According to the Bank of Canada (BoC), the average inflation rate for 2021, as measured by the Consumer Price Index, hit a whopping 4.4% for goods and 2.1% for services.

In short, it’s not great. If inflation gets out of control, the BoC will raise its policy interest rate to slow down the economy. The effects of this can trickle into the stock market, causing growth stocks to lose value.

However, inflation and rising interest rates don’t necessarily have to spell doom for your portfolio. Certain sectors, like energy, can actually benefit from inflation.

By using exchange-traded funds (ETFs), you can easily tilt your portfolio toward the energy sector without the hassle of picking individual stocks. Let’s figure out how this works!

Why we want energy stocks

Inflation means higher commodity prices, whether it be oil, petrol, natural gas, or even renewables. As a consumer, this hurts our wallets when we do things like fill up our car.

However, from the perspective of energy companies, this means increased demands and revenues, which trickles down into a higher share price. For this reason, energy stocks have been historically positively correlated to inflation during periods of rising prices.

The best ETF for the role

I think a good short-term (one-year) addition to your portfolio could be the iShares S&P/TSX Capped Energy Index ETF (TSX:XEG), at least until the BoC is done with rate hikes and inflation cools down a bit.

XEG offers targeted exposure to companies in the Canadian energy sector. The fund will cost you a management expense ratio (MER) of 0.61% to hold, which is expensive for an ETF, but typical for a thematic fund.

XEG currently has a total of 22 holdings. Notable underlying stocks include Suncor Energy, Canadian Natural Resources, Crescent Point Energy, Cenovus Energy, Imperial Oil, and Tourmaline Oil. XEG also puts caps on the weights of each stock in the index and rebalances their allocations quarterly.

How does it perform during inflation?

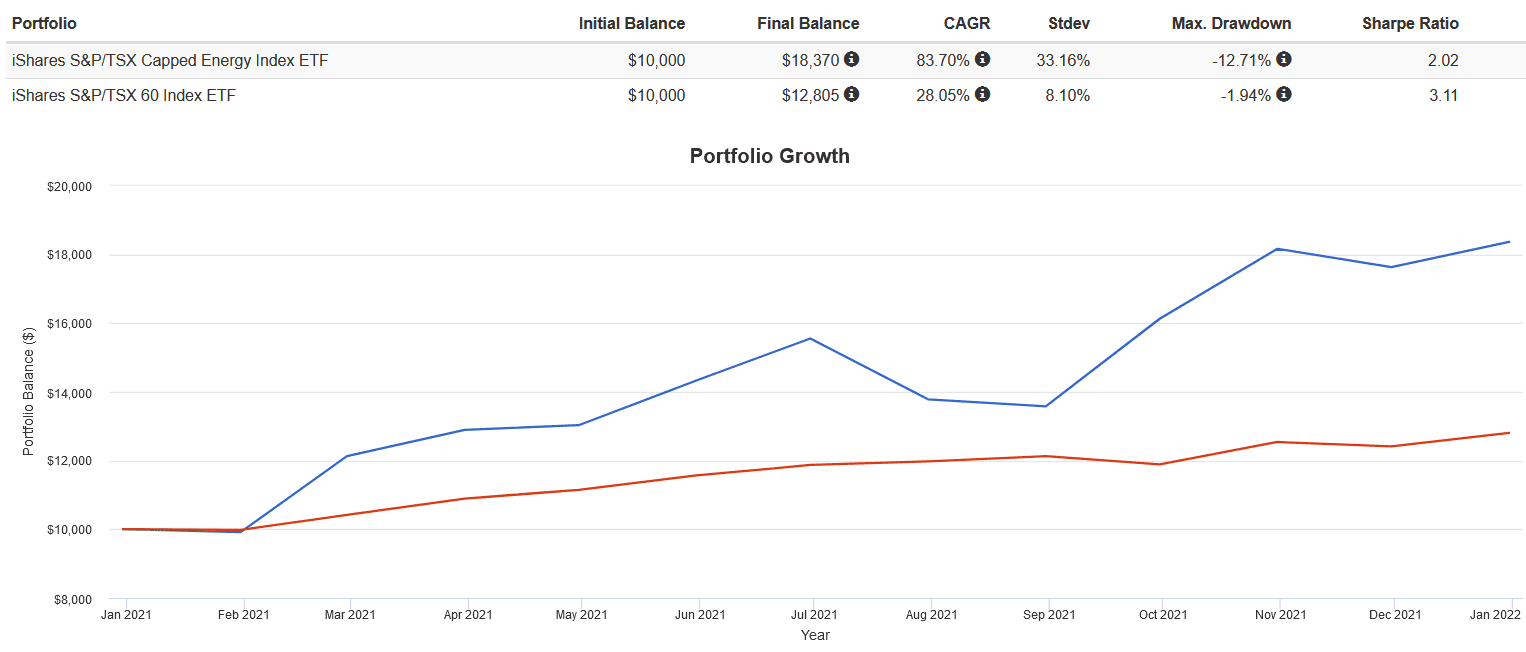

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

XEG will most likely underperform the broad Canadian stock market during the long run, due to the cyclicality and high volatility of the energy sector. However, as a short-term holding, it tends to outperform dramatically during inflationary conditions. The following backtest pitting XEG against the S&P/TSX Capped Composite Index for 2021 shows this:

The Foolish takeaway

The BoC has been optimistic about its inflation forecast, stating that it expects inflation to remain high for the first half of 2022, before easing back to the target 2% in the second half.

As of its last press release on December 8, the BoC has decided to maintain the policy interest rate at the current 0.25% and reaffirmed its commitment to hold it there until the economy has fully recovered.

However, other sources have disagreed, stating that they expect interest rate hikes to occur in the near future, perhaps as early as the first quarter of 2022. The markets have been rather choppy lately, perhaps reflecting this uncertainty.

In my opinion, multiple rate hikes are long overdue and coming. If the BoC does not raise rates soon and in a steady manner, it risks having no more room to drop rates when the next market crash and recession occurs.

For this reason, a good short-term play could be tilting your portfolio toward the energy sector, and an ETF like XEG is a great low-cost and simple way of executing that.