Buying stocks for your tax-free savings account (TFSA) should not be a short-term move. On the contrary, it should be a move that is driven by long-term fundamentals. At Motley Fool, this is one of our investing principles – to be in it for the long-term. So when I look for stocks to buy for my TFSA, this is my guiding principle. Please read on to see why stocks like Blackberry Inc. (TSX:BB)(NYSE:BB) make my list of stocks to buy and hold in a TFSA forever. The TFSA contribution limit is growing and is now at $82,500. We have increasingly more room to take advantage of this tax break.

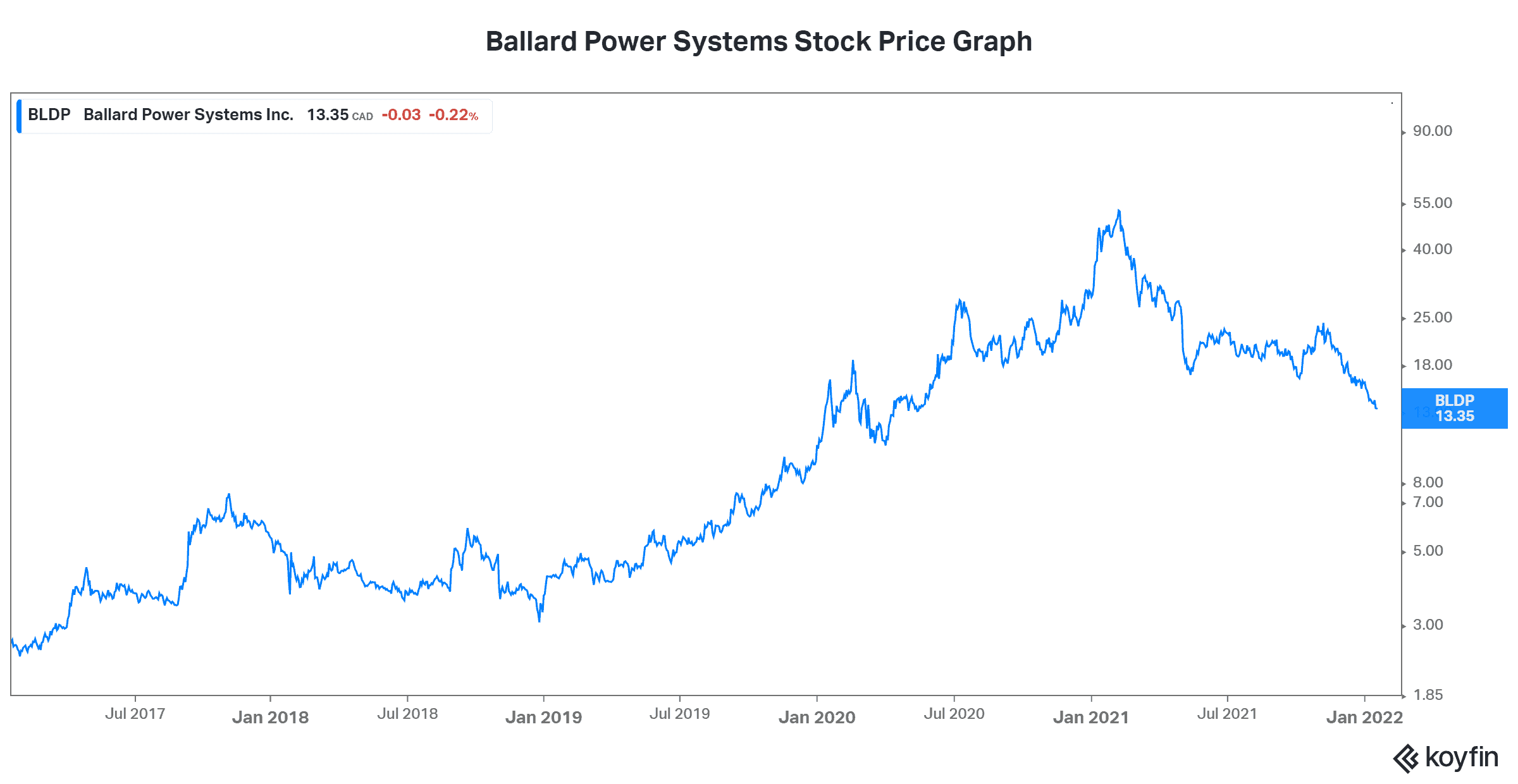

TFSA stock #1: Ballard Power Systems

Ballard Power Systems Inc. (TSX:BLDP(NASDAQE:BLDP) is a leading global provider and developer of innovative clean energy and fuel cell solutions. Ballard’s fuel cells power heavy-duty transportation vehicles such as buses and trucks. They are the zero emission solution for these vehicles.

The reason I’m recommending Ballard Power stock for a TFSA is quite simple – the fuel cell industry is growing rapidly and Ballard has a prime position. In fact, the fuel cell industry is estimated to be $130 billion. And this doesn’t even take into account the interest that’s emerging from new potential customers. For example, customers from Canada’s rail industry are beginning to engage with Ballard. Also, there’s a lot of interest from the European commuter railway industry. Lastly, there’s been a sharp increase in the interest for fuel cells in the stationary power market.

There’s clearly a lot of promise here. I think that in the long run, Ballard stock will grow exponentially. But, this company is just beginning to penetrate this market that’s also just beginning to emerge and grow. That means that we have to be prepared for growing pains. And we have to be prepared for volatility. Ballard does not yet turn a profit. And its stock price is extremely volatile, as we can see in the chart below. But it has the potential for explosive capital gains in the long run.

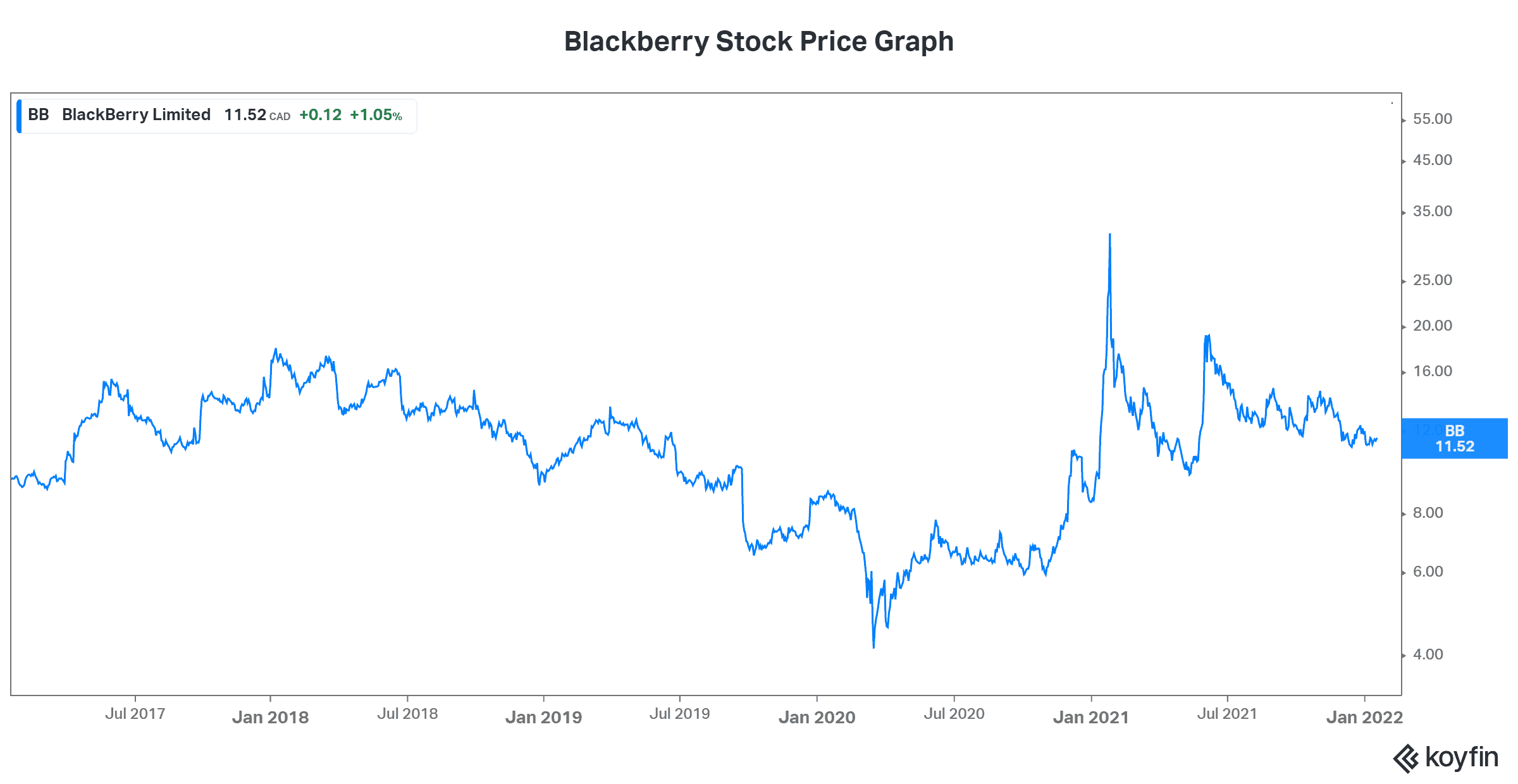

TFSA stock #2: Blackberry stock

Blackberry is another stock that is in the right industry. And like Ballard, Blackberry is also new and emerging. In fact, it was only a few years ago that Blackberry shifted gears. In a bold move, the company transformed itself by exiting the handheld phone industry. Blackberry focused on cybersecurity and embedded systems instead, two of the most lucrative industries today.

So Blackberry has been building itself up. And the company has done a commendable job. The greatest judge of this lies in the quality of its technology and solutions. These solutions and software have won countless awards in their respective industries. They’re also being used by some of the most reputable companies out there. This is very telling and it gives me confidence in Blackberry stock.

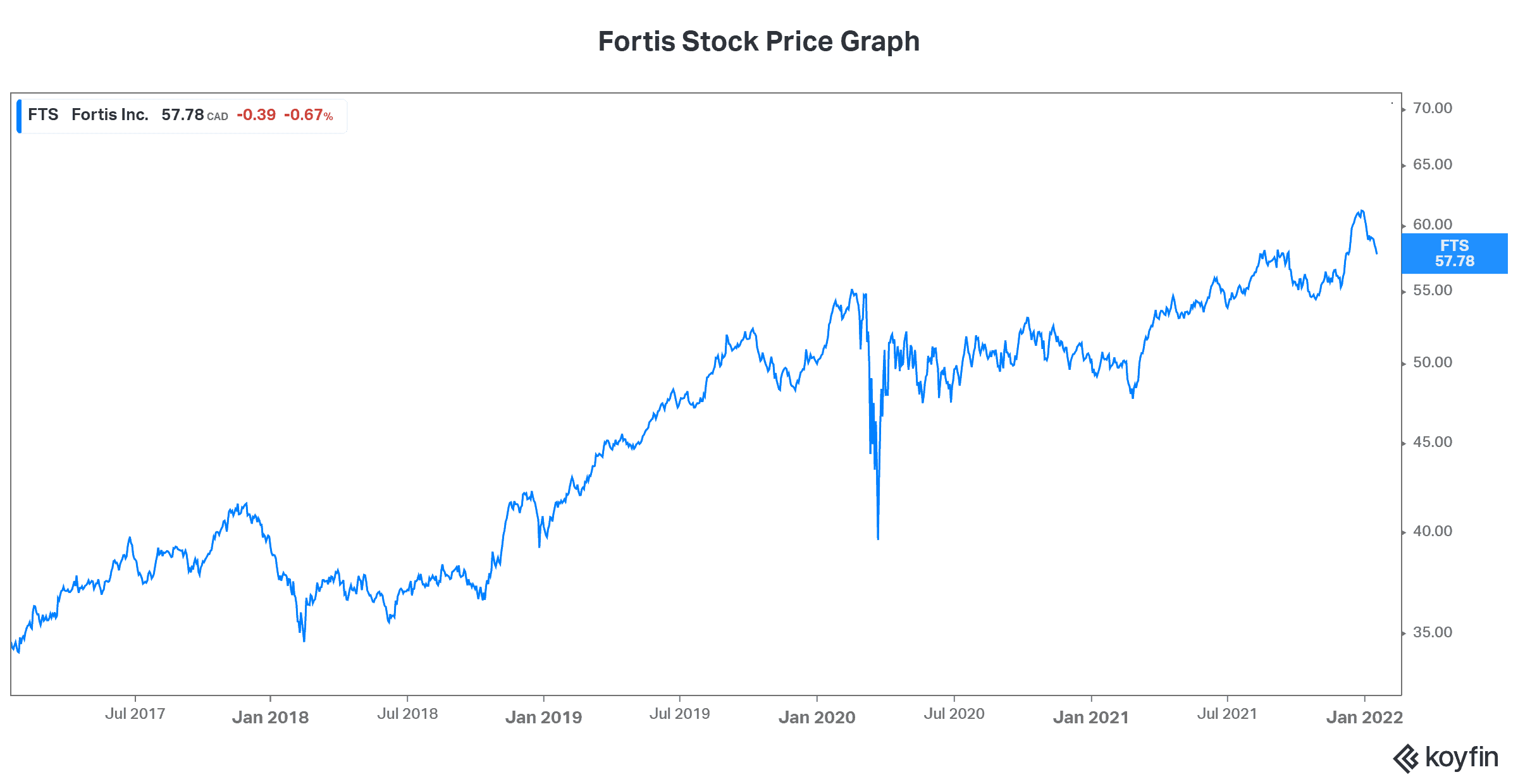

TFSA stock #3: Fortis stock

Lastly, Fortis Inc. (TSX:FTS)(NYSE:FTS) is a top stock to buy and hold forever in a TFSA. It’s a company that is very different from the other two in this article but it has its place in any TFSA portfolio. What draws me to Fortis is its steady and predictable performance. This has created a lot of wealth for shareholders of Fortis over the years. For example, Fortis has grown its dividend consistently for the last 48 years. That’s a long time. Its stock price has also grown very nicely, as you can see in the graph below.

All of this has been achieved by providing North America with the power it needs to survive and thrive. It’s a very predictable business that’s immune to economic shocks. But as we have seen, it’s also a very lucrative one.

Motley Fool: The bottom line

TFSA investing is most successful if we invest for the long term. I hope that this article has given you some useful ideas to make use of your TFSA contribution limit. In my view, these stocks are worth considering given their places in their respective industries and the fact that their long-term fundamentals are very favourable.