2021 was a wild ride for TSX stocks, and 2022 will likely be no different. I think 2021 surprised everyone by the amount of upside Canadian stocks could experience in and through the COVID-19 pandemic. While returns were great in 2021, I think there could be a reversion to more normal stock returns in 2022. However, that does not mean wise investors won’t be able to outperform.

Looking to the new year, here are three TSX stock market predictions that investors need to take into account for 2022.

Image source: Getty Images

TSX stocks will be volatile in 2022

Firstly, stocks will be volatile. The stock market is a frenzy both to the upside and the downside. Day to day and quarter to quarter, stocks often behave irrationally. The sooner investors’ accept that they will, at times, have stocks that are in the red, the easier it is to operate in and through the volatility.

As Warren Buffett has said: “The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”

A stock market surprise is inevitable

Secondly, the TSX stock market will likely be upset by something unforeseen. This could be a geo-political situation, another COVID-19 variant, or a higher-than-expected interest rate hike. One of the best ways to offset such volatility is to have a diversified portfolio of stocks and to always hold a little cash to “buy the dips.” To repeat another great Warren Buffett quote, “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

Your portfolio will likely be profitable in five, 10, or 20 years

Lastly, you will have a better chance to make money by owning stocks (like a business owner/partner) than you will trading in and out of stocks (like a speculator). If you buy stocks in high-quality businesses with strong fundamentals, history shows that you have a high chance of making money.

I can’t guarantee that you will earn a positive return this month, this quarter, or by the end of the year. However, if you stick with businesses that have great balance sheets, smart managers, attractive products/services, and trends supporting growth, you have an excellent chance of earning great returns over many years of being invested.

One top TSX stock I hope to hold in 2022 and long beyond

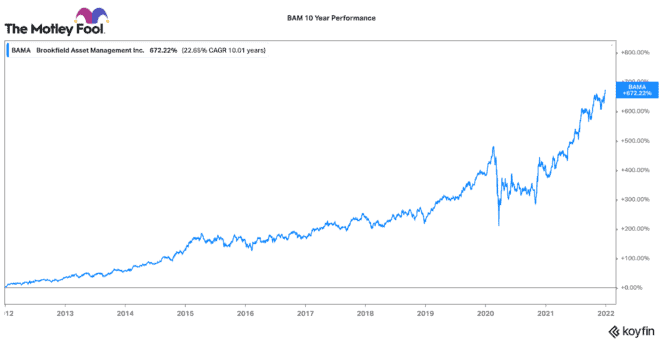

One TSX stock I hope to hold in 2022 and far beyond is Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). I like this stock because it diversifies my portfolio. Being one of the world’s largest asset managers, it has operations in everything from renewable power to private equity to infrastructure to insurance.

The company manages both publicly traded businesses and private capital for institutional shareholders. Brookfield has been seeing incredibly strong demand for its funds and financial products, especially because bonds have been a losing asset over the past few years. While interest rates might rise, Brookfield has actually historically outperformed when interest rates are in the 3-5% range.

This TSX stock is up 500% over the past 10 years. That is a near 20% compounded annual growth rate (CAGR) over that time. However, Brookfield has actually been growing distributable earnings per share by an even faster 32% CAGR over the past five years. Given its scale, high-quality management team, and strong balance sheet, this TSX stock should be primed to keep rising for years in and through the market cycles.