Despite a tonne of tailwinds that should be helping gold stocks, the price of gold has plateaued and even traded down slightly over the last year, leading many gold stocks to underperform in 2021. And Kinross Gold (TSX:K)(NYSE:KGC), though, one of the best stocks in the industry, was not immune to the selloff in gold stocks.

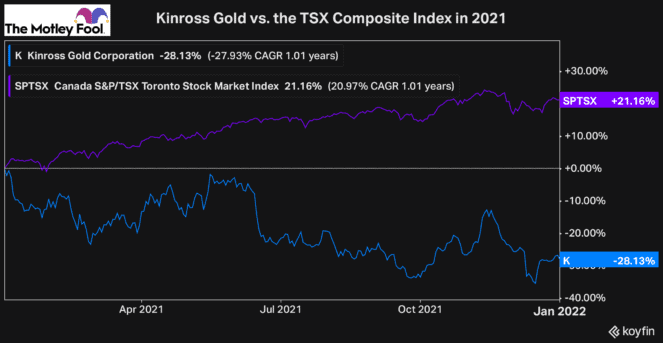

In fact, Kinross stock ended the year down a whopping 28%. And, compared to the TSX, which earned investors a total return of more than 21%, it’s a significant underperformance.

Even though Kinross stock, as well as many other gold producers, was down significantly in 2021, gold prices were down just 8%. It’s clear that many of these gold stocks have been oversold.

Although some of the selloffs can be explained by the small dip in gold prices, much of the reason Kinross stock sank in 2021 was just due to gold stocks falling out of favour. With so many other growth opportunities in the markets and the rise of cryptocurrencies, gold stocks have been ignored and, consequently, become quite cheap.

Therefore, if you’re wondering whether Kinross offers value and is worth a buy today, here’s what to consider.

Is Kinross Gold stock a buy in 2022?

At the moment, there are several attractive gold stocks that look severely undervalued right now, but Kinross has to be one of the best.

It currently has a market cap of $9 billion and an enterprise value (EV) of $10.1 billion, which, when compared to its earnings, shows just how cheap the stock is.

On a forward basis, Kinross’s EV/EBITDA ratio is just 3.4 times, which is incredibly low. Furthermore, even its forward price-to-earnings ratio is significantly cheap, currently sitting at just 10.1 times. But as much as the stock looks cheap, it still faces some considerable headwinds going forward.

After gold prices increased significantly last year from the $1,300 range to the $1,800 range it’s in today, gold stocks like Kinross saw their margins and profitability increase significantly. In fact, in 2019, Kinross’s gross margin was just 49%, and in 2020, that grew to 59%.

However, now with inflation surging, Kinross’s management expects that cost inflation in 2022 will run at

5-7% year over year on operating costs and roughly 10% year over year for its capex. So, as its costs increase should the price of gold stay flat, Kinross’s margins and profitability will take a hit. However, this is just something to be mindful of, as that already looks to be priced into the stock.

Besides the increasing costs expected this year, Kinross looks to be in great shape. After producing 2.5 million ounces of gold in 2019 and 2.3 million ounces of gold in 2020, that number is expected to be closer to two million in 2021.

However, going forward, according to Kinross’s guidance, management expects the stock to produce 2.7 million ounces of gold in 2022 and 2.9 million ounces in 2023. So as long as gold prices can at least stay flat and Kinross can control its costs, there should be more growth coming for investors.

Bottom line

Deciding whether to buy Kinross now can be a difficult decision. On the one hand, there is still a tonne of risk and uncertainty in the market, an environment where gold stocks tend to do well.

On the other hand, these stocks have struggled through the last year when real interest rates were considerably negative and should have provided a significant tailwind for the price of gold.

So, although the environment looks promising right now with all this volatility, as interest rates are increased this year, it could become a headwind for gold stocks.

There’s no doubt that gold stocks like Kinross are certainly extremely cheap, and it might not hurt to buy the dip and gain some exposure. For now, though, they are still out of favour. While I would continue to watch these stocks closely and potentially gain a little exposure, in my view, it’s still a little too early to back up the truck just yet.