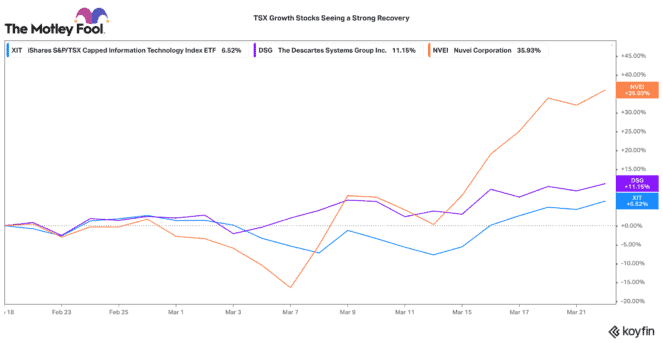

After a stiff decline so far this year, growth stocks on the TSX are starting to get a bid again. Certainly, it is difficult to tell if this recovery is sustainable. However, the S&P/TSX Capped Information Technology Index has demonstrated several consecutive upward trading days since March 14.

The stock market has been overly pessimistic

Given the consistency of the recovery, this might be indicating a change in sentiment towards growth stocks. Well-known investment manager Barry Schwartz might have the answer for this. Yesterday, he tweeted a quote by Barton Biggs and stated the following:

“Why do stock prices rally when the headlines are still terrible? ‘[T]he news doesn’t actually have to be good, it just has to be less bad than what has already been discounted in prices.’”

Barry Schwartz quoting Barton Biggs

There is a lot of uncertainty both economically and geopolitically. Yet, a lot of this “bad news” has already been overweighted by the market. As a result, we are now seeing a lift as news is just “less bad” than has already been priced.

Undoubtably, volatility will continue to persist. Yet, there are some signs that a potential bottom for TSX growth stocks has been reached. Considering this, investors could have a little more confidence to buy if there are further pullbacks to come.

Two TSX tech stocks that have recently been seeing strong price recoveries are Nuvei (TSX:NVEI)(NASDAQ:NVEI) and Descartes Systems (TSX:DSG)(NASDAQ:DSGX).

Nuvei: A leading TSX payments stock

Over the past five days, Nuvei stock has recovered by over 27%! Keep in mind, this TSX stock is still down 43% since it was hit by a short report last fall. However, the bounce back is a welcome recovery for patient investors.

Nuvei operates a payments platform that enables merchants across the world to accept and manage various payment methods, currencies, and even cryptocurrencies. The company delivered a monster year in 2021. Total payments volumes increased year over year by 121%, revenues grew 93%, and adjusted EBITDA grew 95%.

While guidance expects payment volumes, revenues, and adjusted EBITDA growth will slow to the range of about 30%, management believes this growth rate can be sustained into the future. Likewise, it has a longer-term target for increased profitability and higher EBITDA margins.

This TSX stock can be volatile, so I would perhaps wait for a further pullback to add to the position. However, the longer-term future for this business certainly looks promising.

Descartes Systems: A top TSX software stock to buy and never sell

Descartes Systems is another TSX growth stock that has been enjoying strong momentum. Its stock is up more than 10% in the past month. In fact, this stock has remained resilient through the recent market downturn.

Descartes operates the world’s largest logistics communications network. Likewise, it has a large suite of software-as-a-service offerings for the shipping/logistics industry. It has a very resilient business that actually benefits from supply chain uncertainty. A large majority of its revenues are recurring, and it captures very high (+40%) EBITDA margins from its business.

This TSX stock is almost never cheap. Given its reliable business model, it always trades at a premium multiple. However, for a long-term hold, this is a very well-managed, highly profitable business that should compound for many years to come.