Gold stocks were among the best-performing stocks yesterday. Stocks like Barrick Gold (TSX:ABX)(NYSE:GOLD) rallied as much as 8%. With inflation heating up and world tensions escalating, gold stocks are a good place to be right now.

Why gold? Why now?

Upon reading this article, many might question my logic. Many might say that gold is a lost investment class, having been replaced by cryptocurrency. We might not even remember a time when we needed safety assets in our portfolios. I mean, rising markets is really all we’ve seen for many years now. But like every great cycle, this one, too, must come to an end.

I’m reminded at this point of oil and gas. Not too many years ago, investors would not even consider these stocks. This was because they were suffering from “perpetually” low commodity prices. They were also being shunned by the investment community. Therefore, underinvestment and poor financials ruled the day. Today, well, we all know about the bull cycle that has lifted energy stocks. But even back then, the seeds of value were being sown. Underinvestment in the industry meant falling supply. A lack of investor demand meant unfairly low stock prices. Back then, most people would not go near oil and gas stocks. The irony is that it was the best time to buy. Those who bought then are seeing fantastic returns today of over 100% in many cases.

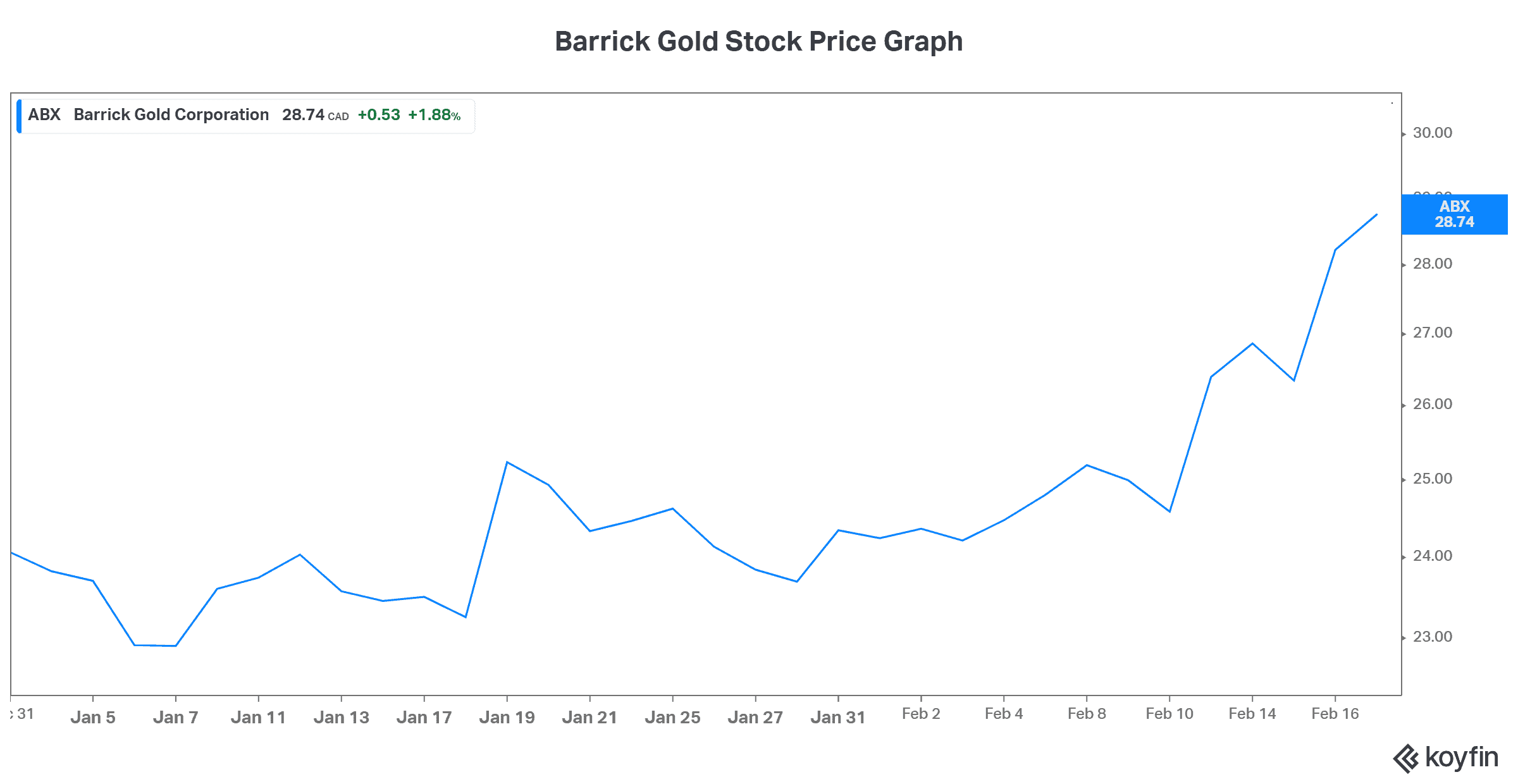

Barrick Gold: Still the go-to gold stock

Barrick is one of the largest and most well-known gold stocks on the TSX and globally. It has a market cap of $50 billion. Importantly, it really is the go-to name globally for gold exposure. This means that I think we can expect demand for Barrick Gold stock to prop it much higher in the coming months. If inflation continues to rise and world tensions continue to escalate, we will have the perfect storm for Barrick.

So, Barrick’s assets are spread all over the world. This includes some politically risky and unsafe areas. This is something that I don’t like about the company. But it doesn’t change the fact that gold is a safe haven. It also doesn’t change the fact that Barrick Gold is the most top of mind gold stock that investors flock to. In short, I think we’ll be needing this safe haven in the coming months.

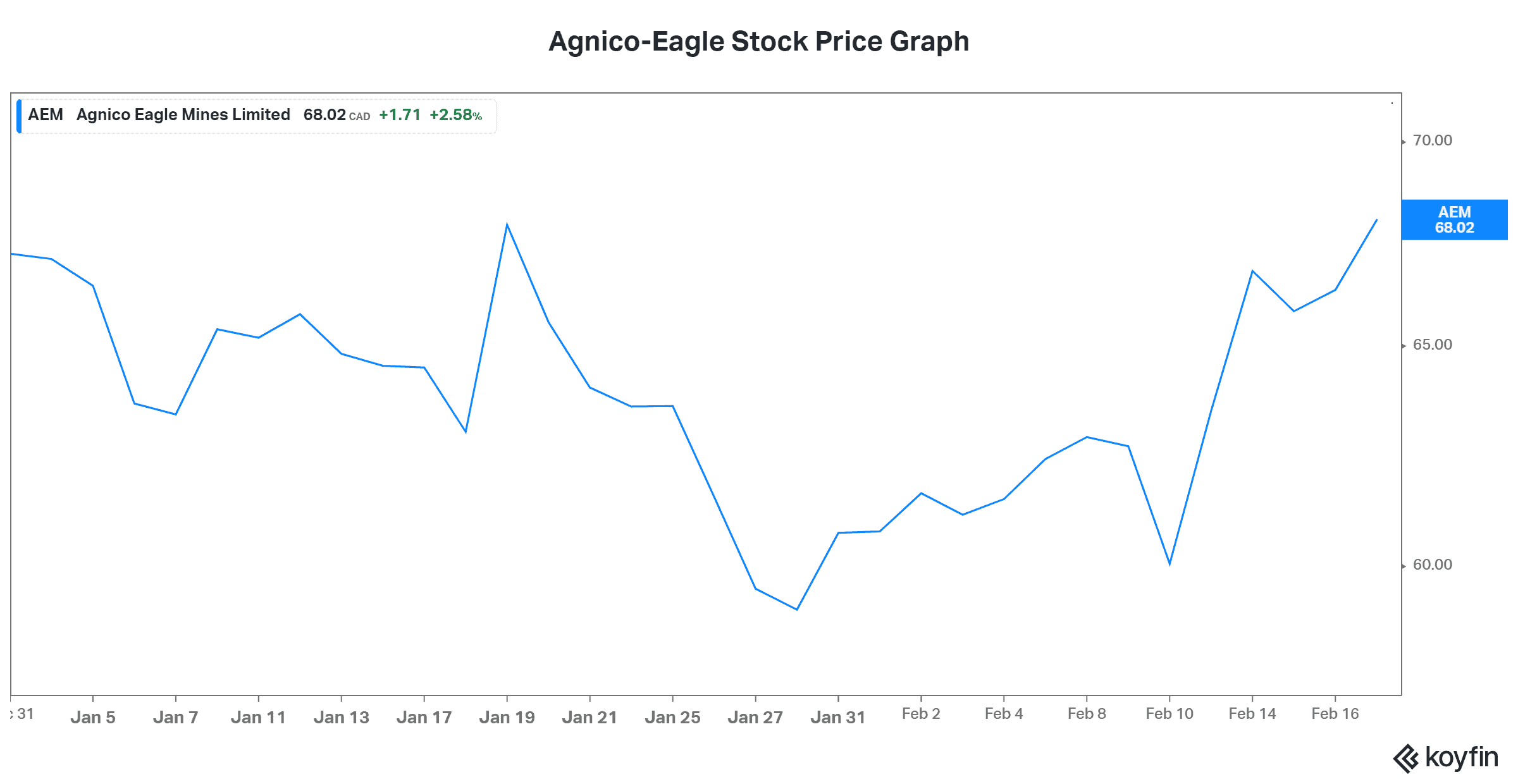

Agnico-Eagle Mines stock: The “safer” safe haven

For investors who share this concern, consider Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM). Agnico is a force of its own, operating only in safe regions — politically and otherwise. This means that Agnico’s operations are in areas like North America, Europe, and Mexico. Compared to Barrick and most other gold companies that have operations in many outright dangerous parts of the world, this is a key advantage.

Also, Agnico-Eagle Mines has an industry-leading cost structure. This has translated into strong cash flows and strong dividend increases. This is evident in the company’s 8% compound annual growth rate in its dividend in the last five years. It’s even more evident in the last year, when the dividend more than doubled.

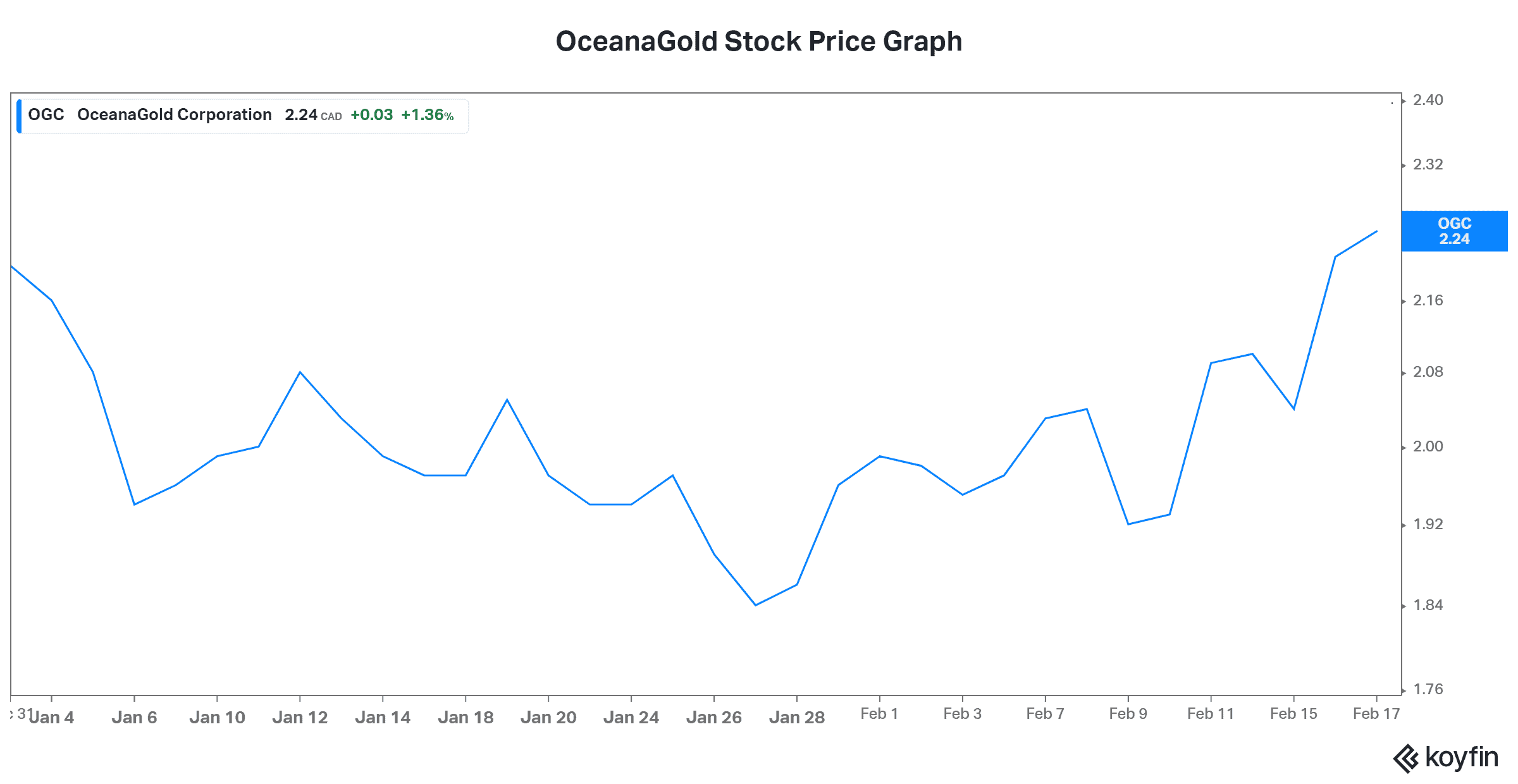

OceanaGold: The up and coming

For the investor who is perhaps looking for more risk for the potential of a higher return in the gold space, attractively valued OceanaGold (TSX:OGC) is a good option. This gold stock is dirt cheap, yet it’s also benefitting greatly from rising gold prices. In fact, in its last quarter, revenues doubled and net income swung to a positive $45 million.

Cash flows are soaring along with gold prices, as Oceana Gold stock climbed almost 10% higher yesterday. It’s no Barrick Gold, but it looks very interesting here trading below book value.

Motley Fool: The bottom line

Gold stocks remain undervalued in the market today. But the environment is fast changing. With rising inflation and global tensions, we can be sure that they won’t remain undervalued much longer. In fact, I think we can expect rising fortunes and dividends for gold stocks such as Barrick Gold.