The Tax-Free Savings Account (TFSA) is one of Canada’s most efficient mechanisms to build wealth. There is no other registered account established by Canada Revenue Agency (CRA) that allow for savings to be invested with zero tax obligations!

Zero tax liability also means no tax reporting requirement. Consequently, when you invest through your TFSA, you will have less stress having to report complicated income forms when it comes to tax season.

Maximize returns by paying no tax on investments

The CRA just announced a $6,000 increase to the 2022 contribution limit. That means if you were 18 years or older in 2009, you can now contribute a grand total of $81,500 to your TFSA. That is $81,500 that can earn interest, dividends, distributions, and capital gains completely tax-free. If you want to boost your returns, invest through your TFSA to keep all of your returns.

That is why the TFSA is ideal for compounding wealth. Say you don’t have $81,500. You can still build significant wealth with as little as $10,000. Here is a great example.

This would have been an ideal TFSA stock

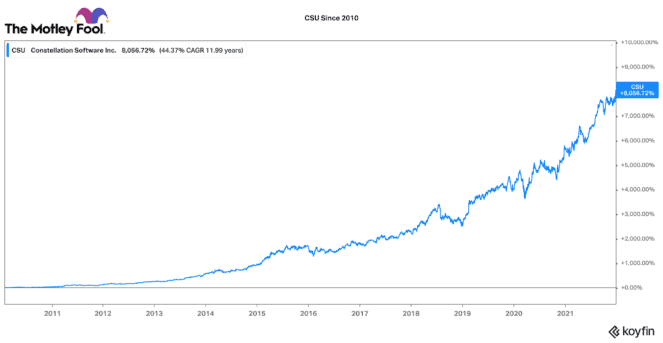

In 2010, the total TFSA contribution limit was $10,000. You could have bought around 270 shares of Constellation Software (TSX:CSU) for around $37 a share. If you were patient and held these shares all the way until today, they would have produced a 6,293% return (including dividends). That means your $10,000 would now be worth nearly $640,000 today!

Constellation Software has been one of the best performing stocks on the TSX over the past 10 years. It has been consolidating niche vertical market software businesses across the world. Its management has been very deliberate about how it invests and allocates capital. Likewise, it is incredibly focused on delivering in a shareholder friendly way. Hence, the company’s share count has not risen over 21.9 million shares since 2009!

The point is, if you find a high-quality stock like Constellation, your best bet is to tuck it into your TFSA and then do nothing. Let the company do the work for you. If the company has a “secret sauce” in their business, don’t trade it and don’t mess with it. Despite such a strong performance, Constellation Software still looks like a great business to buy and hold for the long term going forward.

Potentially turn $10,000 into $100,000 with this TFSA stock

If you are looking to turn $10,000 into $100,000 in your TFSA, then you may want to consider an up-and-coming Constellation-like software business. Topicus.com (TSXV:TOI) was actually spun-out of Constellation Software in early 2021. Constellation still holds a 30% stake in the business. Topicus.com’s board is littered with Constellation business unit executives.

However, there are a few differences that make Topicus.com unique. First, it operates out of the Netherlands where it has a unique focus on acquiring European software businesses. I like this opportunity. Europe does not have the same saturation of venture capital and private equity money, so Topicus.com has a unique advantage to deploy capital.

Second, Topicus.com is growing through acquisition, but it also has a special focus on organic business growth. In recent years, Constellation has largely focused on growth through acquisition, whereas Topicus.com is looking to organically develop new services and expand into new markets.

All in, Topicus generates a lot of free cash flow, which it is re-investing using Constellation’s investment formula. Topicus.com is not a cheap stock. However, if it can execute, chances are good it can generate very strong returns for many years to come. It could make a very nice component to help build long-term wealth inside your TFSA.