The Canadian stock market delivered very strong results in 2021. The S&P/TSX Composite Index ended the year up 3,195 points, or 18%, to 21,222. Despite multiple variants of the COVID-19 virus, the easing of pandemic-related fiscal stimulus, and prolonged inflation, the economy and the stock market performed resiliently. I don’t think anyone expected 2021 would deliver the resounding investment results that they did.

2022 might be a mean-reversion year

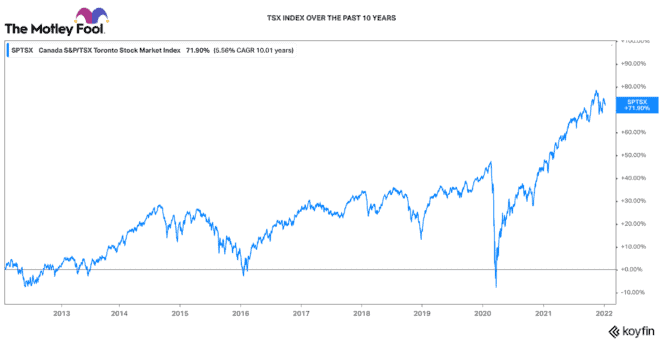

Consequently, that leads to the first Canadian stock market prediction for 2022. The TSX Index will likely deliver more normal returns this year. Over the past 10 years, the TSX has risen by an average 5.6% compounded annual growth rate (CAGR).

It is possible that Canadian stocks will exceed that rate (perhaps to the 7-10% range) but not pass the gains enjoyed in 2021. However, shrewd Canadian investors should still be able to outperform. The key is to have a diversified portfolio with a focus on high-quality businesses (strong balance sheets, great management teams, and long-term growth ahead).

Inflation is here to stay … for now

Inflation will likely persist, and interest rates will rise modestly. Demand pressures will normalize, but costs (i.e., wages, input costs, energy, rents) will continue to rise. The Bank of Canada will raise interest rates, but only modestly, to not pop the highly levered Canadian housing market.

Stocks with strong pricing power and the capacity to pass on costs are ideal in this environment. Three Canadian industrial stocks with this capacity are Magna International, Intertape Polymer Group, and Hardwoods Distribution.

Canadian small-cap stocks could catch a bid

Canadian small-cap stocks should start to see a bid in late 2022. Small-cap stocks severely underperformed in 2021, and many trade with very attractive valuations. Many large-cap growth stocks became significantly overvalued. As valuations pull back, an appreciation for strong fundamentals in the small-cap group may return. Some growth-at-a-reasonable-price, small-cap stocks include Sangoma Technologies, Calian Group, and H2O Innovation.

Real assets should have a strong year

Real assets like real estate will continue to provide a nice combination of income and cash flow growth. In an inflationary environment, real estate stocks generally perform well, because they can raise rents and property values rise.

Dream Industrial REIT, with its global portfolio of distribution and warehousing properties looks attractive. BSR REIT, an owner of American multi-family properties also looks interesting for a combination of income, value, and growth.

Canadian energy stocks should outperform, again

Commodities, especially Canadian energy stocks, should continue to have a strong year. Energy demand has recovered significantly since 2020; however, supply has only incrementally returned. Consequently, oil and natural gas prices are seeing a very strong bid. This is incredibly supportive for top energy stocks like Suncor (TSX:SU)(NYSE:SU).

Suncor looks attractive, because it underperformed most other energy peers in 2021. The company has faced operational issues that should hopefully be resolved in 2022. Consequently, it could be primed to deliver outsized free cash flow returns. If mainstream investment managers get interested in energy again, Suncor will be one of the top positions they add.

Since the pandemic, the company has reduced debt, lowered its cost structure, and increased production efficiency. It also returned its dividend to its pre-pandemic level. It now pays an attractive 5% dividend. Some other Canadian energy stocks that could perform well are Cenovus Energy and Arc Resources.

The Foolish takeaway

The reality is, predictions are nuanced and biased. Chances are good that factors largely unknown today will likely disrupt these estimates. Yet the key to investing success is to buy good-quality companies with strong fundamentals. Own them as an investor and not as a trader. Over the long term, market volatility irons out, and long-thinking, patient investors will be winners in the end.