Cryptocurrencies have increasingly become a topic of great interest among investors. We’re all drawn in by the explosive returns and possibilities. But while this is totally understandable, with cryptocurrencies like Bitcoin (CRYPTO:BTC) getting hit hard in the last few months, we have to remind ourselves of the risks. In short, when we buy Bitcoin or other cryptocurrencies, we’re playing a high-stakes game.

What’s next in the Bitcoin world? Should we use this fall as a signal to buy, or should we steer clear?

Image source: Getty Images

Bitcoin has many detractors

So, what’s the story of Bitcoin? Simply put, Bitcoin is a decentralized digital currency. It’s the world’s largest cryptocurrency by market capitalization and the first cryptocurrency to gain real traction. Theoretically, Bitcoin and other cryptocurrencies offer a faster, low-fee payment system for transactions.

In theory, digital currencies like Bitcoin are intriguing, but there are, of course, risks. The biggest risks are its use in illicit transactions as well as its enormous volatility. Regardless, it’s clear that cryptocurrencies like Bitcoin cannot be ignored by governments. Increasingly, they are not. For example, President Biden announced an executive order to “address the risks and harness the potential benefits” of cryptocurrencies. This will be done through measures that address financial stability, illicit finance, financial inclusion, and investor protection.

The truth is that nobody really knows what will come of Bitcoin and other cryptocurrencies. But what we do know for sure is the excessive volatility involved — Bitcoin’s price has had large swings upward and downward. Furthermore, what’s driving this volatility is really unclear, with no clear method of any accurate valuation process. As Bill Gates has said, Bitcoin’s price can be influenced by something as simple as a “tweet from Elon Musk.” It feels too random. For me, it reminds me of pure gambling. Bill Gates has warned against investing in Bitcoin for these reasons.

Instead of Bitcoin, consider high-risk/high-reward stocks that have strong fundamentals behind them

I understand the desire to make outsized returns. I’m all for it! My perspective is that we have to keep as much control as possible in our investing careers. We need to keep the odds stacked in our favour. Really, all investing has risks. The key is to find the best risk/reward tradeoff for our own personal risk levels.

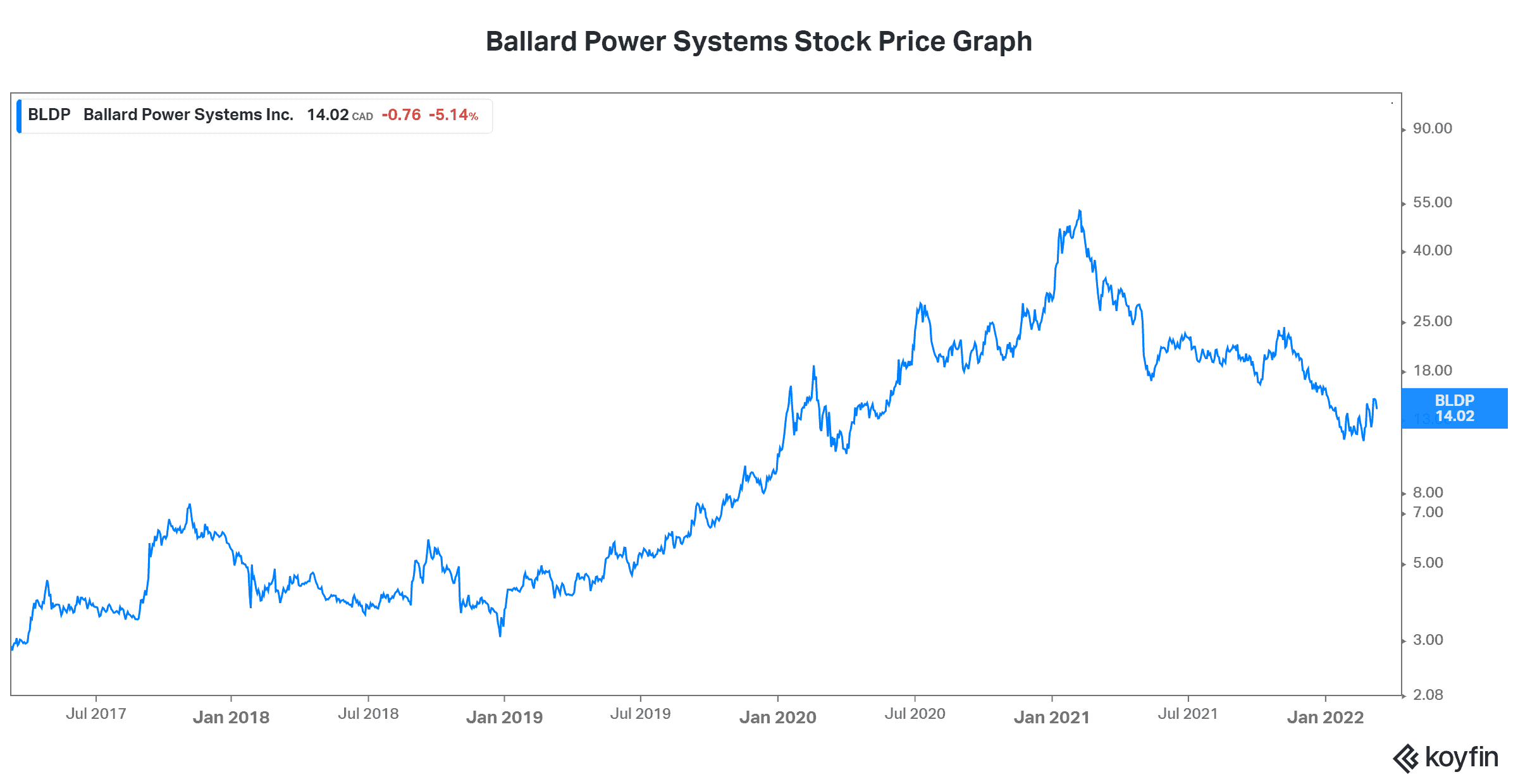

A stock like Ballard Power Systems (TSX:BLDP)NASDAQ:BLDP) would definitely fall into the higher-risk category. This is due to a variety of reasons. For example, Ballard doesn’t have earnings. Also, it’s in the fuel cell business — a business that is in its infancy, with uncertainties and risks. But on the flip side, Ballard has some clear drivers that we can feel good about. These drivers ensure that we have a guiding light to help us develop our investment thesis. Unlike the randomness of Bitcoin, with Ballard, we have some fundamentals to help us.

More about Ballard Power stock

Ballard Power is a leading global provider of innovative clean energy and fuel cell solutions. These fuel cells power transportation vehicles, such as buses and trucks with zero emissions. So, you can see the growth potential here. It is, in fact, an exciting industry with explosive growth potential. Adoption of Ballard’s fuel cell is growing rapidly globally. The move toward clean energy is gaining steam and Ballard is benefiting with a leading presence in this market. In fact, more and more countries and jurisdictions are using Ballard’s fuel cells to power their buses, trains, trucks, and even ships.

For Ballard, costs are coming down fast, and as long as Ballard holds onto its leading position in this market, the company and the stock will soar. Ballard Power stock has risen 400% in the last five years. It’s a far cry from Bitcoin, which has risen over 3,500%, BUT I can sleep at night knowing that I have good reasons to bet on Ballard.

Motley Fool: The bottom line

So, Bitcoin has definitely made many people very happy. But I fear that it has also given many others big problems. When you can’t afford to lose money, the volatility and randomness of Bitcoin is something you should stay away from. How much would you risk at a casino? Let that guide you.