Do you think you can beat the market? While some investors can get lucky and outperform it in the short term, many will fail to over the long run. The market is efficient, and the various stock market indexes out there are notoriously difficult to beat.

The most famous index, and the benchmark many professional investors measure themselves against is the S&P 500. The S&P 500 tracks the largest 500 companies listed on U.S. exchanges and is widely seen as a barometer for overall U.S. stock market performance.

The index is composed of stable U.S. blue-chip companies like Microsoft, Apple, Google, JPMorgan, and Amazon, and it is diversified across various sectors like technology, health care, financials, communications, consumer staples, consumer discretionary, industrial, and energy.

How has the S&P 500 performed?

For the purpose of this scenario, let’s take ourselves back 30 years to 1992.

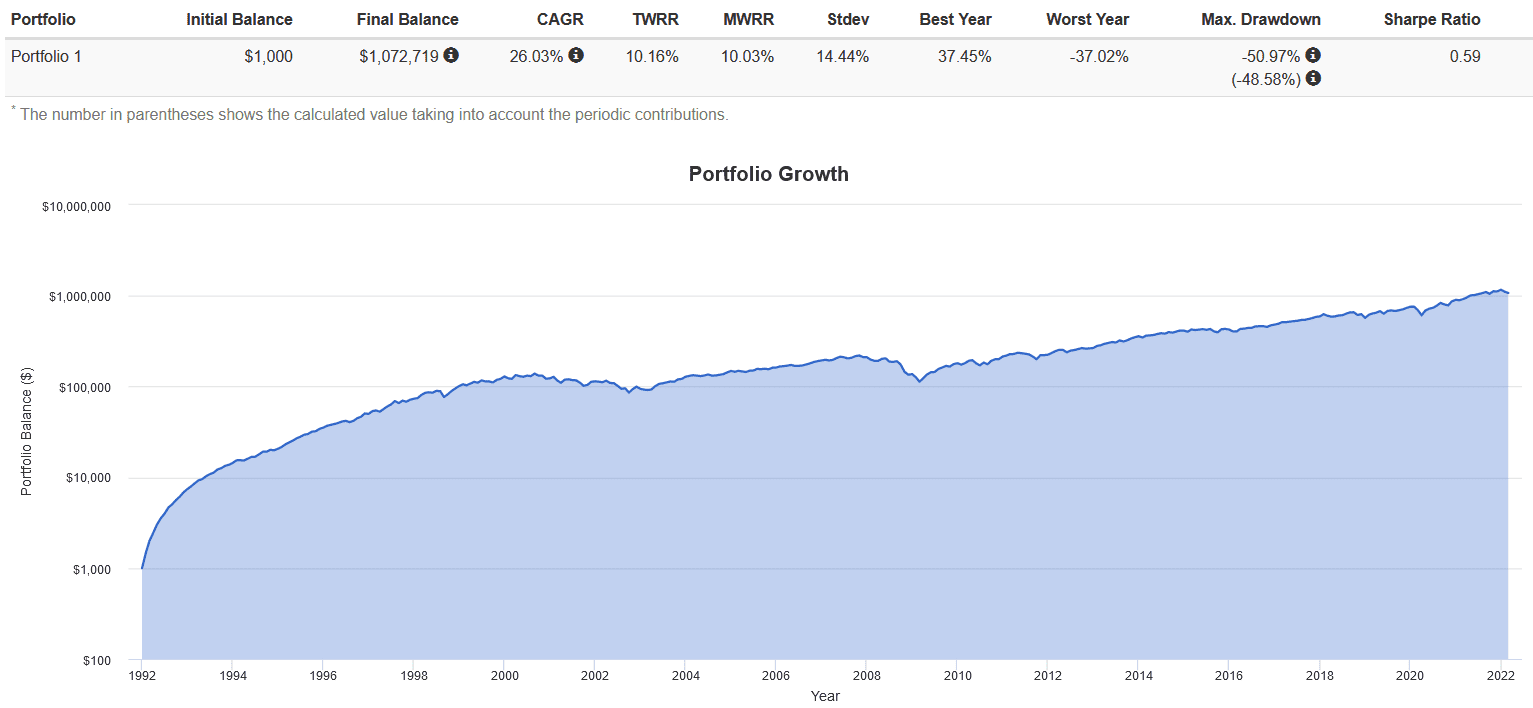

You’re a 25-year-old new investor, with $1,000 to invest and another $500 to contribute monthly. You dutifully invest in a S&P 500 index fund and buy shares on the first trading day of every month without fail. You don’t try and time the market, panic sell during any crashes, or use leverage. You stay rational and avoid falling prey to investing biases.

Here’s how much you would have by 2022:

If you managed to consistently invest and hold through various black swan events such as Black Monday 1987, the 2000 Dot-Com Bubble, the 2001 911 Crash, the 2008 Great Financial Crisis, and the 2020 COVID Crash, you would be able to retire at age 55 with over a million dollars.

The S&P 500 can create great wealth, but only if you stay disciplined, have patience, and stay the course. If you’re not as bullish on U.S. large-cap stocks, a good diversification method could be adding small-cap value stocks or international stocks.

How do I invest in the S&P 500?

Canadian investors can buy and hold the S&P 500 using exchange-traded funds (ETFs). I’ll be covering the two ETFs with the lowest management expense ratios (MER) and highest assets under management (AUM).

If you’re investing in Canadian dollars, consider Vanguard S&P 500 Index ETF (TSX:VFV). VFV has $6.5 billion AUM and a MER of 0.08%. VFV is not currency hedged, meaning that its value can and will fluctuate based on the CAD-USD exchange rate.

If you can convert CAD to USD cheaply using Norbert’s Gambit, and are holding in an RRSP to avoid foreign withholding tax, Vanguard S&P 500 Index ETF (NYSE:VOO) is a better buy with a lower MER of just 0.03%.

The Foolish takeaway

Still wary? Here’s what the great “Oracle of Omaha” Warren Buffett had to say about the S&P 500 during the 2021 Berkshire Hathaway shareholder’s meeting:

“I recommend the S&P 500 Index Fund, and have for a long, long time to people.”

– Warren Buffett

True to his word, Buffett even instructed his trustee to invest 90% of his estate into a low-cost S&P 500 index fund after he passes away. Warren Buffett also famously won a decades long bet against hedge funds by investing in nothing more than a S&P 500 index fund. Talk about conviction!