Most Canadian investors maintain a home country bias in their stock portfolios. This refers to the practice of over-weighting Canadian equities relative to their world market capitalization.

For example, although Canada comprises just 3% of the total world stock market, many Canadians keep an allocation of 20%-50% to Canadian equities in their portfolio.

There are numerous benefits to implementing a moderate home country bias (20%-30%), including lower volatility, reduced currency risk, and better tax efficiency.

Today, I’ll be going over two staple exchange-traded funds (ETFs) every Canadian investor should have as a foundation in their stock portfolio.

BlackRock iShares S&P/TSX Composite High Dividend Index ETF

Up first is a favourite for dividend growth investors, iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI). XEI passively tracks the performance of 76 Canadian stocks characterized by high dividend yields.

XEI is heavily weighted in the financials (29.95%) and energy (32.04%) sectors, which is expected given the plethora of high dividend paying stocks represented there. Overall, it resembles the broader Canadian market.

The top 10 holdings in XEI include Royal Bank, Toronto-Dominion Bank, Bank of Nova Scotia, Enbridge, Bank of Montreal, Canadian Natural Resources, Canadian Imperial Bank of Commerce, TC Energy, BCE, and Suncor Energy.

Currently, XEI costs a management expense ratio (MER) of 0.22% to hold, which is costlier than broad indexes but not expensive for a specialty fund. The 12-month dividend yield stands at a respectable 3.43%.

BlackRock iShares Core S&P/TSX Capped Composite Index ETF

Investors looking for a passive indexing approach can elect to instead track the broad Canadian stock market with iShares S&P/TSX Composite High Dividend Index ETF (TSX:XIC). XIC tracks 240 large-, mid- and small-cap stocks.

XIC is still concentrated in the financials (33.64%) and energy (14.99%) sectors, but there is a more balanced allocation to other sectors such as materials, industrials, technology, utilities, and telecoms.

The top 10 holdings in XIC include Royal Bank, Toronto-Dominion Bank, Shopify, Bank of Nova Scotia, Enbridge, Brookfield Asset Management, Bank of Montreal, Canadian National Railway, Canadian Pacific Railway, and Canadian Natural Resources.

Currently, XIC costs a MER of just 0.06% to hold, which is extremely cheap and as affordable as it gets for Canadian investors. The 12-month dividend yield stands at a decent 2.38%.

Head to head performance

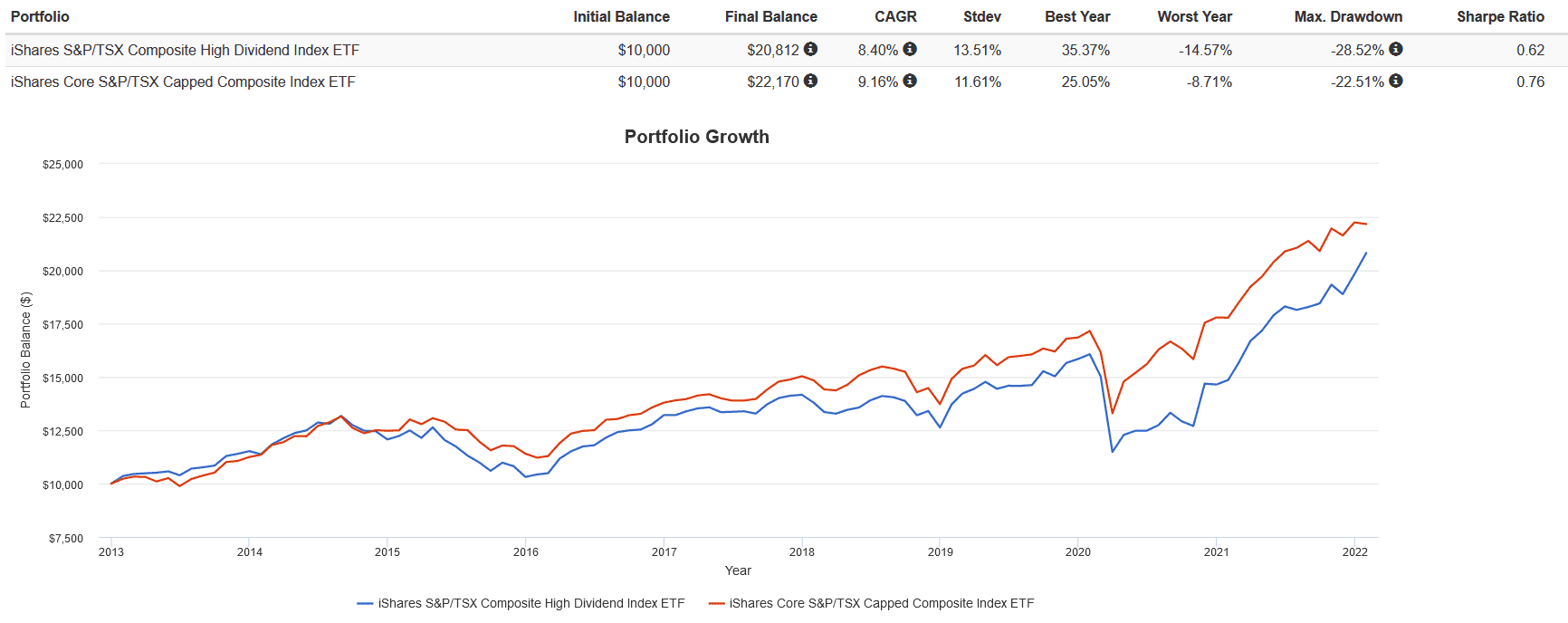

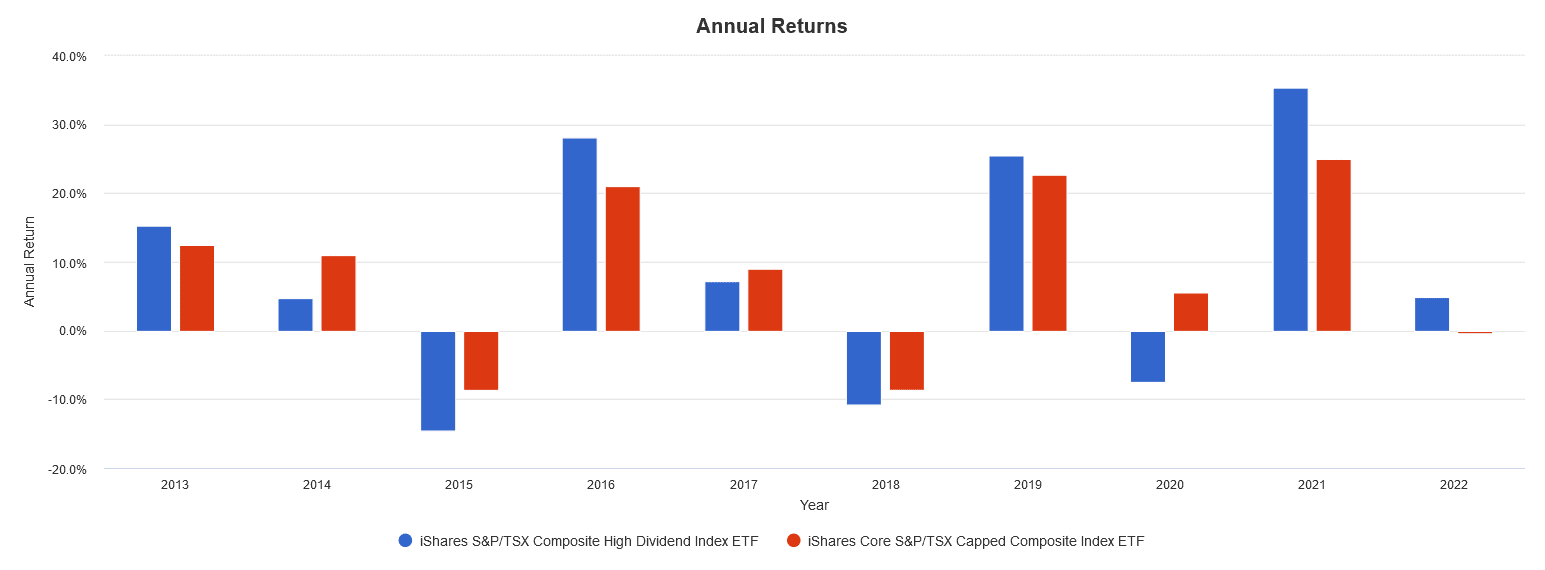

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2014 to present with all dividends reinvested XIC has outperformed XEI in terms of higher total return (CAGR of 9.16% vs 8.40%), lower volatility (Stdev of 11.61% vs 13.51%), smaller drawdowns (max of -22.51% vs -28.52%), and better risk-adjusted returns (Sharpe ratio of 0.76 vs 0.62).

The Foolish takeaway

If I had to pick one to buy and hold until retirement, I would with XIC. The diversification benefits from owning the entire Canadian stock market and at a much lower MER makes it more attractive than XEI for me. XEI is too heavily concentrated in the financial and energy sectors, which are prone to cyclical under-performance.

Despite XEI’s higher dividend yield and total return, I would still opt for XIC. Controlling sources of risk like under-diversification and high fees go a long way toward boosting portfolio returns. That being said, if your goal is income, or you have reason to bet on a concentrated portfolio of blue-chip dividend stocks, XEI is the way to go.