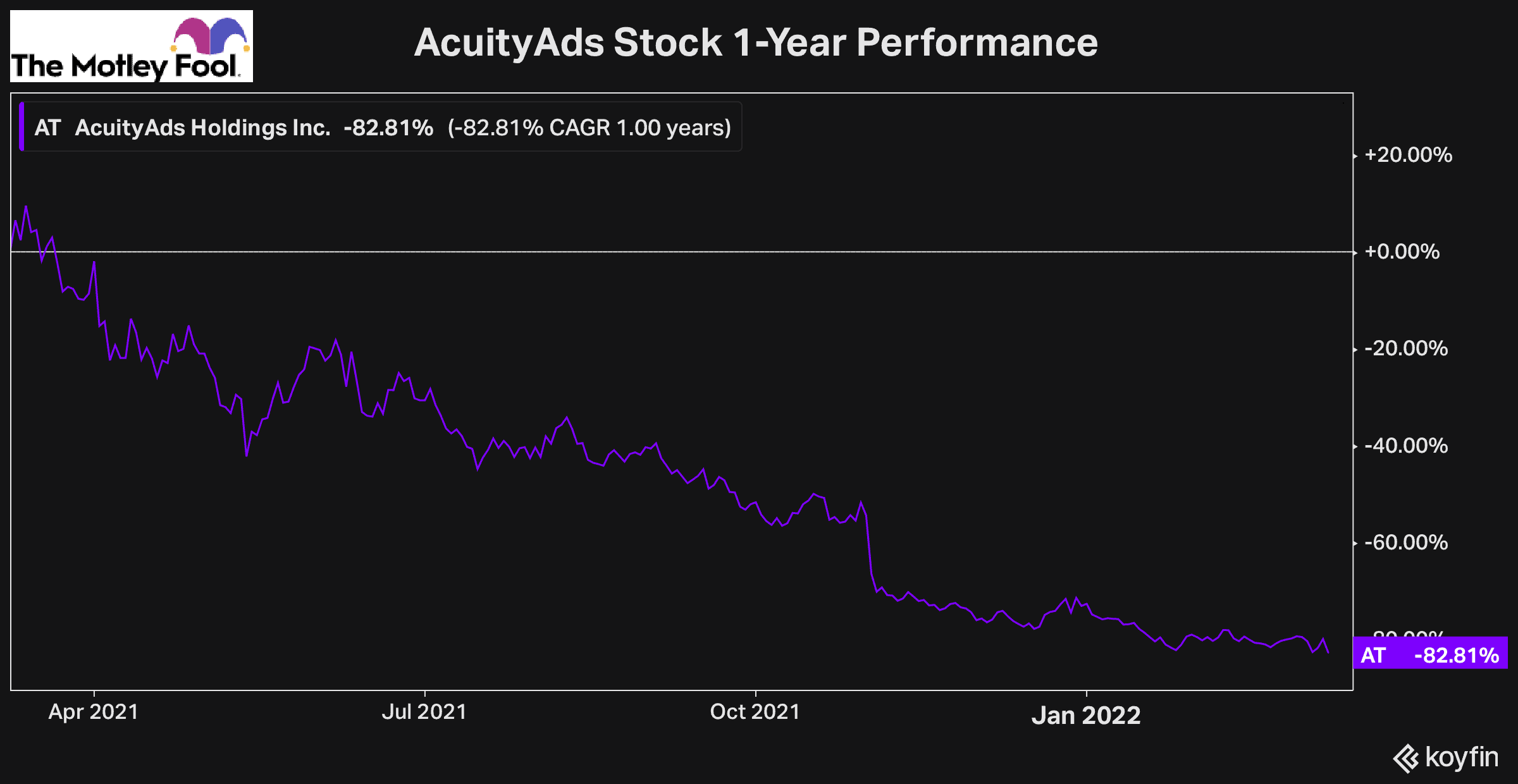

On Thursday, before the market opened, AcuityAds Holdings (TSX:AT)(NASDAQ:ATY), the Canadian AdTech stock, reported its fourth-quarter earnings for 2021. If you aren’t familiar with AT stock, it’s had quite a disastrous 12 months in terms of its share price performance.

First, dating back to roughly this time last year, tech and AdTech stocks especially began to be rerated lower by the market. Essentially the high-growth premiums that investors had been paying for tech stocks were starting to come down, and it was impacting the share prices of these stocks.

From March to November of last year, AT stock lost more than 50% of its value. Then in November, when it reported third-quarter earnings, and many were expecting a significant uptick in sales, they never quite materialized.

From there, the stock sold off another 50% and has since been facing the headwind all tech stocks are facing, in that investors are moving away from these higher-risk stocks in the current environment.

That brings us to this Thursday when AT reported its fourth-quarter earnings before the market opened and then preceded to sell off by 14% over the trading day.

Why did AT stock sell off after reporting earnings?

There are a few factors that could be behind the sell-off in AT stock on Thursday. First, the earnings it posted weren’t spectacular and surely weren’t the high growth numbers investors have been hoping for. However, with that being said, the numbers weren’t terrible either. Investors are getting impatient, though. For those who have held for a year, the stock is down over 80%.

Plus, in addition to its earnings report, another factor weighing on AT stock at the moment is the current market environment. And many tech stocks saw a significant decline in their share prices on Thursday.

Is AcuityAds still worth buying and holding?

At this point, I can understand if investors are throwing in the towel, as the performance to date hasn’t been ideal. However, AcuityAds does have significant growth potential. And even more compelling is the fact that its stock is extremely cheap.

As of Friday morning, AcuityAds is trading for roughly $2.90 a share. Now consider that $1.45 per share of that, exactly half of AcuityAds’ current value, is net cash. So while AcuityAds’ current market cap is just $175 million, its enterprise value (a better measure of its actual value) is just $85 million. That’s incredibly cheap.

With an enterprise value of just $85 million, the stock trades at a forward EV/EBITDA of 4.5 times. That’s low for any company, let alone a high-potential tech stock.

Right now, with tech stocks being so out of favour, they are certainly the best stocks for long-term investors to be buying today if they are looking for value.

With that being said, they face significant headwinds in the short run. And with AcuityAds specifically, it will take a considerable catalyst to get the share price moving in a meaningful way.

So there is a potential opportunity to buy the stock today or continue to hold it at this price. However, if you have a better investment idea offering similar value but fewer headwinds in the short run, you may want to consider that instead.

At the end of the day, AT stock is definitely cheap. But right now, and until the company can show meaningful signs of progress, it’s clear that the stock is cheap for a reason.