The March 2020 COVID crash and brief bear market was a sobering reminder for many investors about the need for a bond allocation, even for the most aggressive portfolios. While stocks fell by over 30%, government bonds rose, with U.S. long-term treasuries (LTTs) up some 20% at the peak of the crash.

This behaviour isn’t unique to that crash. LTTs have acted as a “parachute” during numerous market crashes, including the Dot-Com Bubble, 911, and the Great Financial Crisis. Despite the rising-rate environment, I think LTTs are still one of the best available options for hedging against equity risk.

Why do we want bonds?

We want LTTs in particular because they have a low to negative correlation with stocks. To put it simply, when stocks fall, LTTs tend to rise, and by a lot, due to their high volatility. This is called the “flight to quality,” caused by investors panic selling stocks and buying government bonds en masse.

Unlike other hedges, like put options or VIX futures, bonds have a positive expected return over time. Moreover, during a bear market, governments tend to drop interest rates, which sends yields lower, sharply raising the price of LTTs (more on how interest rates affect LTTs later).

Investors who have a good allocation to LTTs can reap the benefits of re-balancing. At the start of every quarter, sell the high-performing assets (usually stocks) and buy the lower-performing assets (usually bonds) until you hit your target asset allocation (e.g., 60/40 stocks/bonds).

Rebalancing ensures you sell high and buy low. In the event of a market crash, you can also tactically rebalance, as your LTTs will likely have increased in price, allowing you to sell for a profit and buy cheap stocks at a deep discount. This will enhance your long-term gains.

Why long-term U.S. treasuries?

With bonds, our main risks come from defaults and interest rates. With LTTs, default risk is moot. U.S. government debt is regarded as risk free. This is why we don’t want to use corporate bonds as a hedge, because they tend to drop with equities during times of crisis. However, interest rate risk is a bit different.

Bond prices are inversely related to interest rates. When rates go up, bond prices fall, and their yield increases. Duration measures how sensitive of bond prices are to interest rate movements. A bond with a duration of two years would fall about 2% if interest rates rose 1% and vice versa if rates fell.

We want LTTs, because they are more volatile than short-term bonds, have no default risk compared to corporate bonds, and have the highest negative correlation with the stock market. Therefore, they can act as a reliable “counterweight” when stocks crash and interest rates drop.

Which ETF should I use?

Your best bet here is iShares 20+ Year Treasury Bond ETF (NYSE:TLT). TLT tracks the performance of U.S. Treasury bonds with remaining maturities greater than 20 years. The fund has an effective duration of 19.06 years, with a weighted average coupon of 2.50%, and management expense ratio of 0.15%.

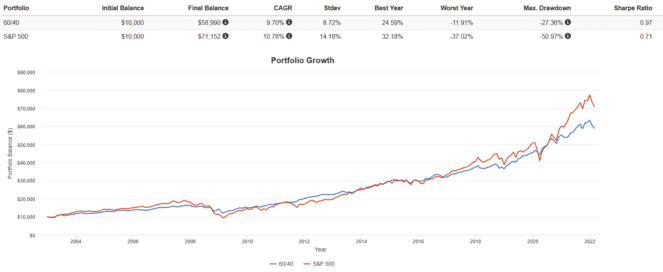

From 2003 to present, with all dividends reinvested and quarterly rebalancing, a 60/40 portfolio of the S&P 500 and TLT significantly outperformed the S&P 500 alone in terms of higher risk-adjusted returns and lower max drawdowns during various crashes.

It is important to note that this period was time of falling interest rates, which boosted the returns of bonds. A period of rising interest rates (like right now) may cause the correlation between LTTs and equities to become more positive, which would hurt their protective ability. A small allocation to gold might help here.

The Foolish takeaway

I still expect LTTs to do their job during a crash. Remember, we’re not talking about holding LTTs in isolation, which is a bad idea in a rising-rate environment. We’re talking about them in terms of their contributions to a portfolio.

Recently, LTTs prices spiked again as a result of investor fear and uncertainty around the Russia-Ukraine conflict. This is a good sign that LTTs are still seen as the safe-haven asset to buy when stocks are in a free fall.