Do-it-yourself (DIY) investing is not for the faint of heart, but the rewards can be life changing! Although there are many pitfalls, traps, and “learning experiences” when investing, aptitudes like patience, curiosity, and humility can go a long way to improve long-term returns.

Every investor must do what works for them, their lifestyle, and their finances. There is no black-and-white way to invest. Investing is truly a journey of discovery. You get to learn so much about companies, markets, the economy, and even yourself. While building wealth is generally the primary goal, you will find you’ve earned so much more in the journey.

If you are a committed DIYer and are looking for some great stocks to own for a lifetime, here are three top TSX stocks to consider owning now.

A top-performing TSX stock

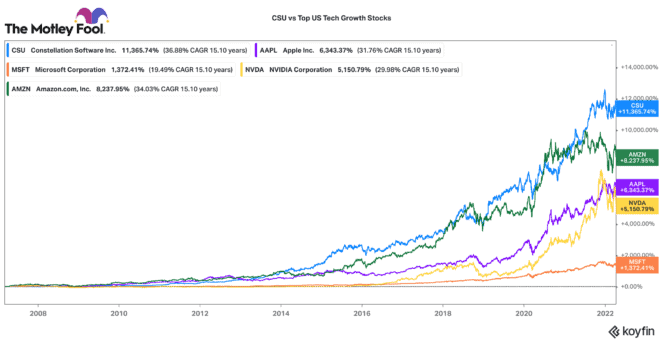

Over the past 15 years, Constellation Software (TSX:CSU) is one of the best-performing stocks in North America. Since 2008, this stock has soared 8,956%! This TSX stock has delivered shareholders an average annual compounded return of 35%! It owns, acquires, and operates niche software businesses around the world.

Given that the company is worth over $45 billion, many investors have worried that its growth will undoubtedly slow. That could occur. However, as of late, Constellation has been accelerating its pace of acquisitions. It has increased the size, number, and verticals in which it acquires.

The reality is, the larger this business scales, the more opportunities it gets to grow. Constellation has a top management team and stable, cash-yielding businesses. It is a relatively low-risk bet that could result in massive wealth generation for patient long-term investors.

A top TSX GARP stock

A company that continues to beat expectations despite stock market pessimism is BRP (TSX:DOO)(NASDAQ:DOOO). This is a top TSX growth-at-a-reasonable-price (GARP) stock. BRP manufactures some of the most well-regarded brands in recreational vehicle and marine products. These include Sea-Doo, Ski-Doo, CanAm, and Lynx.

Since its initial public offering in 2013, this stock has delivered a 339% return (or 18% compounded annual growth rate). While the company has been challenged by the recent supply chain crisis, it has navigated creatively and admirably. Last year, it grew sales and adjusted earnings per share by 28.5% and 84%, respectively.

BRP is projecting slower growth this year, but its long-term outlook still looks favourable. The company has a great and growing product line up. Likewise, it generates a lot of free cash flow, so it has a solid balance sheet and is buying back a huge amount of stock. What more can you ask for from a TSX stock that only trades for a cheap nine times earnings!

A top high flyer

If you are looking for a bit more of a tech high-flyer stock, you may want to consider Nuvei (TSX:NVEI)(NASDAQ:NVEI). It provides a specialized payment platform that caters to e-commerce, online gaming, gambling, and cryptocurrency.

The platform helps merchants integrate a broad array of payments across currency, geography, and payment class. It’s a vital service in today’s global marketplace. The pandemic was a favourable tailwind for this business. Last year, it grew revenues and EBITDA by 93% and 95%, respectively.

It likely won’t hit that growth rate again. Despite that, Nuvei is still targeting sales and EBITDA to grow by around 30% in 2022.

Over the longer term, it believes it can sustain that pace, while also improving EBITDA margins to the 50% range. These are ambitious targets to achieve. However, if it does what it says it can, shareholders could be highly rewarded over time.