If you want to start 2022 on the right foot financially, Dye & Durham (TSX:DND) and Tecsys (TSX:TCS) are two growth stocks that should perform well in January.

Dye & Durham

Dye & Durham provides cloud-based information services and workflow solutions to legal, government, and financial services firms. The company’s strategy is to grow through acquisitions that immediately generate profits.

As Dye & Durham works in a niche market, it doesn’t worry about too much competition. The company also showed strength when it rejected a takeover bid to privatize the company. Dye & Durham continued with its existing business strategy of growth through acquisitions as it believes this strategy can deliver shareholder value. The efficient execution of all acquisitions by the company makes it one of the best growth stocks to buy and hold forever.

The company posted better-than-expected results for the first fiscal quarter of 2022. Revenue and adjusted EBITDA increased 414% and 398%, respectively, with net income of $22.1 million. The strong results underscore the breadth and pace of Dye & Durham’s underlying growth.

Dye & Durham has signed an agreement to purchase Telus Financial Solutions for $500 million. This acquisition should go a long way in strengthening its digital infrastructure.

The company also signed a deal to acquire Link Group, a technology-driven market leader that connects people to their assets for $3.2 billion. The acquisition confirms the company’s ambition to achieve $1 billion in adjusted EBITDA.

Its diverse customer base, high retention rate, geographic expansion and long-term contracts with top clients will support its growth. In addition, its strong M&A pipeline and strong balance sheet will likely accelerate its rate of growth.

Tecsys

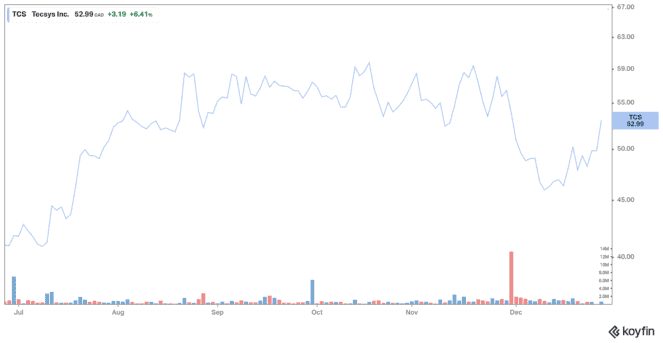

Another growth stock that deserves a mention is Tecsys. Tecsys develops and sells end-to-end supply chain management software solutions. Thus, the company is right in the “sweet spot” with all of the current supply chain issues.

Its main clients are health networks in the United States a vertical that it dominates. It also serves businesses with complex distribution needs, like wholesaling and transportation logistics, as well as retailers with omnichannel sales.

The company just reported another quarter of record sales with high-margin SaaS recurring revenue growth and has a record backlog.

Tecsys had its 11th consecutive quarter of record revenue at $34.3 million, up 12% year over year. SaaS revenue increased 28% to $6.6 million, while subscription bookings was up 50% to $4 million. Professional services revenue was up 11% to $13.1 million.

Peter Brereton, president and CEO, said in a press release: “Our three target verticals are all performing or outperforming expectations, with notable wins in healthcare with three new major hospital networks, and an expanding customer base in global retail and our distribution market. We are confident that we are favourably positioned as the heightened focus on supply chains turns into greater investment in supply chain agility and the specialized technologies that underpin it.”

The company just reported another quarter of record results and record backlog, and the pullback represents a tremendous buying opportunity

Tecsys has been included in the TSX30 for 2021, which recognizes the 30 top-performing stocks over the past three years.

Tecsys’ dividend yield of around 0.5% is low, but it’s a Canadian Dividend Aristocrat. Specifically, the growth stock has increased its dividend for 13 consecutive years.