This year has started off with a boom! Equity markets are up, many companies are thriving, and it seems as though we’ve shaken off a lot to get here. From value stocks to energy stocks, the year has been good. Many growth stocks, on the other hand, have not fared as well. But others are among the best stocks to buy right now. What does 2022 have in store for them?

Let’s not be fooled. Looking ahead, there are many things to worry about. For example, inflation is rising, and that’s never a good thing for markets or the economy. Without further ado, here are three growth stocks to buy in 2022.

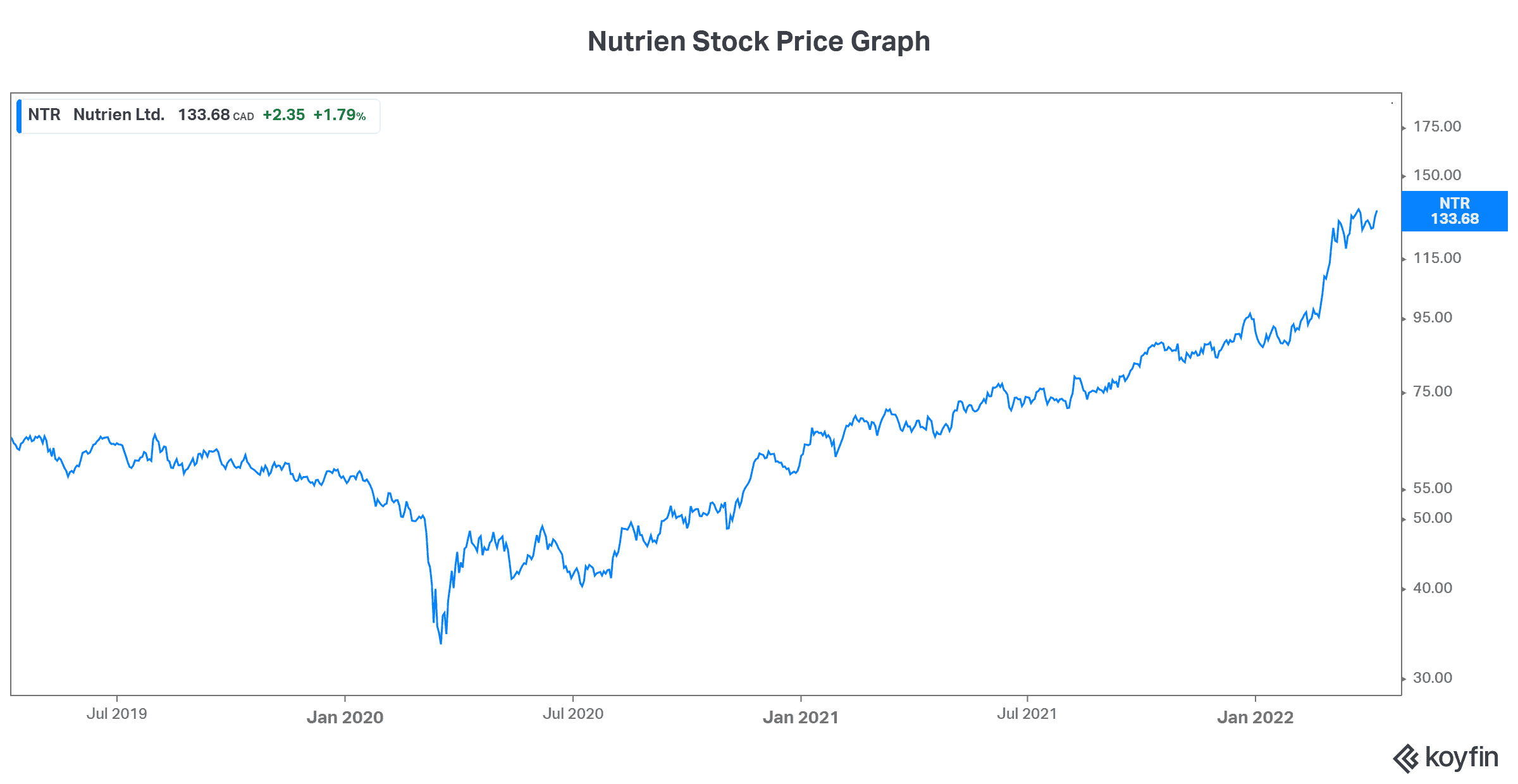

A growth stock to buy that’s soared 38% so far in 2022

Nutrien Ltd. (TSX:NTR)(NYSE:NTR) was formed through the January 2018 merger of PotashCorp and Agrium. It’s the world’s largest fertilizer producer and agricultural input retailer, with a vertically integrated business. It benefits immensely from its scale, and is thus driving efficiencies and ultimately, cash flows.

The investment thesis for Nutrien is actually quite simple. The global population is increasing. As a result, the agricultural industry can be expected to experience steady and growing demand for the foreseeable future. So Nutrien’s stock price is soaring in 2022. This comes after many years of stock price underperformance and it’s a welcomed revaluation of the stock. It’s no longer grossly undervalued, but it is still attractive.

This is due to the growth profile of the company. In fact, in the last five years, revenue has grown 52%. Also, operating cash flow has grown almost 90%. In short, valuations are more than reasonable considering Nutrien’s growth profile and long-term viability. This makes it one of the best growth stocks to buy now.

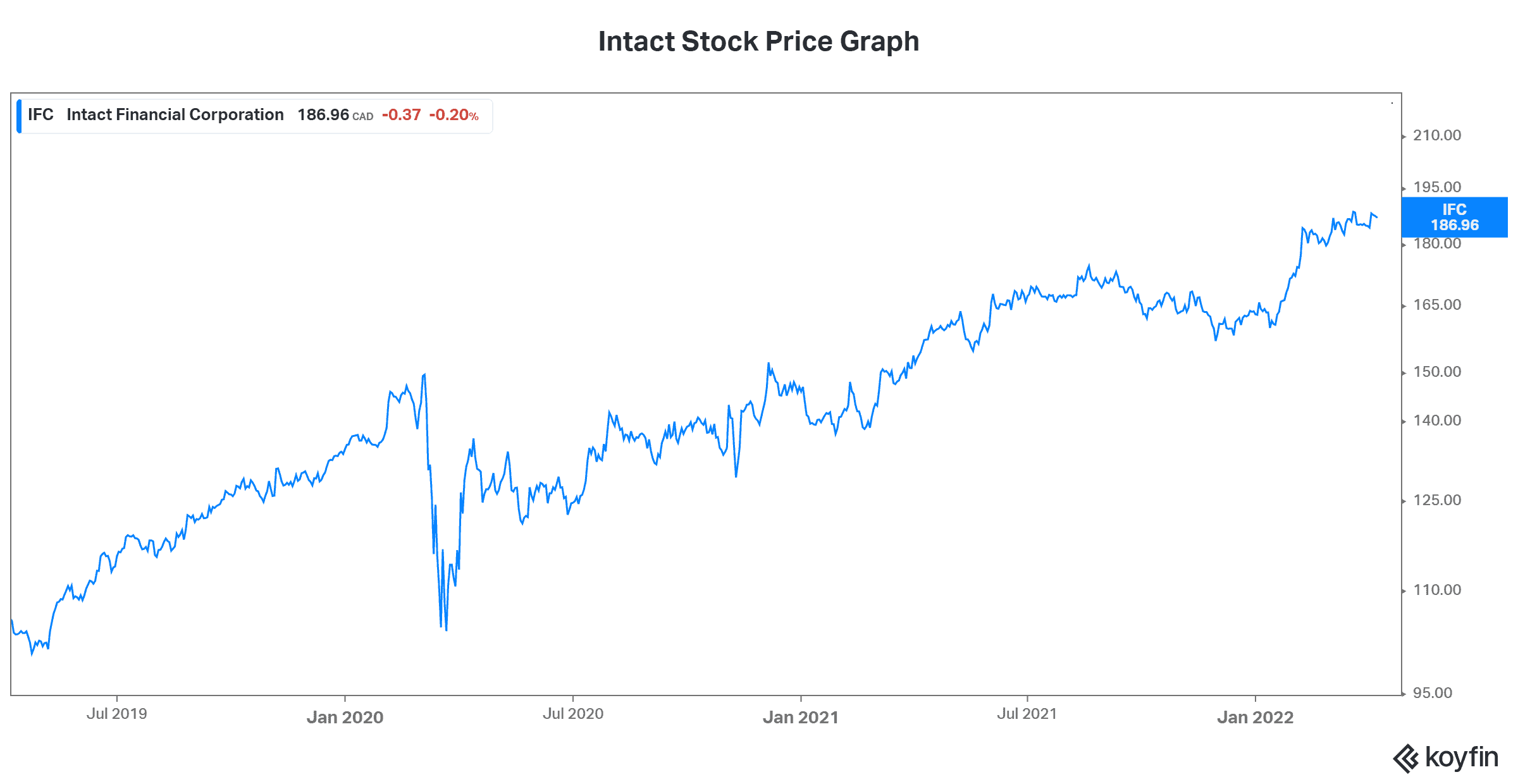

How is an insurance stock a growth stock?

For the next growth stock to buy, let’s shift gears. Intact Financial Corp. (TSX:IFC) is the largest provider of property and casualty (P&C) insurance in Canada. The company has grown and perfected its leadership position over the years, benefitting its shareholders along the way. Essentially, strong returns, a growing dividend, and industry excellence has become a way of life for Intact.

Intact has grown in large part due to acquisitions. This insurer is blazing along, taking advantage of its fragmented industry. Acquisitions have not only added scale and diversification, but also significant cost savings along the way. All told, its net operating income per share (NOIPS) grew at a compound annual growth rate (CAGR) of 15% since 2009. Check out Intact’s most recent results where its NOIPS increased 19% and earnings per share increased 51%, and you’ll see why this is one of the best stocks to buy right now.

Intact remains on course to continue to consolidate the fragmented P&C market while generating positive growth and returns.

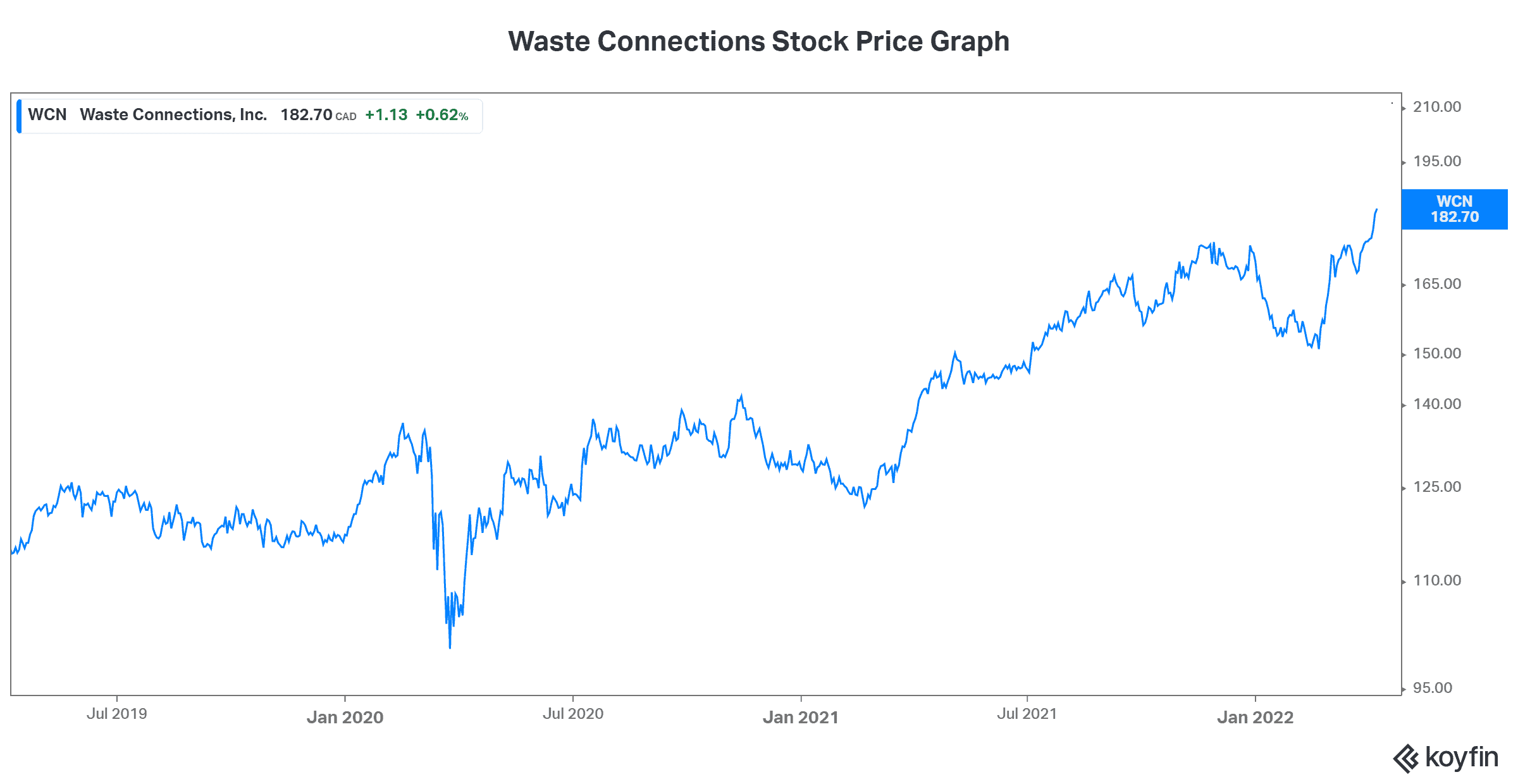

The last of the growth stocks to buy now is turning waste into profits

Finally, the last growth stock that I’d like to highlight here is Waste Connections Inc. (TSX:WCN)(NYSE:WCN). Waste Connections is an integrated solid waste services company. It provides waste collection, disposal, and recycling services in the U.S. and Canada. It’s a high quality company in a booming industry.

Over the last many years, growth rates have been strong for this company. In the last five years, revenue has grown at a CAGR of 6%. More importantly, cash from operations has grown at a CAGR of 7.4%. In the latest quarter, this growth has intensified, with year-over-year growth of 16% and 20% respectively.

This business is defensive. It’s an essential one that can withstand economic troubles. This is a very positive characteristic, especially in today’s environment. In my view, this is a top defensive growth stock to buy now. It’s a stock to buy because it’s a strong, quality company that has tremendous cash flows and a history of returning this cash to shareholders.

Motley Fool: the bottom line

The three growth stocks listed in this article are some of the best stocks to buy right now. They’re leaders in their respective industries, and they’ve built sustainable competitive advantages that will carry them through the next phase of their growth.