When it comes to mitigating the risk of a market correction, we need to look for assets that have a slight to moderate negative correlation with our stock portfolio. That is, when our stocks zig, they zag. This is called a hedge. Sometimes, minimizing large drawdowns is just as important as chasing gains.

We’re also hoping that it goes up slightly over time so as to not lose value, but, more importantly, it should function as a parachute in times of crisis. When the market tanks, we want it to go up in value, so we can sell it at a profit and use the proceeds to rebalance into our stock positions at a low price.

For many investors, this meant a healthy allocation to bonds in their portfolios. However, persistently high inflation and the prospect of multiple interest rate hikes in 2022 have walloped both stocks and bonds, with high valuation growth stocks and long duration bonds incurring the largest losses. So what can investors do now?

Can gold work?

When bonds no longer protect us as much in a crash, we have to seek alternatives. An option here is gold. Gold has a low correlation to both stocks and bonds and high volatility, making it an excellent diversifier for portfolios. However, there are some issues with gold. Most notably, it has zero expected real return over time.

An ounce of gold 100 years from now will still be an ounce. A stock can spit out dividends or grow as the underlying company does, and bonds pay coupons and the principal eventually. Gold just sits there. Therefore, it’s just good at keeping its value. Its price fluctuations are due to speculation, nothing more.

A better hedge with a more positive carry are gold miner stocks. These are shares of publicly traded companies that engage in the exploration, development, and processing of gold. Gold miner stocks are unique in that they’re affected by both equity market risk and the price of gold. This trait gives them some downside protection during a correction.

Can gold miners protect us?

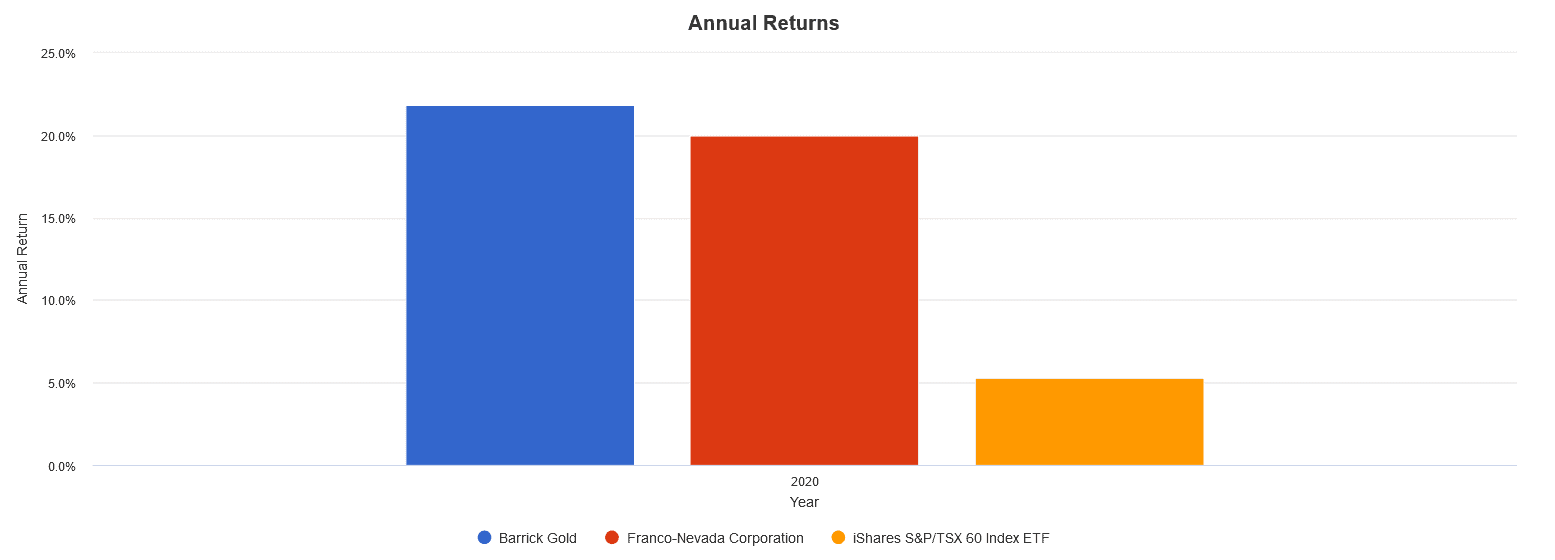

For a thought exercise, Iet’s see how the two largest TSX gold miners, Barrick Gold (TSX:ABX)(NYSE:GOLD) and Franco-Nevada (TSX:FNV)(NYSE:FNV) performed versus the iShares S&P/TSX 60 Index ETF (TSX:XIU) during various historical market crashes.

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

First up is the great financial crisis of 2008. We see that during this time, both ABX and FNV were in the green, with gains of 8.32% and 42.44% respectively, versus the -31.09% loss XIU incurred.

Next up was the March 2020 COVID-19 crash. Once again, ABX and FNV beat XIU with gains of 21.81% and 19.99% respectively, despite the latter staging a whipsaw recovery to end the year at 5.27%.

The Foolish takeaway

The low negative beta of ABX and FNV, coupled with their non-correlation with U.S. markets make both stocks a decent hedge against a market correction. A small allocation could be a good alternative to bullion or gold ETFs.

During a correction, the rise in share price can be sold at a profit and used to tactically re-balance into other equities when they are low. Holding this stock over the long term may also smooth out your returns by reducing volatility.