Real estate investment trusts (REITs) are great for Canadians looking to diversify their investment portfolios. As a pool of real estate assets trading on a stock exchange, REITs offer liquidity, monthly income, and potential for capital growth.

However, picking the best REIT can be difficult with so many choices out there. The amount of time you need to spend reviewing financial reports can be exhausting. There’s also no guarantee that your specific pick will do well, either.

ETFs are your best bet

Fortunately, there are some fantastic exchange-traded funds (ETFs) that track the REIT sector. These include Vanguard FTSE Canadian Capped REIT Index ETF (TSX:VRE) and iShares S&P/TSX Capped REIT Index ETF (TSX:XRE).

Both VRE and XRE offer broad exposure to different types of REITs in a single ticker. Investing in either will give you consistent monthly distributions, which is great for income-oriented investors.

Both indexes are passively managed, which keeps fees low and place caps on the proportions of their underlying holdings. That is, no individual REIT can grow beyond a certain percentage allocation.

How the holdings differ

The underlying holdings are where VRE and XRE begin to diverge. Whereas VRE tracks the FTSE Canada All Cap Real Estate Capped 25% Index, XRE tracks the S&P/TSX Capped REIT Index.

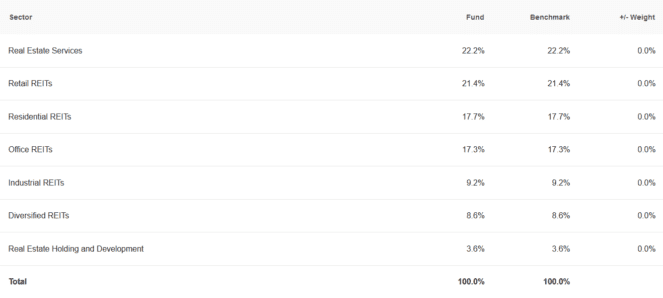

In terms of broad composition, VRE has the following weights allocated to each sub-sector:

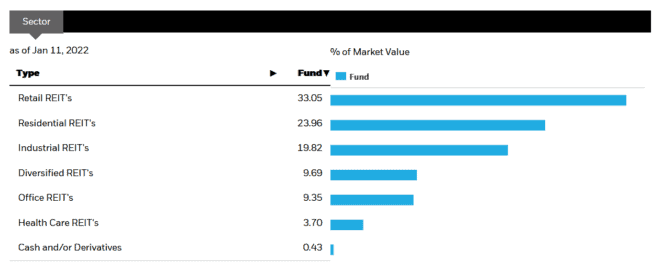

XRE opts for a slightly different weighting for its sub-sectors:

We see that XRE is much more concentrated in the retail and industrial sub-sectors, while VRE is more concentrated in the office sub-sector. Remember that these weighting will passively change as their indexes are updated, so over the long term, the composition may look very different.

In terms of individual holdings, VRE has 15, while XRE has 20. Common holdings include Canadian Apartment Properties REIT, RioCan REIT, Granite REIT, Allied Properties REIT, and H&R REIT. All of these REITs are solid picks to buy and hold on their own, so I’m not surprised to see them here as top holdings.

What the numbers say

When evaluating a REIT ETF, we want to look at the distribution yield and the management expense ratio (MER). Aside from the quality of the underlying holdings (a non-issue with these two funds), these factors represent sources of risk and drag you can control.

When it comes to yield, XRE beats VRE slightly at 2.99% vs 2.90%. However, keep in mind that the yield can vary based on the share price. Moreover, overall capital appreciation with distributions reinvested is the bigger picture, so we need to look at their total return instead.

When it comes to MER, VRE beats XRE handily at 0.38% vs. 0.61%. This is nearly half as much! While this might not seem like a lot, over time, the higher fees can compound significantly to reduce your gains.

How have they performed?

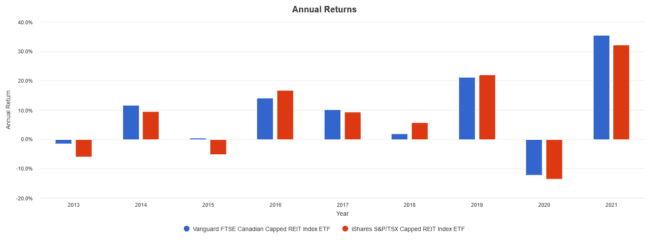

A word of caution: the backtest results provided below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

From 2013 to present, with all distributions reinvested, VRE beat XRE with an overall higher CAGR, but with slightly higher volatility and drawdowns. However, VRE still had the better risk-adjusted return (Sharpe ratio).

I attribute this outperformance to the lower MER of VRE and the higher portion of retail REITs in XRE, which were hard hit due to COVID-19. However, over the long term, I expect these gaps to narrow, as the two funds are very similar.

The Foolish takeaway

My pick would be VRE. Both funds have similar holdings, yields, and performance. In this case, my choice boils down to the MER, which is much lower for VRE. Keeping fees under control will boost returns over time compared to a similar but more expensive fund.

That being said, both ETFs are excellent choices. Canadian investors seeking monthly income with capital growth should consider VRE or XRE. These ETFs are an excellent way to gain exposure to the real estate sector and are great for complementing a stock portfolio.