U.S. stocks have delivered astonishing results from 2010 to now. Since the end of the 2008 Great Financial Crisis, both of the major U.S. indexes, the S&P 500 and NASDAQ 100, have posted tremendous gains, primarily fueled by the growth of large-cap tech companies like Alphabet, Microsoft, Apple, Amazon, Meta, Netflix, and Tesla.

That being said, investing in these indexes isn’t always straightforward. Depending on your brokerage, buying a USD-domiciled exchange-traded fund (ETF) could cost you currency conversion fees of up to 1.5%. Unless you’re familiar with Norbert’s Gambit or have access to forex trading, this could seriously hinder your returns.

Fortunately for Canadians, major fund providers like Vanguard and Blackrock offer CAD-domiciled index ETFs, with only marginally higher expense ratios than their U.S. counterparts but no currency conversion fees. Let’s take a look at my top candidates.

Vanguard S&P 500 Index ETF

Vanguard S&P 500 Index ETF (TSX:VFV) is the top Canadian ETF for tracking the S&P 500 ETF, with $6.5 billion assets under management (AUM) and a high volume traded daily. The fund costs a management expense ratio (MER) of 0.08% to hold, which is a rock-bottom price in the Canadian ETF industry.

VFV is passively managed, replicating the S&P 500 index as decided by Standards & Poor’s. Currently, the fund holds 512 stocks, with the largest concentration in information technology, followed by consumer discretionary, healthcare, financials, communications, industrials, consumer staples, energy, real estate, materials, and utilities.

Being a CAD-domiciled U.S. ETF, VFV is not currency hedged, meaning that its value can and will fluctuate based on the CAD-USD exchange rate. Generally, if the USD appreciates, then the fund will gain additional value. Conversely, if the CAD appreciates, the ETF will lose additional value.

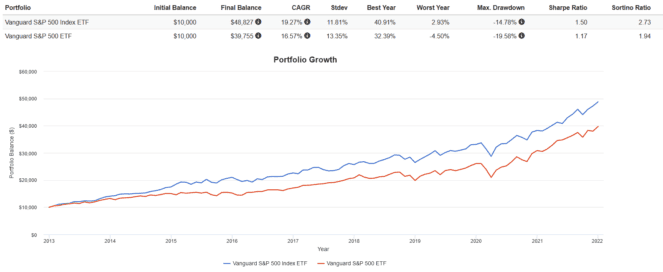

Since inception, VFV has outperformed its U.S. domiciled equivalent, despite having a higher MER and more tracking error. This is due to the strengthening of the USD over this time period, which caused unhedged VFV to have a higher return and less volatility. Over a long time horizon, currency fluctuations generally even out.

BlackRock iShares NASDAQ 100 Index ETF

To track the NASDAQ 100, you’ll want iShares NASDAQ 100 Index ETF (TSX:XQQ). With over $1.9 billion AUM, this ETF is the largest of its kind in Canada. Currently, holding this ETF will cost you a 0.39% MER, which is pricey for a passively managed fund, but not more so than other Canadian competitors.

The NASDAQ 100 differs from the S&P 500 in numerous ways. Namely, it excludes financial stocks, focuses on stocks listed on the NASDAQ Exchange, and only holds 101 large-cap U.S. growth stocks. The index is heavily concentrated in the U.S. tech sector, which makes up 50% of the weighting of this fund. As a result, ETFs tracking this index have more return potential but also more volatility.

Unlike VFV, XQQ is currency hedged using forex derivatives. Theoretically, this means that XQQ’s value will not be affected by fluctuations of the CAD-USD and should track its American counterpart closely. In practice, the nature of the futures contracts used and the imperfect way they are rolled forwards introduces tracking error over time.

We see that since inception, XQQ has tracked its U.S.-domiciled ETF closely but underperformed by over 1% CAGR, with slightly higher volatility and drawdowns too. As explained earlier, currency fluctuations can actually reduce volatility and boost returns. When they are hedged away, you lose that benefit and incur additional tracking error, causing underperformance over the long term.

The Foolish takeaway

Canadian stocks are great and all, but there is a case for diversifying geographically. Canada’s stock market is heavily concentrated in financials and energy, which introduces the risk of sector underperformance. Not investing in the U.S. may also cause you to miss out on great bull runs from some of the best companies in the world.

Finally, as a general rule of thumb, the U.S. stock market comprises around 55% of the world’s market, so your portfolio should reflect this weighting. Depending on your views for big tech or the approximate U.S. market as a whole, either VFV or XQQ could be an excellent addition to your portfolio.