The conventional wisdom of “bonds are for safety” hasn’t held up too well in 2022. A combination of high inflation and rising interest rates (plus anticipated central bank hikes in the near future) have sent bond yields soaring and bond prices plummeting (the two are inversely related).

So, with an entire asset class doing poorly, what can risk-averse investors do to keep their capital safe and volatility low? The solution here is ultra-low duration (a measure of interest rate sensitivity) fixed income assets, which can be bought in exchange-traded fund (ETF) form.

These investments hold a variety of safe, risk-free fixed income holdings, such as deposits in high-interest savings accounts, guaranteed investment certificates, or short-term U.S. government Treasury Bills (T-bills). Let’s look at my top two picks today!

iShares Premium Money Market ETF

First up is iShares Premium Money Market ETF (TSX:CMR), which provides investors with exposure to a variety of high-quality, short-term debt securities for a management expense ratio of 0.24%.

CMR has strong liquidity and makes preservation of capital a top priority, making it a safe haven during a market crash. With an effective duration of 0.14, CMR is also insulated from from rising interest rates.

However, don’t expect to make much in terms of interest from this ETF. The current distribution yield is 0.17%, which will not outpace inflation at all. Still, it’s better than holding cash in a TFSA or RRSP.

Purpose High Interest Savings ETF

Next up is Purpose High Interest Savings ETF (TSX:PSA), which holds deposits in cash accounts invested with top Canadian banks for an MER of 0.15%.

Like CMR, PSA also has strong liquidity and makes preservation of capital a top priority, which makes it crash-proof. However, unlike CMR, PSA is actually helped by rising interest rates.

When rates increase, the yield of PSA will also increase, because the interest rate it earns on its high-interest savings accounts also goes up. Currently, the yield is 0.81%, which is paid out monthly.

The Foolish takeaway

If you’re looking to park cash in a TFSA or RRSP for a while, a money market ETF like PSA or CMR might be a good choice. They’re relatively low-cost, have high liquidity, are safe from rising interest rates, and will not lose value during a crash.

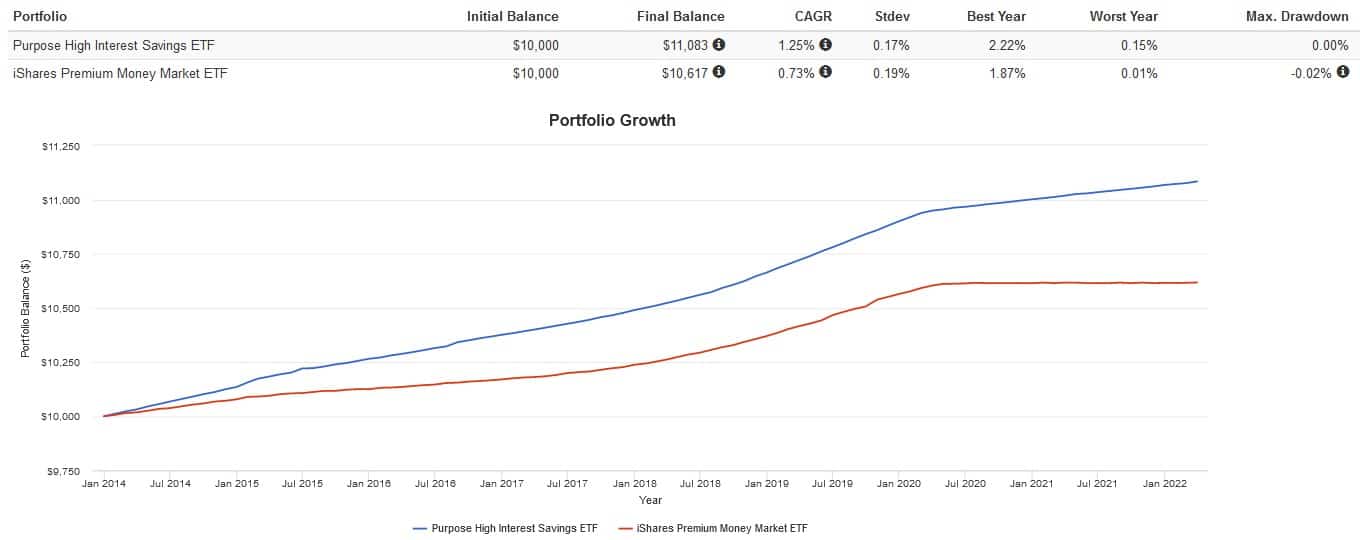

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

From 2014 to present, both CMR and PSA stayed positive despite a bear market in 2018, a crash in 2020, and the current bear market in 2022. While the yield might not have outpaced inflation, at least your capital would have remained safe!

My pick here would be PSA – you get the same protection of principal and interest rate insulation, but with a better yield and lower MER. Regardless, both ETFs beat holding cash, especially if you’re with a zero-commission brokerage.