Growth stocks like Shopify (TSX:SHOP)(NYSE:SHOP) have had a really nice run in the last few years. They’ve outshone value stocks, as they’ve outperformed the market. In more recent times, however, the surge of the Omicron virus and sky-high valuations have thrown a kink into this. Many of the most promising growth stocks have gotten decimated in 2022 and late 2021. Only 14 days have passed in this new year, but much has shifted.

How should we take advantage of this new development?

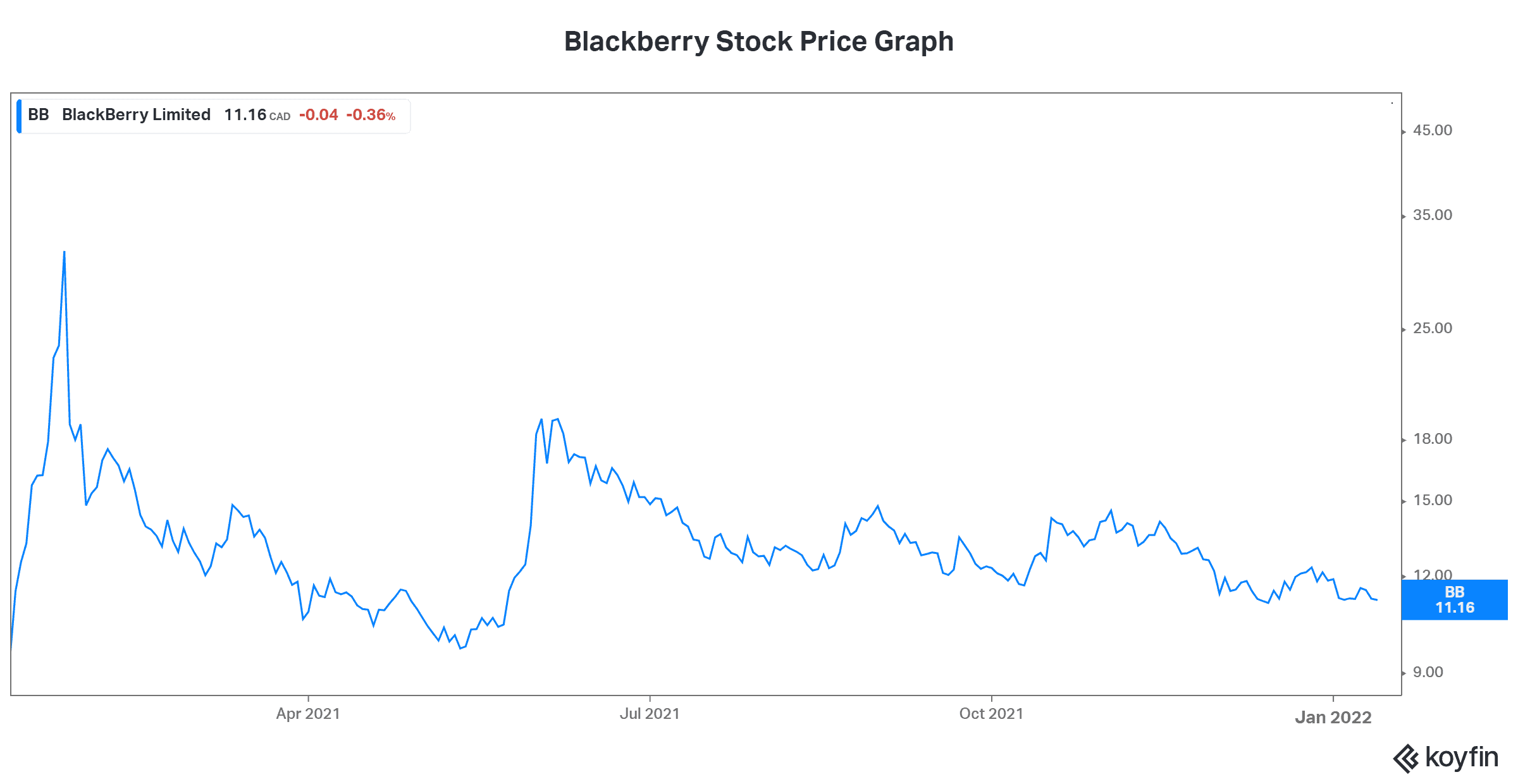

BlackBerry stock: A growth stock riddled with volatility

In my view, one of the most exciting growth stocks today is BlackBerry (TSX:BB)(NYSE:BB). Unlike Shopify, it’s a stock that does not get the respect it deserves. Nonetheless, it’s one of my top growth stocks. You see, BlackBerry is in the business of the future. Its technology is what is driving and supporting two of the most powerful trends today.

The cybersecurity business, which is estimated to be worth over $150 billion, is an increasingly relevant and high-growth business. Also, BlackBerry is a leader in embedded systems. BlackBerry’s software enables machine-to-machine connectivity. And it’s transforming many industries. The company is best known in this area for its success in creating connected and autonomous cars. But this technology is also used extensively in medical devices and robotics.

So, in the last three months, BlackBerry stock has fallen more than 20%. It’s a fall that was not really surprising, given that the stock is infamous for its volatility. But it was disappointing, as I believe there’s so much value in the name that the market is just not recognizing. The bottom line is, BlackBerry’s revenue growth hasn’t accelerated like investors would like to see. For example, revenue increased a mere 5% in its latest quarter. It’s not the kind of revenue growth I would expect from a growth stock. I believe that growth rates like those at Shopify will soon be coming to BlackBerry.

Investors have been waiting a long time for the growth that I believe is just around the corner. And the latest quarter was actually a nice improvement. BlackBerry went from declining revenue to growing revenue. That’s huge.

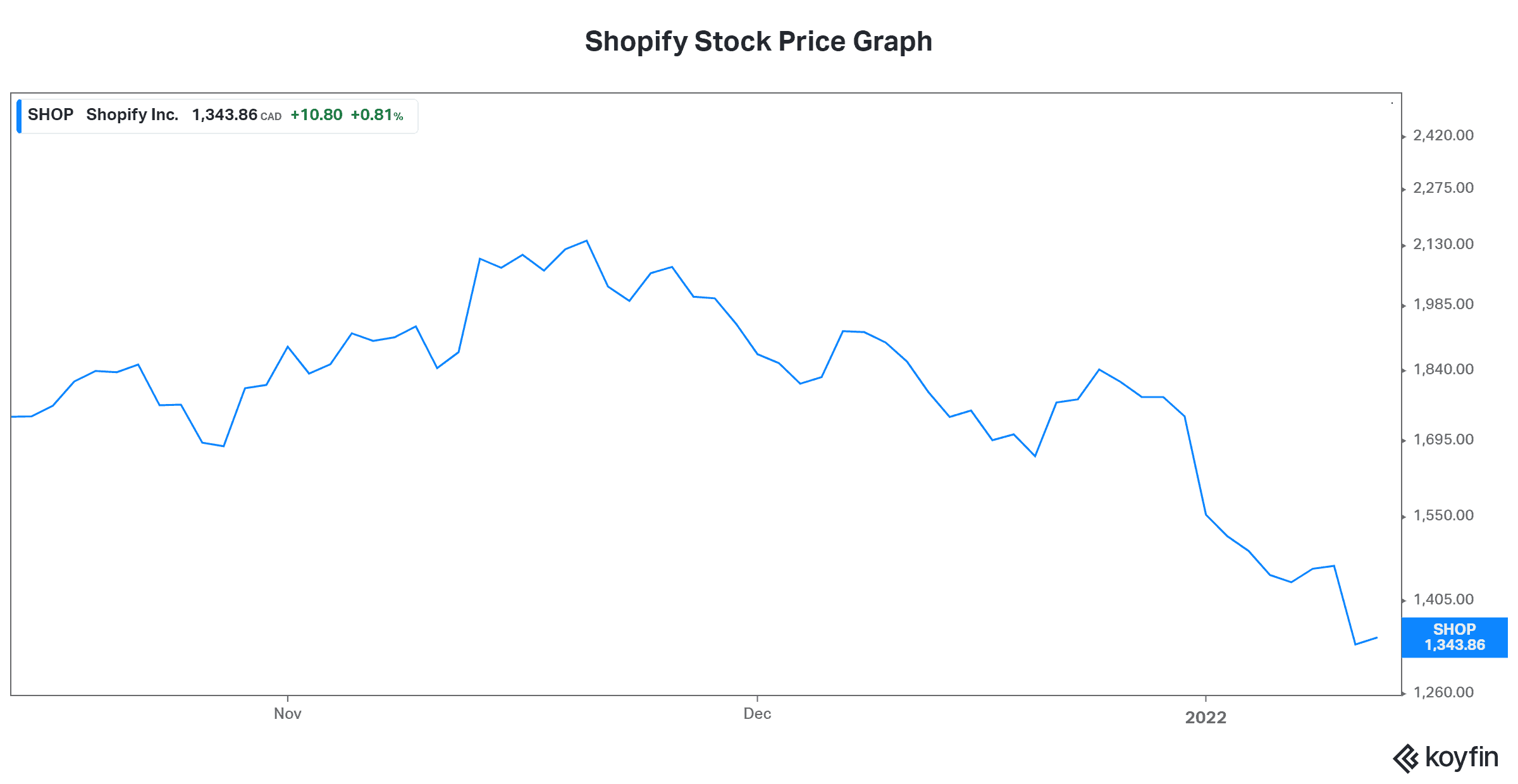

Shopify stock: Down 23% in so far in 2022

Shopify stock is down big so far in 2022. In the last three months, it’s down a little more — 26%. In fact, the whole tech sector has had a difficult time as of late. Maybe investors are growing weary of the lofty valuations that have become so common with tech stocks.

Today, with interest rate hikes looming, high-growth, high-valuation stocks look all the more vulnerable. Inflation will rear its ugly head, and these stocks will get hit hard. Smaller businesses, like the ones on Shopify’s platform, will also be harder hit. They have less resources to withstand the pressures.

Shopify is undoubtedly one of the best growth stock successes that Canada has had. Today, revenue at Shopify is growing over 20%. This is a fabulous rate, but it’s down from prior quarters and years. Sequential revenue growth in the last quarter was insignificant. This may have caused a revaluation of Shopify stock

Like Shopify, Well Health Technologies stock has staying power

Well Health Technologies (TSX:WELL) is an omni-channel digital health company. Well Health stock has tumbled, despite the fact that business fundamentals remain strong. The 40% drop in its stock price in the last three months has been a shocker. It’s also provided us with an opportunity to buy into this growth stock.

Like Shopify’s e-commerce business, the digitization of the healthcare industry has been a long time coming. Because of the realities of the pandemic, it’s finally here in full force. It’ll bring with it greater efficiencies, greater patient and doctor satisfaction, and a better standard of care. The ending of the pandemic is not the end of Well Health. The new and improved way of doing healthcare is here to stay.

Motley Fool: The bottom line

Recent market action has created an opportunity to buy into growth stocks like Shopify that were previously prohibitively expensive. It’s an opportunity worth considering for long-term growth.