2022 has been a challenging year for Canadian stock investors. Whether it be inflation, rising interest rates, or the war in Ukraine, the stock market has had plenty to worry about.

Stocks often shoot first and ask questions later

It is often in moments of crisis that the best buying opportunities present themselves. The stock market has a “shoot first; ask questions later” approach. If there is bad news, it generally overreacts to the downside. When the markets are bullish, they often rebound beyond where they should.

Quality Canadian stocks historically recover and exceed losses

The good news from history is that markets generally go up more than they go down. Likewise, stock markets generally rise higher and faster than they have fallen.

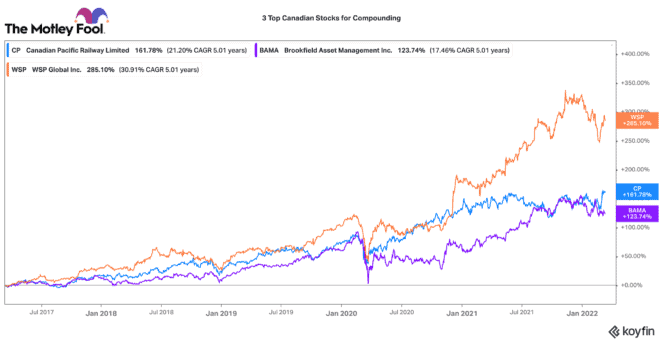

Consequently, if you have a long investment horizon, market dips are an incredible opportunity to accelerate long-term returns. If you are looking to nibble today, here are three compounding Canadian stocks I would buy for the long run.

CP Rail: An infrastructure staple

Canadian Pacific Railway (TSX:CP)(NYSE:CP) has delivered incredibly consistent returns for shareholders over the decades. Over the past 10 years, it has delivered an annual average total return of about 21.5%! In fact, it has been one of the best-performing railroad stocks in North America over that time frame. It has grown earnings per share by around 20% a year.

While Canadian Pacific is the smallest tier-one railroad in North America, it has been exceptionally managed by CEO Keith Creel and his team. CP is consistently one of the most efficient railroads among peers.

The company is working to fully acquire Kansas City Southern Railway. This would expand its railroad network completely across North America.

This deal is expected to lead to significant synergies, solid expansion opportunities, and a strong competitive advantage. While CP is taking on a lot of debt to fund the purchase, the deal should be very accretive over the long term.

Brookfield: A Canadian anchor stock

A top-quality Canadian stock that recently pulled back is Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). Year to date, this stock is down more than 10%. However, this is a wonderful opportunity.

With over $680 billion of assets under management (AUM), Brookfield’s growth is accelerating as it gets larger. For the past five years, it has grown AUM and distributable earnings per share compounded annually by 25% and 29%, respectively.

Unlike other asset managers, its stock price has lagged its growth rate. As a result, Brookfield is looking at options to unlock further shareholder value (spinoffs, share buybacks, etc.).

This Canadian stock has a great management team, high-quality assets, and a growing investment platform that should fuel reliable growth for years to come.

WSP Global: A global engineering leader

WSP Global (TSX:WSP) is one of the largest engineering, design, and consulting firms in the world. It has built out its franchise by serially acquiring smaller, specialized firms across the world.

Over the past five years, its increased size, scale, and operating leverage have fueled accelerated stock returns. In that time, shareholders have enjoyed a total 289% return (or 31% compounded annual growth rate).

In its recent year-end 2021 results, it grew net revenues, EBITDA, and adjusted earnings per share by 27%, 37.8%, and 78%, respectively. Its backlog also significantly increased by $3.3 billion in the quarter. The company has a great balance sheet and excess liquidity to keep deploying into acquisitions.

This Canadian stock is almost never cheap, but it has pulled back from all-time highs recently. For a relatively low-risk, reliable, compounding stock, WSP Global looks attractive for a long-term buy.