Alright, I know. I’m the guy who writes about index funds and taking a passive approach to investing on here. Why am I suddenly writing about stock picking, when I don’t even own a single stock?

Well, for one, stock picking can be fun. Researching a company, following the news, chatting with friends, and reading and posting DD on Reddit can be a good hobby for some people.

Moreover, stock picking can lead to outsized gains. As Warren Buffett once famously said: “Diversification may preserve wealth, but concentration builds wealth.” If done right, smart stock picking could potentially lead to outperformance if you make the right call and hold for the long term.

With that in mind, here are my top five picks if I had to create a Canadian dividend growth stock portfolio that beats the market.

Portfolio construction criteria

I opted for large-cap companies that have a history of profitable earnings, lower beta (volatility vs. the market), consistent dividend payments over decades with ever-increasing yields, wide economic moats, good management, and strong financial ratios.

There is a good rationale for this criteria. Most of these ensure exposure to the Fama-French Five-Factor Model’s “investment,” “quality,” and “value” risk factors, which have been found to be statistically significant in explaining excess returns (alpha) over time.

I then selected five blue-chip companies with these traits that were also “the best in class” among their sector peers. While speculating among the small-caps might also allow me to capture the “size” risk factor, it would be too volatile and risky with just five stock picks. Here were my picks:

- Bank: Royal Bank of Canada (TSX:RY)(NYSE:RY)

- Railway: Canada National Railway (TSX:CNR)(NYSE:CNI)

- Pipeline: Enbridge (TSX:ENB)(NYSE:ENB)

- Telecom: BCE (TSX:BCE)(NYSE:BCE)

- Utility: Fortis (TSX:FTS)(NYSE:FTS)

When it comes to portfolio management, I opted for equal weightings (20%) to each stock and annual re-balancing. Dividends should be reinvested equally as soon as they’re paid out quarterly.

How did the portfolio do?

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

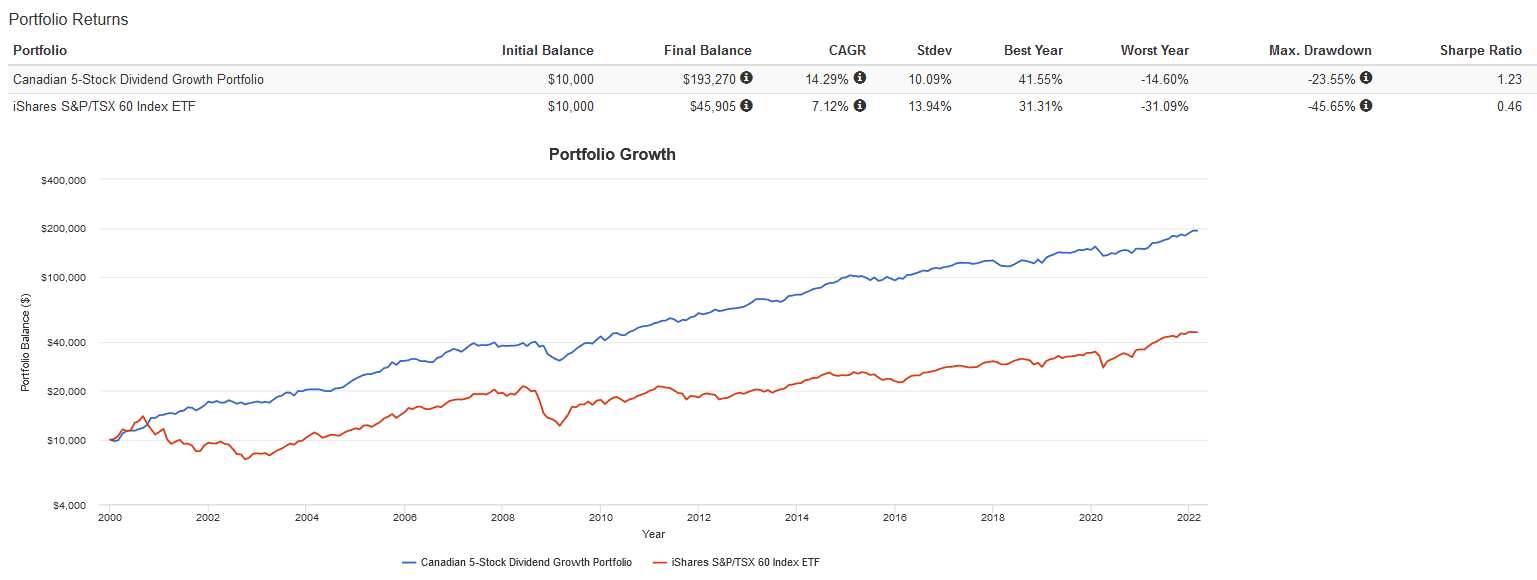

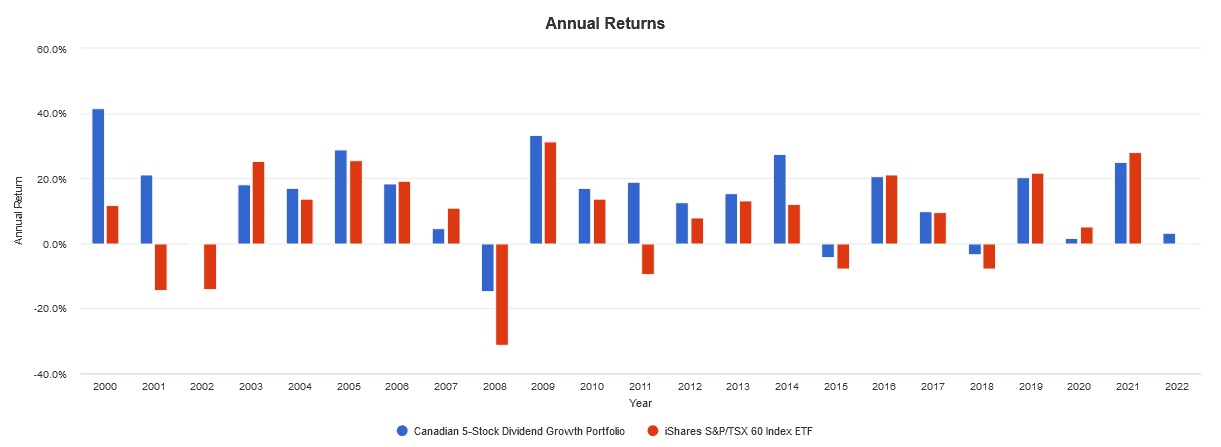

From December 31, 1999, to February 28, 2022, my Five-Stock Canadian Dividend Portfolio outperformed the iShares S&P/TSX 60 Index ETF (TSX:XIU) on multiple metrics:

- Absolute returns: Higher CAGR of 14.29% vs. 7.12%

- Risk-adjusted returns: Higher Sharpe ratio of 1.23 vs. 0.46

- Volatility: Lower standard deviation of 10.09% vs. 13.94%

- Drawdowns: Lower peak-to-trough loss of -23.55% vs. -45.65%

An amount of $10,000 deposited at the start of the 22-year period and held to the end would have resulted in a final sum of $193,270 for the Five-Stock Canadian Dividend Growth Portfolio compared to just $45,905 for XIU.

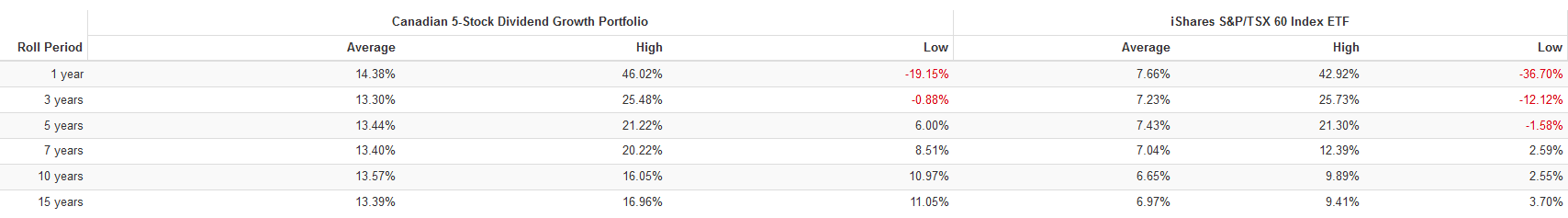

I know what you’re thinking. “Tony, this backtest just shows trailing results, which is dependent on the start date”. You’re absolutely right, so I included the rolling returns over various time periods as well, which once again show the portfolio beating XIU handily.

The Foolish takeaway

If you’re brave enough to stake your investment portfolio on just five stocks for a decent shot at beating the market, this portfolio could be suitable for you. For success, ensure you stay disciplined – reinvest all dividends, re-balance annually, and stay abreast of earnings reports. While the five stocks contained are currently of solid quality, we don’t know what the future holds, so make sure you monitor their financial statements periodically for material changes.