The Canada Revenue Agency just released good news about your Tax-Free Savings Account (TFSA). In 2022, it will raise the TFSA contribution limit by $6,000! While that is in line with 2021’s contribution increase, I never complain when I can invest more money completely tax free.

If you were 18 years or older in 2009, you can contribute a grand total of $81,500. If you have the capital, why wouldn’t you take advantage of such a gift? In fact, it is a quick recipe to save 10-20% annually (depending on your tax bracket) on your investment tax bill.

In the TFSA you don’t have to report any income or capital gains to the CRA. Consequently, you are not taxed on any dividends, interest, or gains. You get to keep all the returns. It helps create an optimal strategy for compounding wealth over time. So, if you are wondering where to invest that $6,000 TFSA contribution limit, here are three diverse stock ideas for 2022.

Brookfield Renewables: A lifetime growth trend

For some dividend income and steady long-term growth, Brookfield Renewable Partners (TSX:BEP-UN)(NYSE:BEP) is a good TFSA stock. The global transition to renewable power is a trend that should unfold for many years to come.

Brookfield has a large global platform with a diverse array of hydro, solar, wind, battery, and distributed generation assets. It is the ideal partner for large corporations, utilities, and municipalities to partner with when they are seeking to lower net carbon emissions.

With 21,000 megawatts (MW) of operating assets and over 30,000 MW in development, this company has lots of growth ahead. Its stock is down 18% this year and it is starting to look very attractive. It also pays a nice growing 3.6% dividend. The extra income is a nice bonus for your TFSA.

CP Rail: A buy-and-hold forever TFSA stock

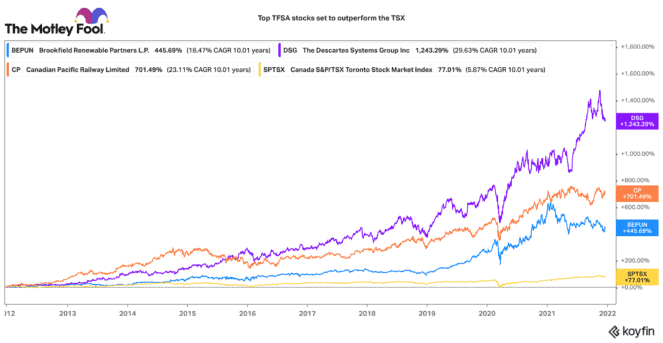

If you have a very long time frame, Canadian railroads have been great stable compounders for years. Over the past 10 years, Canadian Pacific Railway (TSX:CP)(NYSE:CP) has delivered a compounded annual return of 21%. That is nearly 600% over that time frame.

This year, Canadian Pacific has been making progress toward acquiring Kansas City Southern Railway. While it is a pricey deal, it is expected to be transformational. It will create the only rail line that spans across Canada, the United States, and Mexico. From a trade perspective, that would be highly beneficial for CP’s transportation customers.

CP has a great record of delivering market-leading returns. It has one of the best CEO’s in the industry and an excellent efficient operating ratio. I believe this makes it a great stable compounder for any TFSA portfolio.

Descartes Systems: A solid TFSA compounder

A technology stock with a unique transportation focus is Descartes Systems (TSX:DSG)(NASDAQ:DSGX). It provides cloud-based software services for the logistics and supply chain sectors.

Like CP, Descartes has an exceptional track record of elevated returns. Over the past 10 years, this TFSA stock has grown by a compounded annual growth rate (CAGR) of 29.8%. It is more than a 13-bagger in that time frame.

For years, this company has made great acquisitions that consistently expand its service base. Today, it generates very stable recurring revenues, high EBITDA margins (40%), strong organic growth, and lots of free cash flow. Today, it has $170 million of net cash on its balance sheet.

Given tech valuations are coming down right now, it should be primed for elevated acquisition growth next year. While this stock is pricey, it has a steady, defensive growth platform. Low risks and good long-term growth make this a perfect TFSA stock.