Not every investor aims to maximize their returns at all costs. Some with a low risk tolerance, a shorter time horizon, or more modest investment objectives have different goals, such as preservation of capital or slow but steady growth. Some people are apprehensive about investing at all due to the prospects of crashes and bear markets.

My point is that there is more to your investment portfolio beyond chasing the highest absolute returns. Metrics like risk-adjusted returns, volatility, drawdowns, beta, and correlations all come into play. Picking and choosing asset classes that optimize this is critical to ensuring your investments succeed.

What does low risk even mean, anyways?

The risk of our investment portfolio is primarily based on a few different metrics that all kind of work together to produce an overall risk profile.

First up is standard deviation. You can think of this percentage as how much your investments will fluctuate around their average return. For example, two separate portfolios both return 10% on average over 25 years, but the first has a standard deviation of 15% vs. the second at 10%. The first portfolio will experience greater ups and downs, while the second will have a smoother ride.

The second is max drawdown and drawdown recovery time. This is a measure of the percentage our portfolio has historically declined from peak to bottom, and how long it took to get back to that level. We want to keep drawdowns low and recovery time short, so our investments can get back to making money.

Last is beta, a measure of how volatile a stock is compared to the market. The market has a beta of one. A stock that swings more than the market has a beta above one. A stock that moves less than the market has a beta under one. And stocks that move inversely to the market have a negative beta under zero. We want to keep beta low to reduce volatility.

How do we manage these sources of risk?

The lesson here is to keep the standard deviation, drawdown amount/time, and volatility of your portfolio low. You can accomplish this using a balanced allocation of stocks combined with bonds via exchange-traded funds (ETFs).

For the stock allocation of your low-risk portfolio, I recommend BMO Low Volatility Canadian Equity ETF (TSX:ZLB). ZLB utilizes a rules-based methodology to build a portfolio of low-beta, Canadian, large-cap stocks.

ZLB will cost you a management expense ratio (MER) of 0.35% to hold, which is cheap enough for a actively managed specialty fund. The fund also has a annual distribution yield of 2.36% paid on a quarterly basis.

For the bond allocation of your low-risk portfolio, I recommend BMO Aggregate Bond Index ETF (TSX:ZAG). ZAG invests in a variety of high-quality bonds primarily with a term to maturity greater than one year.

ZAG tracks the broad investment-grade, fixed-income market, by holding federal, provincial, and corporate bonds. ZAG has an extremely low 0.09% MER, with a annual distribution yield of 3.05% paid monthly.

How has ZLB performed?

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

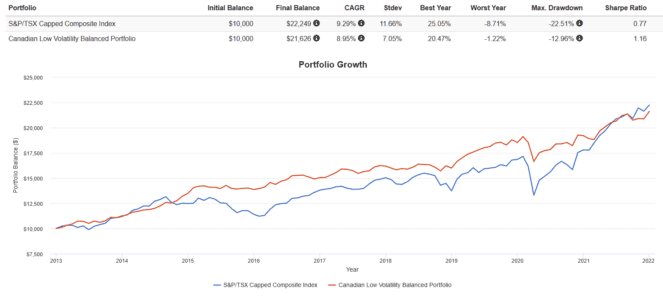

That being said, from 2013 to present with all dividends reinvested, the Canadian Low Volatility Balanced Portfolio performed exactly how we wanted it to. Compared to the S&P/TSX Capped Composite Index, the portfolio had much lower standard deviation, drawdowns, and beta. The overall return was slightly lower, but the ride was much smoother.

The Foolish takeaway

Using ZLB and ZAG in a 60/40 allocation could be an excellent way to set up a portfolio with less volatility, risk, and drawdowns that doesn’t drastically underperform the broad Canadian stock market.

If you are a low-risk investor, there’s nothing wrong about sacrificing some returns to match your risk tolerance, as long as you can still meet your investment objectives. Doing so may prevent you from getting too anxious and panic selling at the worst time, which would be catastrophic.