Air Canada (TSX:AC) stock has had a rough ride in the last two years. Unfortunately, it’s about to get even rougher. The turbulence of the last two years appears to be ending, but there’s another storm ahead. The oil price is skyrocketing, showing no signs of slowing down.

Will this jeopardize Air Canada stock’s recovery?

Air Canada: Onto the next obstacle — a rising oil price

It seems like there’s always something for Canadian airliner Air Canada to be worried about. After two years of halted flights and unprecedented restrictions, the airliner was just gearing up for a return to some kind of normalcy. Welcoming passengers back to the sky seemed to be in within reach

But today, this recovery appears to be in jeopardy. It’s sad but true, and the consequences cannot be ignored. Oil prices are skyrocketing. In fact, crude oil has risen 77% in the last year and 44% so far in 2022. Remember, jet fuel makes up a large portion of Air Canada’s total operating expenses. In 2019, when oil prices averaged below $60, aircraft fuel represented 22% of total operating cost. Oil prices are dramatically higher today, rapidly closing in on $110. This will prove to be very detrimental to Air Canada’s bottom line.

So, while Air Canada is gearing up for a comeback, we cannot ignore this. Air Canada’s profitability will be hit hard. This is not the same business it was in 2019. It was never going to be the same because of the pandemic. But add the rising fuel cost to the list of things that have changed, and we have a strong deterioration in the investment case for Air Canada and its stock price.

Air Canada stock: A recovery is not a given

Throughout history, the airline business was not a stable or profitable business. It was a big headache for airline executives, government, and, of course, investors. Consequently, the common belief was that airline stocks were not great investments. They were just too cyclical and unpredictable. Also, they were just not profitable enough.

Today, I feel like this way of thinking may be making sense once again. We can’t deny that in the years prior to the pandemic, Air Canada executives really performed a miracle on the airliner. They slashed costs, chased and achieved greater efficiencies, and they turned it into a profitable cash flow machine. It was a true success story.

But at this point, the cards are increasingly stacked against Air Canada. While it pains me to say it, I feel like the risk/reward trade-off for Air Canada stock may have just deteriorated too much. Rising oil prices feel like the nail in the coffin.

The fleeting glimpse of better days at Air Canada

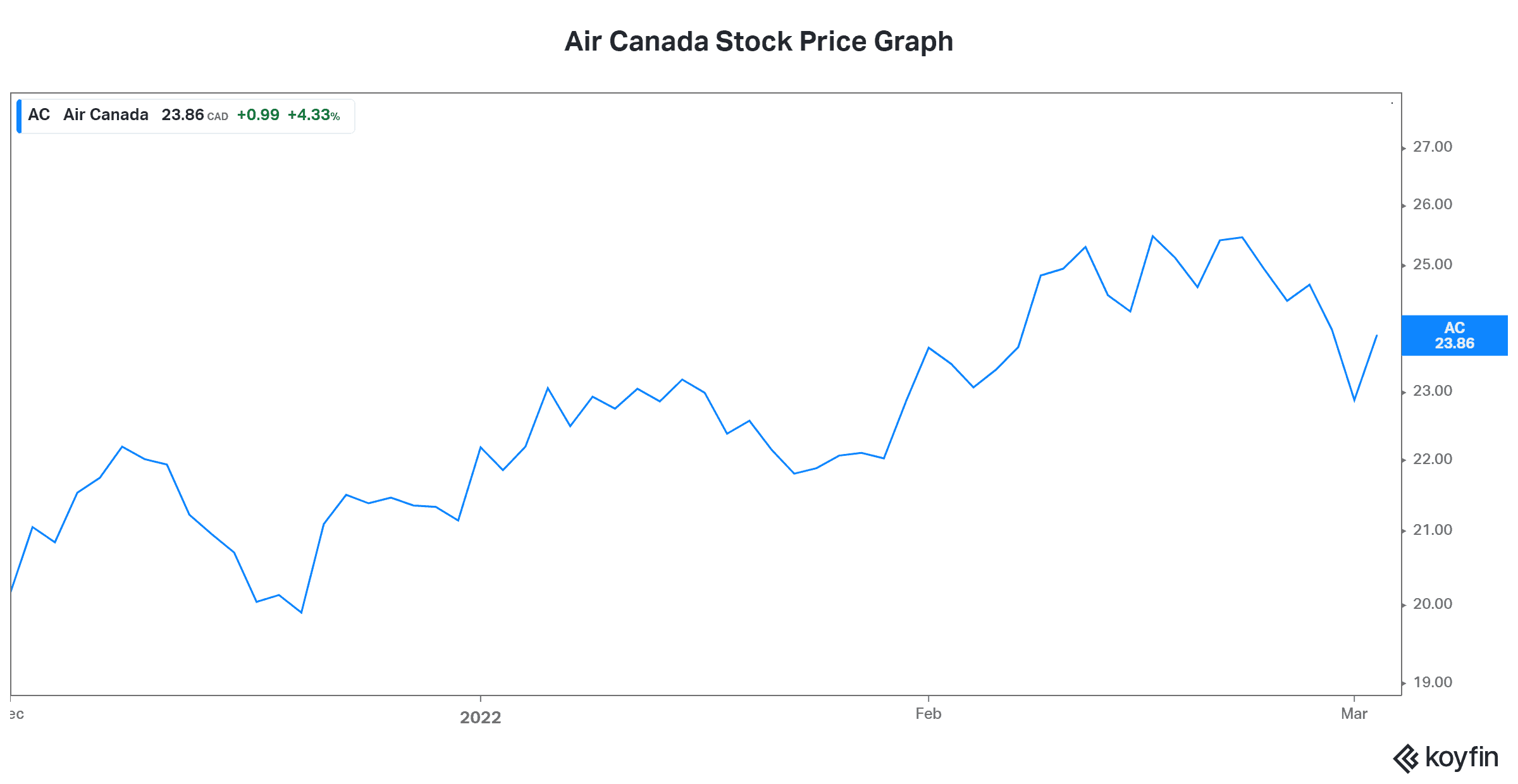

Air Canada’s 2021 results and outlook make this reality sting even more. Ticket sales were climbing fast. EBITDA was finally positive. Things were fast approaching pre-pandemic levels. Take a look at the graph below to see how Air Canada saw its stock price rise as this anticipation was building.

But now, rising oil prices place all of this into question. We’ve already discussed how high oil prices will hit Air Canada’s profitability by dramatically increasing its cost structure. The other piece to this puzzle is how high oil prices will impact consumers’ wealth. In short, there won’t be as much money in people’s travel budgets. Air Canada ticket sales will therefore suffer.

Motley Fool: The bottom line

As we head into the reopening of economies and air travel, be aware of the fact that it’s not all blue skies for Air Canada. While many were hoping for a big rebound for Air Canada stock in 2022, the soaring oil price has placed that whole possibility into question. Tread carefully and be mindful of the changing risk/reward dynamic of Air Canada stock.