The Tax-Free Savings Account’s (TFSA) cumulative contribution limit has grown rapidly since it was first introduced in 2009. Today, the TFSA limit of $81,500 leaves investors with many choices. Should you focus on stocks or bonds? Should your TFSA stocks be dividend stocks or those with high capital gains potential? In this article, I’ll highlight two Canadian bank stocks that every TFSA investor should consider adding to their TFSA.

TFSA stock #1: TD Bank is a best-in-class bank stock

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada’s top two banks. In fact, it’s also one of North America’s top five banks. This position that TD Bank finds itself in is the result of its long-standing strategy that focuses on growth as well as risk controls. In 2022, the TFSA contribution limit was increased by $6,000. Consider using this to add TD Bank stock to your portfolio.

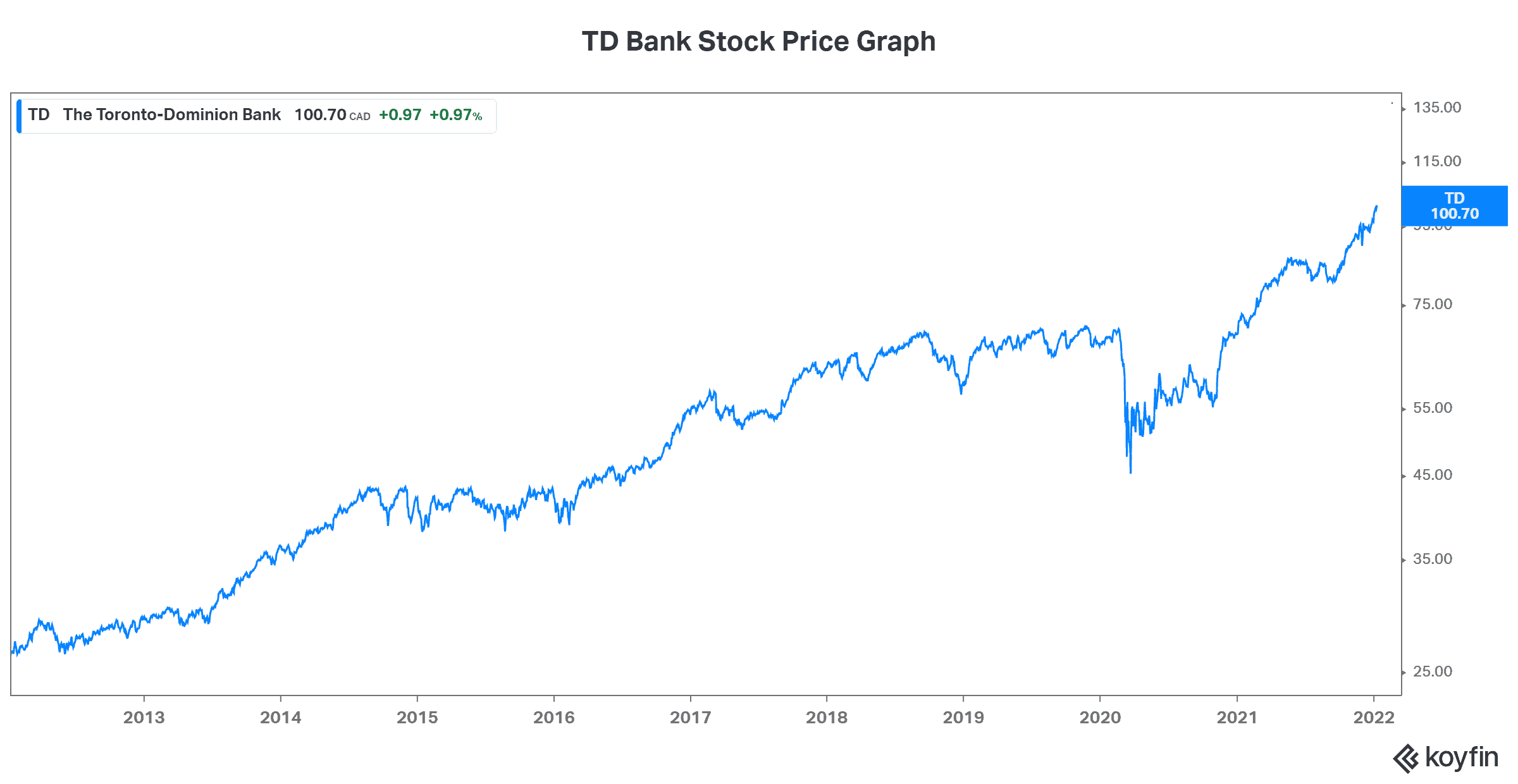

Today, TD Bank stock remains an ideal holding for TFSA investors. The stock yields 3.6%. Also, TD Bank is in the midst of using its excess capital to buy back shares. This will drive up the stock’s value for shareholders. Let’s talk about TD’s excess capital here for a moment. The bank’s common equity Tier 1 ratio is 15.2% — versus its peer group at 13.3%. This is testament to TD’s proven business model. It’s also reflective of TD’s success before, during, and hopefully after the pandemic. Good business practices have taken TD Bank far. They’ve certainly also taken TD Bank’s stock far.

For TFSA investors, TD Bank stock provides the security, safety, and growth that will support any TFSA investor’s future. The stock has rallied over 34% in the last year. And its long-term record is also very commendable and impressive. Its 10-year historical return is 160% and its 20-year return is 370%. This while consistently paying growing dividends.

TFSA stock #2: CIBC stock is the bank stock making a comeback

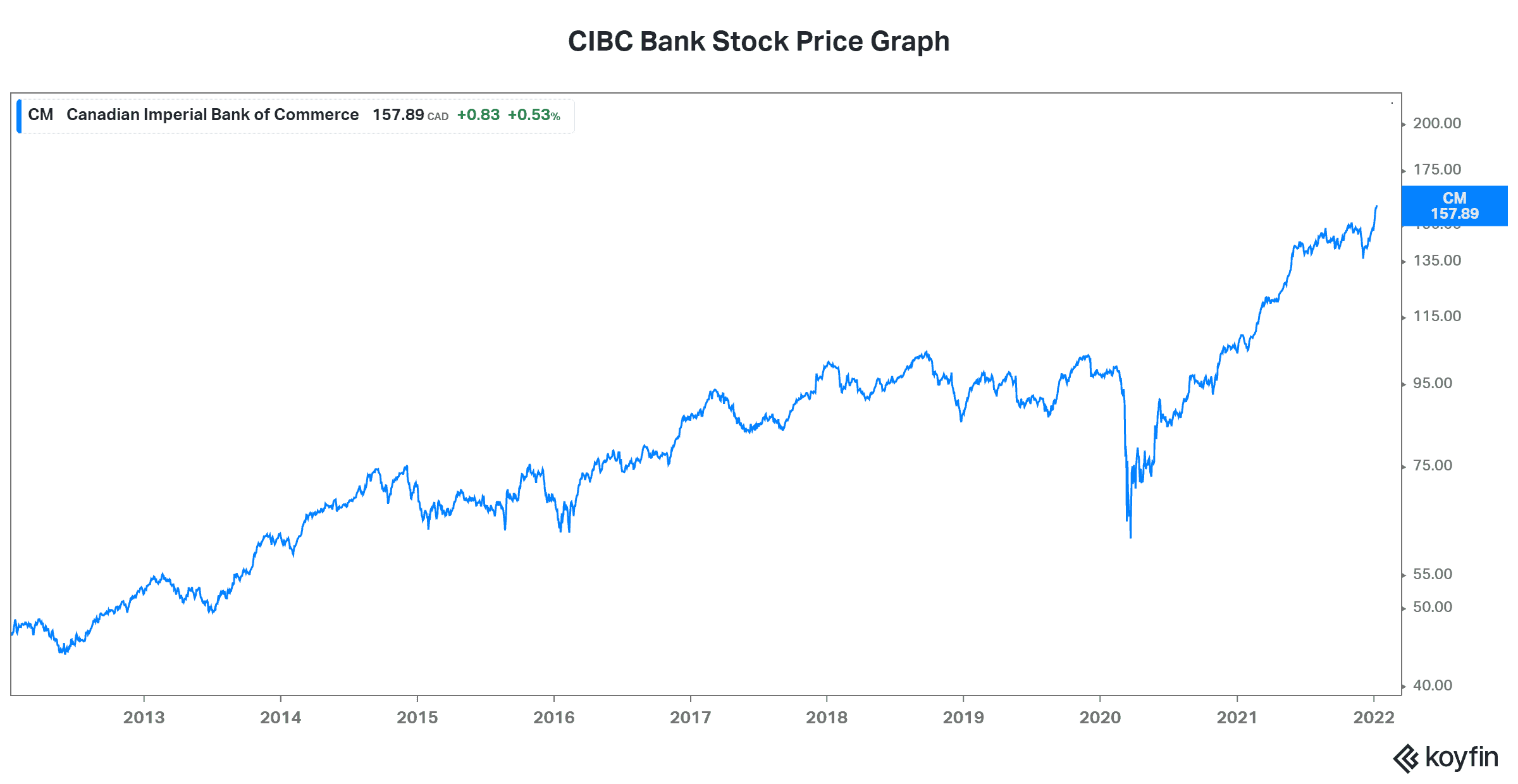

Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) is a Canadian bank that has had a more difficult time in its history. But this difficulty has informed its turnaround. It’s helped make CIBC stock a comeback stock today. CIBC has historically been one of the highest-yielding banks due to the price discount given to it. Today is now different. CIBC stock is yielding an attractive 4.1% — a dividend yield that is worthy of tax sheltering in your TFSA. This dividend is backed by a strategy that focuses on organic growth aimed at improving the business and investing in technology to compete in the new world of banking.

So far, this is yielding results. 2021 was a record year for CIBC in terms of revenue growth. The bank’s market share is rising, and its investment in technology will continue to pay off in the form rising revenue as well as reduced costs. Therefore, this Canadian bank stock is a great addition to your TFSA for long-term returns.

In the last year, CIBC stock has rallied 40% as the value proposition in Canadian banks has become increasingly obvious. These banks are generating record cash flows and earnings, and they have withstood one of the greatest tests to their businesses in a long time. In fact, they have not only withstood the crisis. They have thrived, growing organically and expanding in the U.S., benefitting shareholders tremendously in the process.

Motley Fool: The bottom line

The TFSA contribution limit of $81,500 means that TFSA investors certainly have room for Canadian bank stocks. In fact, we’d be wise to consider Canadian bank stocks for our TFSA portfolios. With record-low yields on bonds, and a multitude of high-risk options, Canadian banks stand out well. I highlighted two of the best bank stock opportunities in this article: TD Bank stock and CIBC stock. They have both provided shareholders with growing dividends and strong capital gains in their long-term histories.