If you’re a long-term investor looking for stocks with value today, there’s no question that tech stocks are some of the best buys. But in addition to tech stocks, a smaller, more niche industry offers even more potential if you’re looking to buy today: cryptocurrencies and crypto stocks.

Tech stocks, especially companies with high-quality goods or services, offer tonnes of value for investors today thanks to their potential to grow over the long term. However, they could face headwinds in the short term, as interest rates are increased. Cryptocurrencies are similar but have fewer headwinds in the short term.

In addition, I’d also argue that right now, the industry as a whole has more potential than most tech stocks, as the development in the sector is constantly ongoing. So, while there are plenty of high-quality tech stocks to buy now, crypto stocks could offer even more potential. And some crypto stocks, such as Galaxy Digital (TSX:GLXY) offer a tonne of value in addition to all that growth potential.

Why Galaxy Digital is one of the top crypto stocks to buy now

Ever since the cryptocurrency market began to sell off late last fall, the entire industry has been under pressure. While smaller, more speculative coins have naturally been the worst performers, even high-quality cryptocurrencies such as Bitcoin (CRYPTO:BTC) have lost a tonne of value.

When you look at Galaxy Digital’s stock, however, it’s clear that the selloff it’s experienced is excessive. Plus, in addition to the fact that it looks cheap, Galaxy also has an incredible business with tonnes of diversification. So, even as the industry has been selling off lately, the company can continue to expand its operations and look for growth.

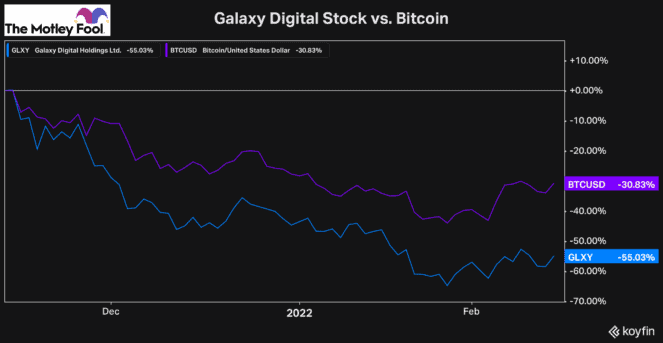

As you can see above, after declining by over 50% in the last three months, compared to Bitcoin, which is down just 30%, Galaxy Digital stock is extremely cheap. This makes now the perfect opportunity to buy this top crypto stock.

Galaxy’s business makes it an excellent long-term investment

Since the stock is so well diversified with five different operating segments, it’s a company that can continue to grow and expand its operations, even if cryptocurrencies like Bitcoin are falling in price. However, even its asset management division, one with the most impact from changing market conditions, shows Galaxy looks to be too cheap, despite the price of Bitcoin and other cryptocurrencies being so volatile.

For example, Galaxy Digital’s assets under management at the end of January stood at roughly $2.3 billion. That’s down from the $3.4 billion it peaked at in November, during the peak of the cryptocurrency industry’s rally. However, while the stock fell by over 45% from the end of November to the end of January, Galaxy Digital’s assets under management only fell by roughly 30%.

So, with several other operating segments that the stock offers exposure to, such as its investment banking division, principal investments and Bitcoin mining, the fact that it’s sold off so much shows it’s undervalued.

Of course, the stock is going to be volatile for a while, especially while the industry continues to see a tonne of volatility. But if you’re investing for the long run, these short-term price fluctuations shouldn’t matter. And, if anything, this volatility gives investors the perfect opportunity to buy the top crypto stock while it’s cheap, which is why it’s one of the top stocks you can buy today.