With the Bank of Canada’s recent interest rates hike and rising geopolitical tensions, there has been an influx of bearish stock market projections.

A few days ago, a JPMorgan analyst told investors to ignore the dire outlook and instead prepare for a rally in stocks this spring.

This analyst believes inflation could peak and heightened tensions between Russia and Ukraine won’t last as long as some might think. I believe this analyst is right.

Many stocks are undervalued due to the recent stock market plunge and are good buys on the dip. Among the stocks that look like good buys now, Nuvei (TSX:NVEI)(NASDAQ:NVEI) and Spartan Delta (TSX:SDE) are two top stocks to buy this spring as they have potential to beat the market. Let’s look at these top stocks to buy in more detail.

Image source: Getty Images

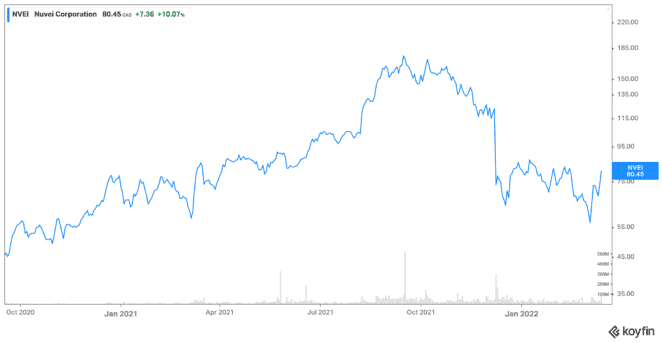

Nuvei

Nuvei shareholders have suffered all kinds of volatility.

After rising nearly 300% in one year, Nuvei stock started to go downhill last September alongside many other tech stocks. But its outlook remains excellent.

The tech company has done a solid job of gaining market share in the competitive payment space.

Nuvei delivered a strong performance in the fourth quarter, with revenue and adjusted EBITDA up 83% and 78%, respectively. Supported by improved global payment capabilities, total volumes increased 127% to $31.5 billion for the quarter.

The company is acquiring new customers and developing innovative products to drive growth. Given the favourable environment and its growth initiatives, Nuvei management expects its revenue to grow 30-35% this year, while its adjusted EBITDA could grow 28-34%. Shares jumped 13% after the results.

Nuvei rose 10% on Wednesday after announcing its partnership with Ledger, a company that develops security and infrastructure solutions for cryptocurrencies

Despite the surge, Nuvei stock is still trading around 55% below its September highs.

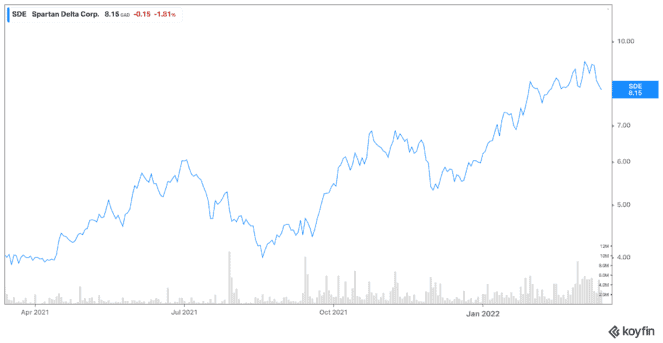

Spartan Delta

Spartan Delta benefited from rising energy prices and a recent acquisition in the fourth quarter.

The Calgary-based oil and gas producer average daily production jumped 178% year over year to 72,428 barrels of oil equivalent. Its free fund flow soared 664% to $21.3 million.

The fourth quarter was the first full quarter since Spartan Delta closed its acquisition of Velvet Energy for $743 million in August 2021.

Spartan’s revenues increased by more than 500% from $96 million in 2020 to $608 million in 2021, driven by $296 million in oil and gas sales during the fourth quarter.

Net profit increased 939% in the fourth quarter of 2021 to $128.46 million year over year. Earnings per share were $0.84 — four times higher than prior year EPS.

The company said Spartan’s fourth-quarter and year-end results show effective and highly profitable organic development and expansion of its operations and opportunities with nearly $1 billion in targeted acquisitions.

In 2022, global crude oil prices reached their highest levels since 2014 due to tight supply and a resurgence in demand, accentuated by escalating military tensions in Eastern Europe following Russia’s recent invasion of Ukraine.

Spartan ended the year well positioned to take advantage of the current market environment and strong crude oil and natural gas prices.

The company has maintained its guidance for average production of 68,500 to 72,500 boe per day and capital expenditures of approximately $330 million in 2022.