According to the Bank of Canada (BoC), the average inflation rate for 2021, as measured by the Consumer Price Index, hit a whopping 4.4% for goods and 2.1% for services.

In short, it’s not great. Essentially, every dollar you had in 2020 bought you 4.4% less for goods and 2.1% less for services in 2021. Your hard-earned money lost its purchasing power!

Still, this can be hard to visualize. 4.4% and 2.1% don’t sound like a lot. Over time, however, those small percentage increases in inflation every year can compound to really ding your savings. Let me illustrate.

What happens to our cash?

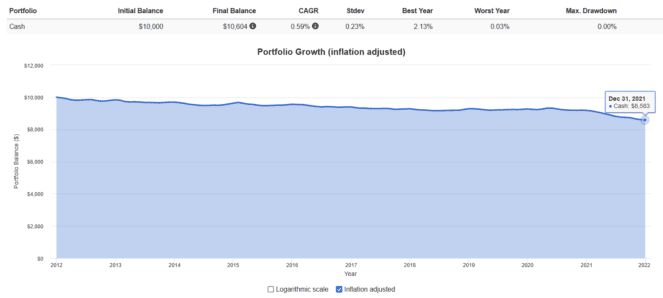

Let’s say you’re a very risk-averse person who hates the idea of investing. You’re afraid of what a stock market crash or bear market could do to your money. So, you decide to deposit $10,000 in a regular bank savings account.

Let’s assume you do this from 2012 to 2022. You would think that at the end of this period, you would still have $10,000, plus a tiny amount of interest, right?

Well, not quite. Your nominal rate of return was 0.59%, giving you a final balance of $10,604. However, your real rate of return was much less. After adjusting for inflation, you really only have $8,583 in 2012 dollars.

What can we do?

To not lose money, we have to make a sufficient return on our investment to at least match inflation. This would generally be around a 2% annual return. The exact investment you’ll make depends on your time horizon and risk tolerance.

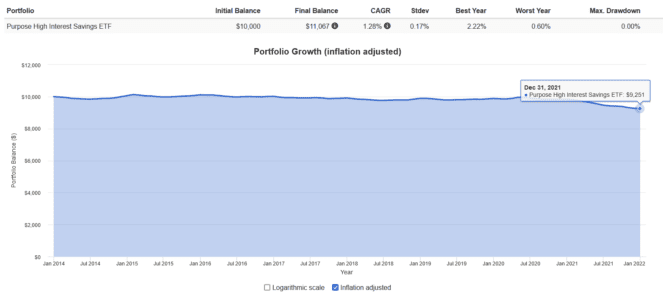

If you need this money within the next one to four years, a safe, non-volatile investment with low risk like a High-Interest Savings Account (HISA) or Guaranteed Investment Certificate (GIC) is best.

As seen below, investing in a HISA or GIC would leave you with $9,251. You might not beat inflation, but you’ll lose significantly less compared to cash with zero risk of losing your principal.

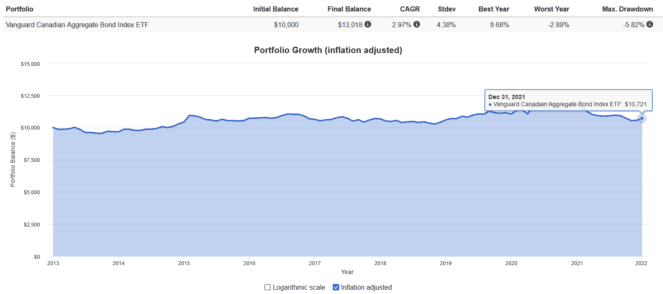

If you don’t need the money for another four to eight years, a slightly more risky but still safe investment would be a high-quality bond exchange-traded fund (ETF).

As seen below, investing in a bond ETF can cause moderate losses in the short term, but will beat inflation over time, leaving you with $10,721. Bonds are sensitive to interest rate changes, so be prepared for some volatility.

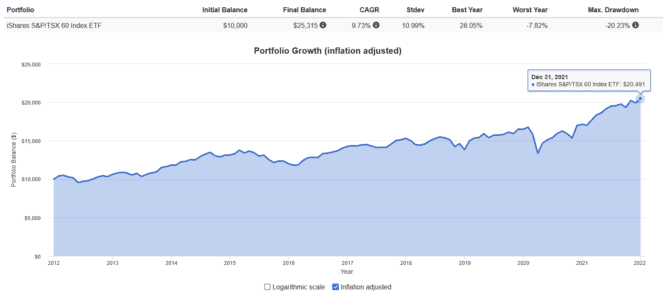

Finally, for investors who don’t need the money for another eight-plus years, I would recommend a stock ETF. A well-diversified portfolio of stocks will always ensure your money grows faster than inflation.

As seen below, investing in an index ETF that tracks the Canadian stock market is volatile but will beat inflation handily over a sufficient time horizon, leaving you with $20,491 — doubling your money!

The Foolish takeaway

Good investors avoid holding large amounts of cash for the fear of inflation eroding its purchasing power. Investors should mix and match HISAs, GICs, bonds, and stocks to suit their time horizon and risk tolerance. Doing so gives you the best chance of keeping your hard-earned dollars safe from inflation.