There’s good evidence to suggest that passive investing is the safest way for the average investor to build a good retirement portfolio. The investor who consistently puts money into low-cost, globally diversified index funds will outperform most stock pickers, active mutual funds, and day traders.

By investing broadly in the total market, you can reduce your idiosyncratic risk, or the risk that one or a few of your stock picks do poorly or go bankrupt. As the legendary investor Jack Bogle once said: “Don’t look for the needle in the haystack; just buy the haystack!”

That being said, certain investors may still feel queasy at the thought of being exposed to the market and its forces. Buying an index fund means following the market, through its ups and, unfortunately, through its downs as well. Prolonged bear markets or negative economic conditions can cause extended periods of loss in your portfolio.

Protecting against bear markets

Investors who are close to retirement age may be unwilling to accept higher volatility or the possibility of large losses in their investments. Unexpected fluctuations close to retirement age can severely limit their quality of life or even postpone retirement altogether until their portfolio recovers.

To hedge against this risk, investors traditionally increased their asset allocation to fixed income as they got older, primarily using bond exchange-traded funds (ETFs). The rule of thumb was 100% minus your age in stocks. So, if you’re a 60-year-old investor, you would have roughly 40% in stocks with 60% in bonds.

However, bonds aren’t necessarily a safe haven these days. During the COVID-19 crash of March 2020, Canadian aggregate bond funds suffered losses nearly as severe as broad market indexes. Rising interest rates and inflation can cause bonds prices to drop, decreasing their ability to diversify the risk impacting your stock allocation.

A portfolio for all conditions

It turns out that there is one free lunch in investing: diversification. Simply put, diversification means constructing your portfolio using multiple types of assets. These assets should ideally be uncorrelated — that is, when some go up, others go down, or even stay flat. By constructing your portfolio like this, you reduce exposure to any particular source of risk by balancing them out proportionality. This is called “risk parity”.

Legendary investor Ray Dalio, founder of the hedge fund Bridgewater Associates, employed this idea when constructing his “All-Weather Fund.” The fund was designed to survive and deliver solid returns in all economic environments, by holding a variety of assets that perform differently during various market conditions.

Very few people can predict where the stock market is going or how the economy will do. The All-Weather Fund takes the guesswork out of this by focusing on resiliency. During periods of market turmoil, the All-Weather Fund excels at preserving capital, making it suitable for investors with a low-risk tolerance or a short time horizon.

How do we build it?

We can’t figure out the exact holdings of the official All-Weather Fund, but we can use the principles Ray Dalio follows to construct our own variant, which we will call the “All-Weather Portfolio.” Firstly, Ray Dalio proposed that portfolios are primarily affected by four macroeconomic conditions:

- Higher-than-expected inflation

- Higher-than-expected growth

- Lower-than-expected inflation

- Lower-than-expected growth

Knowing these principles, our goal is to find the optimal blend of assets that will do well regardless of which scenario our portfolio encounters. This means finding individual investments that perform well in each of the conditions and then balancing their ratios to deliver the best risk-return profile.

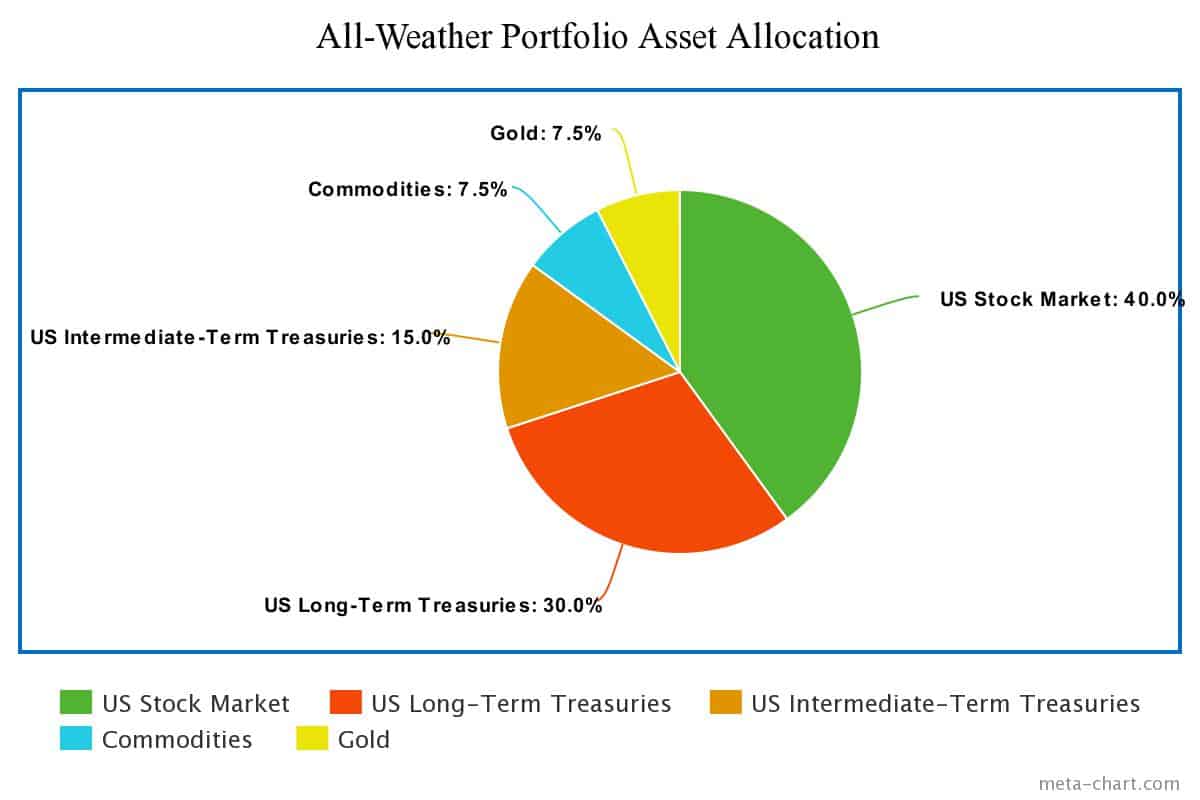

Research and back-testing suggests that from the start of 2002 to February 2021, the optimal asset allocation for the All-Weather Portfolio would have been as follows:

How does the portfolio perform?

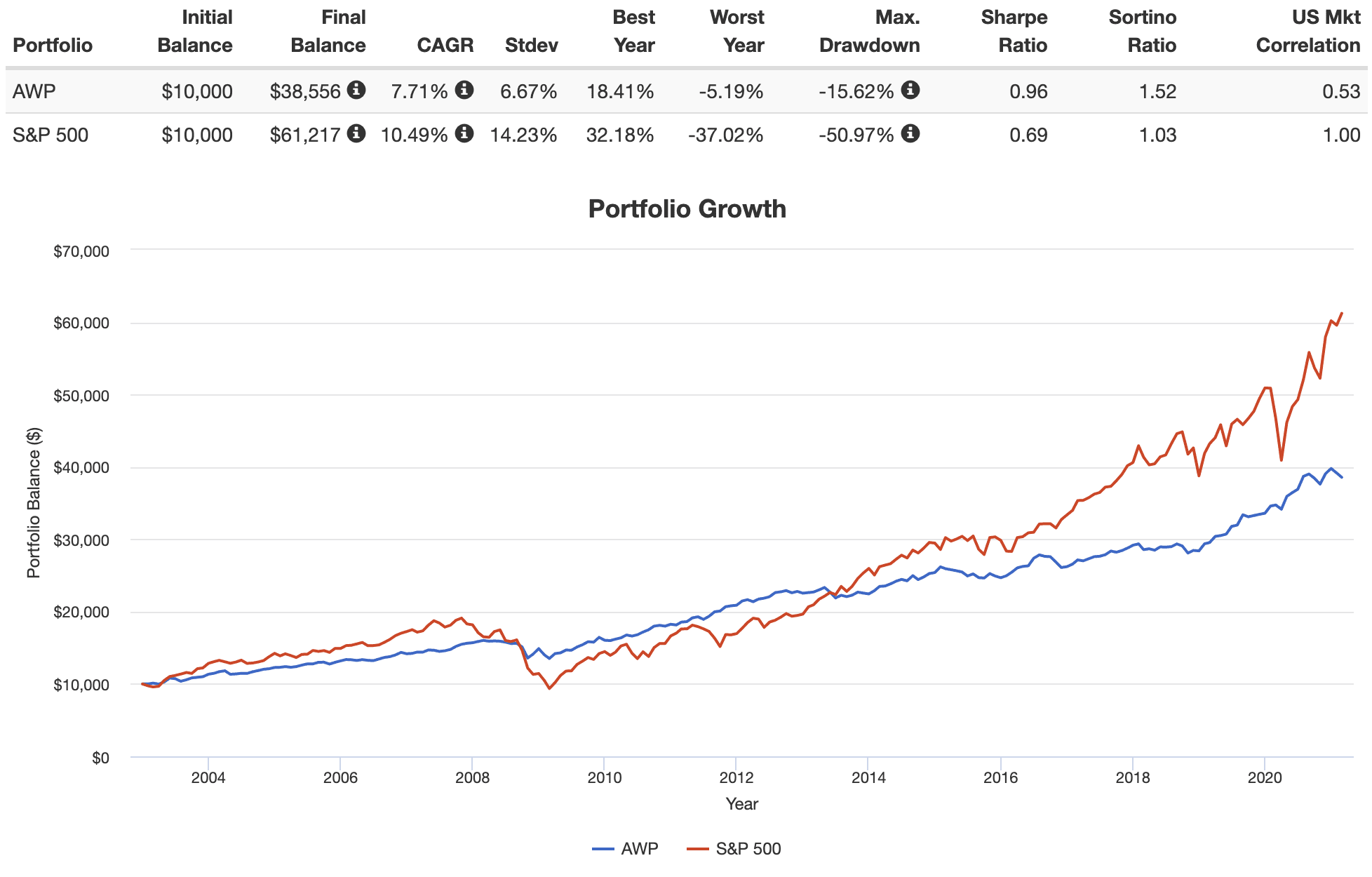

Here’s the performance of the All-Weather Portfolio versus the S&P 500 from the period described above. We see that the All-Weather Portfolio has a lower total compound annual growth rate (CAGR) compared to the S&P 500. An investor with the All-Weather Portfolio would only have $38,565 after this period versus $61,217 for the investor who bought and held an S&P 500 index fund.

What’s the point then, you may ask? Doesn’t the index fund provide a bigger total return? Yes, but that’s not the whole picture. Smart investors look beyond just the absolute returns of their portfolios and understand how risk can impact their goals and timelines. The strength of the All-Weather Portfolio shines when we look at its risk-adjusted return.

It had less than half the volatility (6.67%) of the S&P 500 (14.23%). The Sharpe Ratio (a measure of how much return you get versus how much risk you take on, with higher ratios being better) of the All-Weather Portfolio was 0.96 compared to just 0.60 for the S&P 500. What all this means is that an investor in the All-Weather Portfolio would have seen their investment fluctuate much less, while still earning more return proportionately for less risk taken.

Moreover, the All-Weather Portfolio withstood large crashes extraordinarily well. During the 2008 Great Recession, the All-Weather Portfolio dropped significantly less than the S&P 500, which suffered severe draw-downs and took a long time to recover to pre-crash highs.

We see that the worst year for the All-Weather Portfolio was a measly -5.19%, compared to the whopping -37.2% loss the S&P 500 suffered from 2008 to 2009. An investor in the S&P 500 throughout this time frame would also suffer a massive -50.97 drawdown at some point compared to just -5.19% for the All-Weather Portfolio.

The Foolish takeaway

The All-Weather Portfolio is best suited for investors whose objective is capital preservation. This usually means investors with a large nest egg on the verge of retirement, with lower risk tolerance and time horizon.

Investors who fit this category usually cannot risk a severe drop in their portfolio right before retirement. Imagine being mostly in an index fund in 2008 and due to retire that year! If that happened, you would likely be forced to liquidate some of your portfolio at a loss to cover retirement expenses or delay retirement for several years to recover.

This is not so with the All-Weather Portfolio. Its robust nature provides strong downside protection in most economic conditions, while still ensuring a decent return. Its assets are easy to buy using a self-directed brokerage and simple to maintain with a minimal, hands-off approach. Investing in it can ensure your retirement years remain stress-free and that your fund stays strong and healthy for your golden years.