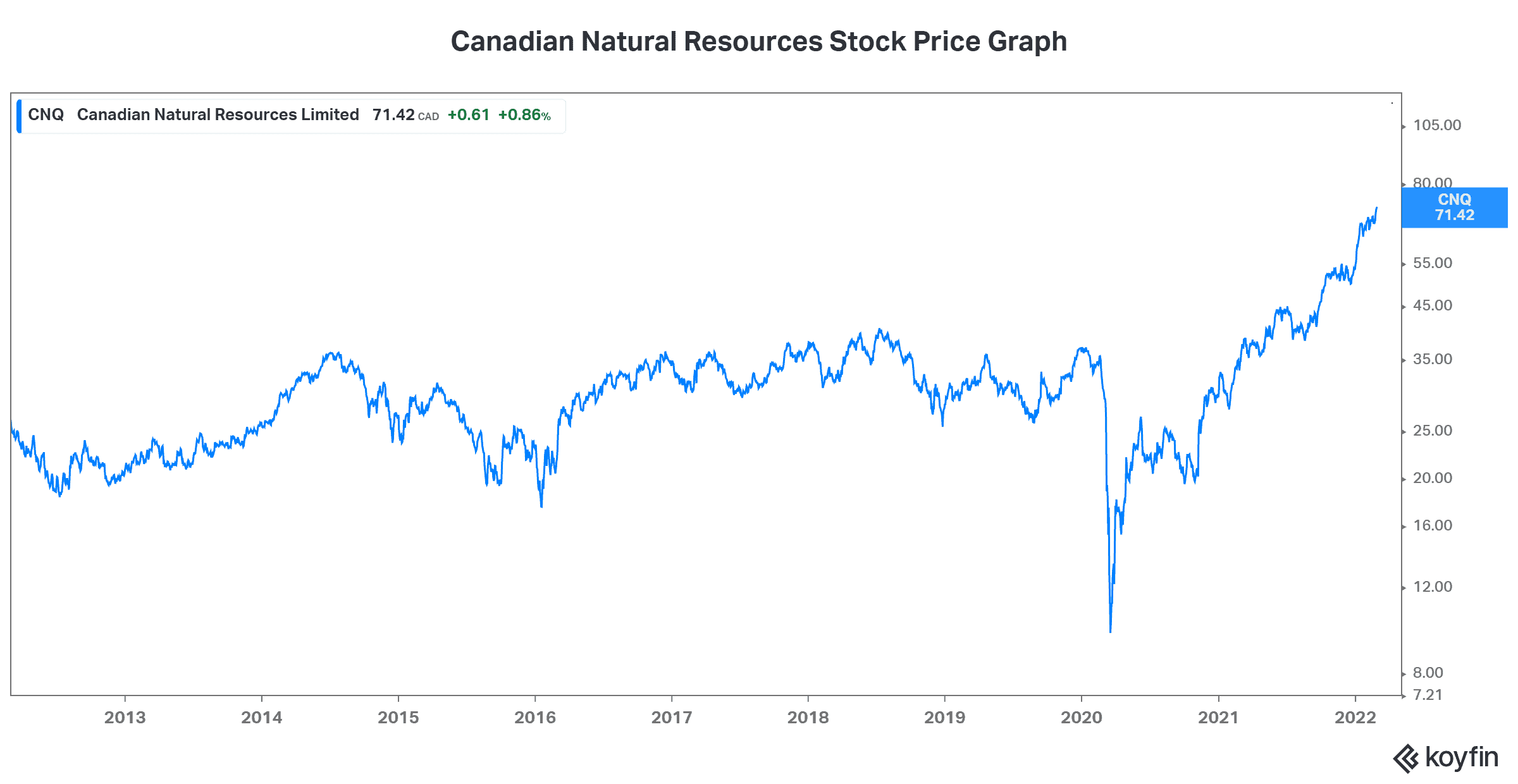

Crude oil prices surpassed $100 today as this oil cycle is quickly becoming one of the strongest in a long time. In fact, prices are hitting levels that haven’t been seen since 2014. What happened in between was a world of pain for oil and gas companies. Energy stocks like Canadian Natural Resources Ltd. (TSX:CNQ)(NYSE:CNQ) were struggling to justify their existence. Investors shunned these companies as crude oil prices tanked and environmental concerns became everything.

But today, the Russian/Ukraine crisis is sending already booming oil and gas prices even higher.

Crude oil prices rising on fundamentals

This very sad situation with Russia and Ukraine is not the only reason for strong crude oil prices. More so, it’s certainly not the only reason for strong natural gas prices. It is, in fact, the result of years of underinvestment and years of neglect. As the famous saying goes, the only cure for low commodity prices is low commodity prices. In other words, the only way that the supply/demand fundamentals of a commodity can be strengthened is if there’s pure economic incentive for the players.

So, if oil and gas prices are low, this will naturally result in lower investment in production because companies do not have a big economic incentive. If they’re losing money on their investment, then they will adjust the investment lower. Thankfully, a company like Canadian Natural Resources was able to survive low prices pretty happily. This is because of its long life, low decline reserves. Essentially, its production is steady, predictable, and requires little capital investment to sustain. So Canadian Natural Resources stock was and is the perfect stock for investors to gain energy exposure. In the last few years, Canadian Natural stock has rallied big, all while maintaining and even increasing its dividend.

Likewise, if oil and gas prices are low, consumers will be more likely to use these sources of energy. The cheapest source will be in high demand just because it’s cheap. At the end of the day, we have just seen market forces at work. Low prices means lower supply and higher demand. This plays out until one day, prices rise again to account for the new supply/demand balance. This is where we’re at today.

Russia/Ukraine conflict exacerbates the supply/demand imbalance in crude oil, driving energy stocks even higher

As you know, this situation with Russia and Ukraine has brought up many fears. One of the fears is that of crude oil and gas supply disruptions. It’s a valid concern and one that’s playing out today as oil prices shoot through the $100 mark. Similarly, natural gas is fast approaching $5 as the same market forces drive it higher.

So with oil and gas prices hitting these highs, Canadian Natural Resources is looking really good. Instead of just holding on for dear life, things are booming. CNQ will report Q4 results on Thursday, and these results are expected to be really strong. In fact, if the third-quarter results are any indication, the fourth quarter will likely be a blow-out. Massive cash flows and huge dividend increases have been the norm for Canadian Natural Resources recently, and I expect this to continue. For the fourth quarter, the consensus expectation is for EPS of $2.14 versus $0.16 in Q4 2020. That’s a whole 1,200% increase.

Motley Fool: the bottom line

So the bottom line here is pretty simple. The tide for energy stocks has turned and is decidedly up. The momentum is huge. Don’t make the mistake of thinking that this is only a trade based on geopolitical conflict. It is, in fact, so much more. Canadian Natural Resources stock has been rallying long before this conflict. Its strong results over the last many years show why this is a top energy stock to buy to get in on this lucrative industry.