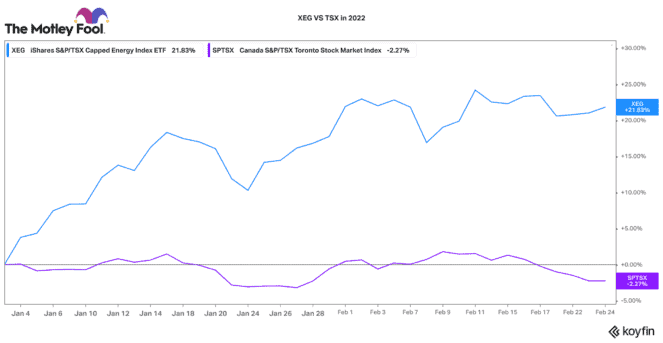

In 2022, Canadian energy stocks have been outperforming just about any other sector. The S&P/TSX Capped Energy Index is up 21% year to date. That is compared to the S&P/TSX Composite Index, which is actually down 2.7% in that time frame.

On news of Russia attacking Ukraine, Brent crude oil spiked over US$100 per barrel for the first time since 2014. Increased sanctions against Russia could continue to limit energy supply and keep prices elevated.

Beyond geopolitical reasons, long-term fundamentals are favourable for Canadian energy stocks

Beyond the geopolitical concerns, global energy supply just has not been keeping up with demand. This is especially so with pandemic restrictions easing and travel trends expected to normalize. According to some analysts, supply-demand fundamentals should support elevated oil prices for much longer than many investors are willing to admit.

This all bodes well for Canadian energy stocks. With inflation soaring, energy stocks have historically been a good hedge. Right now, appears to be an ideal time to have some exposure. Below are three Canadian energy stocks that are still incredibly attractive today.

ARC Resources: A top Canadian energy stock

ARC Resources (TSX:ARX) is among Canada’s largest producers of natural gas. It also has substantial crude and condensate assets. It operates largely in the Montney energy play in Alberta and British Columbia. The company had a great year in 2021. It generated $1.4 billion ($2.16 per share) of free funds flow. On a trailing basis, that is a 14% free cash flow yield!

Given that ARC is allocating over 50% of free cash flows to dividends and share buybacks, 2022 should be even better. ARC has a low-levered balance sheet, great long-term productive assets, and an attractive 2.7% dividend. This Canadian energy stock only trades with a price-to-earnings ratio of seven today, so for income and upside, this is a very interesting stock.

Suncor Energy

Another very cheap energy stock is Suncor Energy (TSX:SU)(NYSE:SU). Suncor used to be the king of large-cap, integrated energy players in North America. However, after dropping its dividend during the pandemic and facing some persistent operational issues, this stock has significantly underperformed peers. Despite rising 17% this year, it still has not hit its pre-pandemic price levels.

While I would like to see it clean up its operational record, this Canadian stock is cheap at 8.7 times earnings. Likewise, investors are compensated with an elevated 4.5% dividend. At current prices, Suncor is yielding significant amounts of free cash flow. As its de-levers, buys back stock, and likely increases its dividend again in 2022, investors should enjoy an attractive total-return profile.

AltaGas

If you want exposure to strong energy markets, but only limited commodity risk, AltaGas (TSX:ALA) is attractive. Around half its business is derived from a regulated natural gas distribution business in the United States. That provides a very predictable stream of cash flows. However, the remainder of its business comes from an integrated midstream operation largely in Canada.

It collects, processes, and exports natural gas products (NGLs, propane, etc.) from the Western Canadian Sedimentary Basin. Given strong energy demand, particularly in Asia, this segment has enjoyed incredibly strong EBITDA growth for several quarters.

This has afforded it the capacity to significantly reduce debt. It also increased its dividend by 6% recently. Today, this Canadian energy stock pays a near 4% dividend. When compared to other midstream/utility peers, AltaGas trades at a discount, despite having higher potential to grow in the longer term.