations and it recently announced the $800 million sale of its Tucker thermal assets. The company is progressing well on its short-term debt-reduction targets. The great news is, the lower its debt, the better its cash-yielding returns. With oil at US$70 per barrel, Cenovus could generate more than $4.5 billion in free cash flow next year. With a market cap of $30 billion, that is a 15% free cash flow yield!

With a 94% return in 2021, this TSX stock vastly outperformed the market. Given it still trades at a material discount to its large integrated peers, it is primed to outperform again in 2022.

Today, this stock pays a minuscule 1% dividend. Yet, considering the strong potential for free cash flow generation, management believes that its dividend payout could rise by as much as 400%. For a great potential dividend and strong cyclical upside, this TSX stock is an interesting bet for market outperformance.