Every good investor should be aware of how potential market corrections could affect their portfolio. If your portfolio is stock heavy, consider how truly ready you are to see up to a 20% unrealized loss in the short term.

Sometimes, getting high returns doesn’t mean chasing performance but rather hedging your bets instead. Minimizing portfolio volatility and mitigating those gut-wrenching drawdowns can boost your returns significantly.

Do bonds still work?

The conventional wisdom for many Canadian investors has been to buy an aggregate bond exchange-traded fund (ETF) to complement their stock portfolios. Usually, you would begin with a lower allocation and increase that as you age and get closer to retirement.

A higher allocation to bonds produces lower returns but lowers portfolio volatility and protects your portfolio during a crash. However, this hasn’t always been the case. During the 2020 March COVID-19 crash, Canadian aggregate bond funds still suffered drawdowns of over 5%.

While not as severe as the -20% losses suffered by stock indexes, such a loss in a perceived “safe” asset can still leave investors feeling psychologically shaken and vulnerable to panic selling.

The power of negative correlation

To find an appropriate, better hedge, we want to look for assets that do two things:

- Trend upwards and produces intrinsic value in the form of capital gains or income.

- Have a negative correlation compared to the stock market.

Your best bet here is BMO Long Federal Bond Index ETF (TSX:ZFL). This ETF contains bonds issued by the federal government of Canada with +20 years to maturity and are as safe as it gets when it comes to credit risk. It currently has a negative correlation of -0.23.

The best crash protection

We want long-term federal government bonds, because they are more volatile than short-term bonds, have no default risk compared to corporate bonds, and have the highest negative correlation with the stock market. Therefore, they can act as a reliable “counterweight” when stocks drop.

When a crash occurs, investors sell risky assets like stocks and buy safe ones like government bonds — a phenomenon known as “the flight to quality.” This makes the price of bonds shoot up sharply. We can then sell the bonds for a profit and rebalance into our stocks, essentially selling high and buying low.

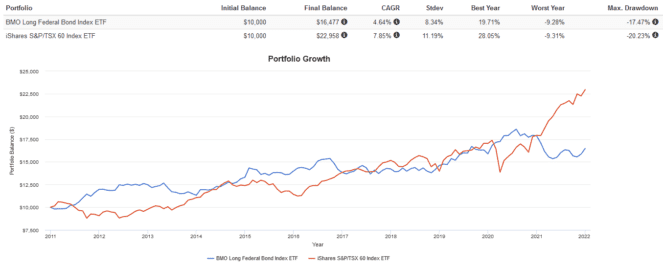

The following picture shows the performance of ZFL vs. iShares S&P/TSX 60 Index ETF (TSX:XIU) from 2011 to 2021. We see that although both assets trend upwards over time and have a positive return, they don’t always move together. Notably, ZFL has increased sharply in value during multiple occasions where XIU has tanked.

How to create a resilient portfolio

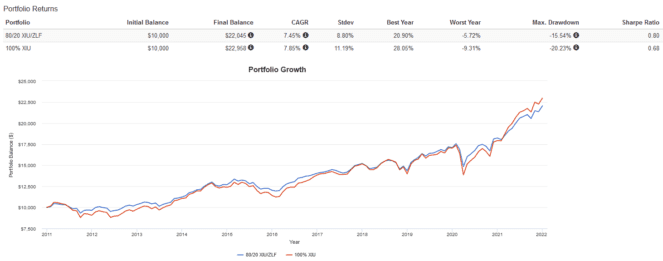

The lesson here is that holding different types of volatile, yet uncorrelated assets actually reduces overall portfolio volatility while boosting risk-adjusted returns. Let’s take a look at the performance of a 80/20 XIU/ZFL portfolio rebalanced quarterly vs. a 100% XIU portfolio from 2011 to 2021 to see how this works:

The 80/20 portfolio had much less volatility (standard deviation of 8.80% vs 11.19%), a lower max drawdown (peak-to-trough loss of -15.54% vs -20.23%), and a higher risk-adjusted return (Sharpe ratio of 0.80 vs. 0.68).

Despite the modestly lower CAGR of 7.45% vs 7.85%, the 80/20 portfolio had a much smoother ride. Over many market cycles, this translates into better peace of mind, steadier returns, and less volatility.

The Foolish takeaway

Long term federal government bond funds like ZFL are excellent sources of diversification for your portfolio. Its negative correlation with the stock market and positive expected returns can add a layer of protection.

The main risk to this strategy is rising interest rates. Bond prices are inversely related to interest rates, and the degree to which they move is based on their duration. Hence, long-term government bonds like ZFL may lose more value when interest rates go up.

However, it is important to remember that we hold ZFL as crash protection. During a liquidity crisis, there is no better safe haven than long-term government bonds. Investor behaviour during corrections should ensure that our hedge rises in value, allowing us to sell it and buy cheap stocks at a discount.