Many Canadians have a goal of saving enough money to buy a rental property. Owning an asset that can gain in value over the long term while also returning passive income today is certainly appealing. But there are also plenty of the best Canadian stocks to buy that can do the same.

And while both rental properties and stocks offer the potential for capital gains and passive income, there are a tonne of advantages to choosing stocks.

First and most importantly, you don’t need very much capital to begin investing in stocks. Not only that, but the transaction costs of buying stocks are much lower, and they are, of course, a lot more liquid investments.

In addition, Canadian stocks offer you the ability to buy companies in several different industries, providing important diversification. And, even more importantly, you can buy stocks in registered accounts such as the TFSA, allowing you to realize all that income without having to pay any taxes on it.

In addition to these crucial advantages, though, residential real estate could face some significant headwinds in the short term.

Many banks are warning of the impact that rapidly rising interest rates will have across the entire economy, especially the red-hot housing market. Not only that, but it’s still unclear how much government intervention will cool the housing market.

Meanwhile, there are plenty of industries where you can find high-quality dividend stocks that are currently seeing tailwinds.

So, if you’ve been thinking about buying a rental property, here is one of the best Canadian stocks to buy instead that could offer you even more capital gains potential and growing passive income.

One of the best long-term Canadian growth stocks to buy now

Rather than buying rental properties in this environment, a stock that has momentum today and will likely be a better long-term investment is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP).

Brookfield, in my view, is a lower-risk investment than buying a rental property. In addition, it offers much more growth potential, which is why it’s one of the best Canadian stocks to buy.

The fund owns highly robust infrastructure assets diversified all over the globe. In addition, it’s constantly upgrading these assets, improving the yields they generate, and, in some cases, selling the assets off for much higher than it paid and recycling that cash into new opportunities.

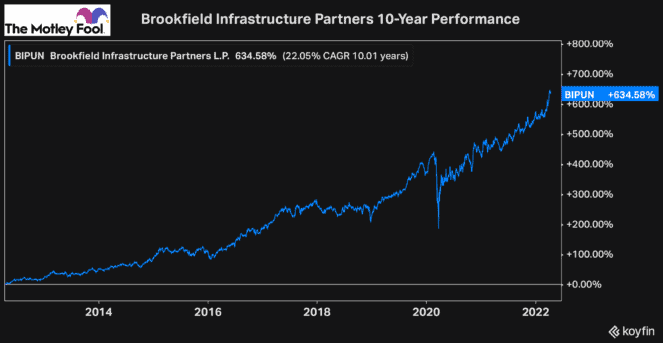

Over the last five years, it’s earned unitholders a total return of roughly 125%, and, over the past decade, it’s earned a total return of 635%. Both of these are almost certainly more than you could make owning rental properties. Plus, owning it in a TFSA would mean all this income would be tax free.

When it comes to passive income, in general, Brookfield aims to grow the distribution to investors by 5-9% each year, which is also likely more than you would consistently earn from a rental property.

Plus, on top of everything else, in the current high-inflation environment, much of Brookfield’s revenue (roughly 75%) is tied to inflation, while at the same time, much of its costs are fixed. Therefore, it has the potential to see a hefty increase in its margins while inflation stays high.

So, if you’re looking for Canadian stocks to buy that can start growing your capital and returning passive income today, Brookfield is one of the best there is.