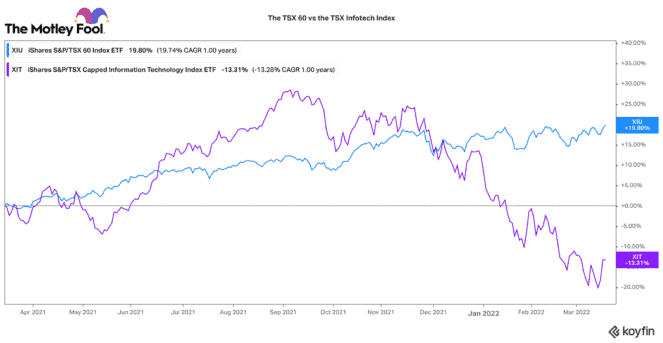

Defensive dividend stocks on the TSX have been outperforming in 2022. Who would have thought that over the year the TSX 60 Index (which, is largely composed of large dividend-paying stalwarts) would vastly outperform the S&P/TSX Capped Information Technology Index? Just a few months ago, it felt like the high-flying Canadian tech and growth sector was invincible.

Well, today, there is plenty to worry about. Consequently, it makes sense that many investors are flocking to safe, defensive dividend stocks to shelter in. Dividend yields have recently compressed. However, here are three quality TSX dividend stocks you can buy with yields of 4% or higher.

Algonquin Power: A great TSX dividend-growth stock

Algonquin Power (TSX:AQN)(NYSE:AQN) has had a nice recovery in 2022. This TSX stock is up nearly 7% over the past month. Yet it still pays a US$0.1706 (or CA$0.2175) dividend every quarter. That equates to an attractive dividend yield of 4.5%. This is elevated above its five-year average yield of 4.28%.

Algonquin has a diverse portfolio of regulated utilities across North America. It also has a growing portfolio of renewable power assets and renewable developments. Last year, the company grew revenues, adjusted EBITDA, and net earnings per share by 36%, 24%, and 11%, respectively.

It has a strategy to acquire carbon-heavy utilities and modernize them with renewable power. It is investing over $12 billion into a five-year capital plan. This should accrete solid 7-9% annual earnings growth. Annual dividend growth should follow suit. For a safe and growing dividend, this is a great TSX stock to buy and hold.

BCE: A TSX dividend stalwart stock

Internet and cellular coverage are essentially modern utilities. They are just as important as water and power. That is why BCE (TSX:BCE)(NYSE:BCE) is in a strong position today. With a market capitalization of $61 billion, it is Canada’s largest telecommunications company. Also, with a 5.2% yield today, it pays the highest dividend yield among its peers.

BCE is in a strong position to benefit from a pandemic recovery. It has plans to broadly deploy 5G technology across Canada. As the world reopens, it should get the benefit of stronger media/advertising revenues and higher roaming fees. BCE has grown its dividend annually on average by about 5.5%, and that should continue going forward.

Northwest Healthcare REIT: A new transformational strategy

Another TSX stock with an elevated dividend yield is Northwest Healthcare REIT (TSX:NWH.UN). It is one of the world’s largest owners and managers of medical and healthcare properties. It pays a monthly dividend of $0.0666 per unit. That equates to a 5.7% dividend yield right now.

In uncertain markets, healthcare properties are attractive assets because of their crucial nature, long-term leases, and strong credit-worthy tenant mix. Northwest has been transforming its strategy over the past few years.

It is increasingly using its scale to acquire properties and then portion them off into joint ventures. This asset-light approach enables it to capture higher-margin, fee-bearing earnings. This strategy is starting to show signs of strong value accretion to shareholders.

The company still has ample room to grow its portfolio. It just made a large-scale acquisition in the United States. That could start a new management platform in one of the largest healthcare markets in the world. All in all, for income and some modest growth, this is a highly defensive stock to buy and hold.