When we first begin to invest in the stock market as beginner investors, it’s stressful. We’re filled with uncertainty and even fear. This might stop us from making the best decisions. It might even stop us from investing at all. The thing is, that would be a mistake. In fact, it would be a huge mistake. Just consider the fact that the S&P/TSX Index has rallied approximately 80% in the last 10 years. Also consider all the dividend stocks that have provided years of income for investors. Being on the sidelines is not an option.

So, for those of you that are beginners, here are three dividend stocks to help you get your feet wet. They’re the kind of stocks that won’t keep you up at night. They also have attractive dividend yields.

A top dividend stock that’s currently firing on all cylinders

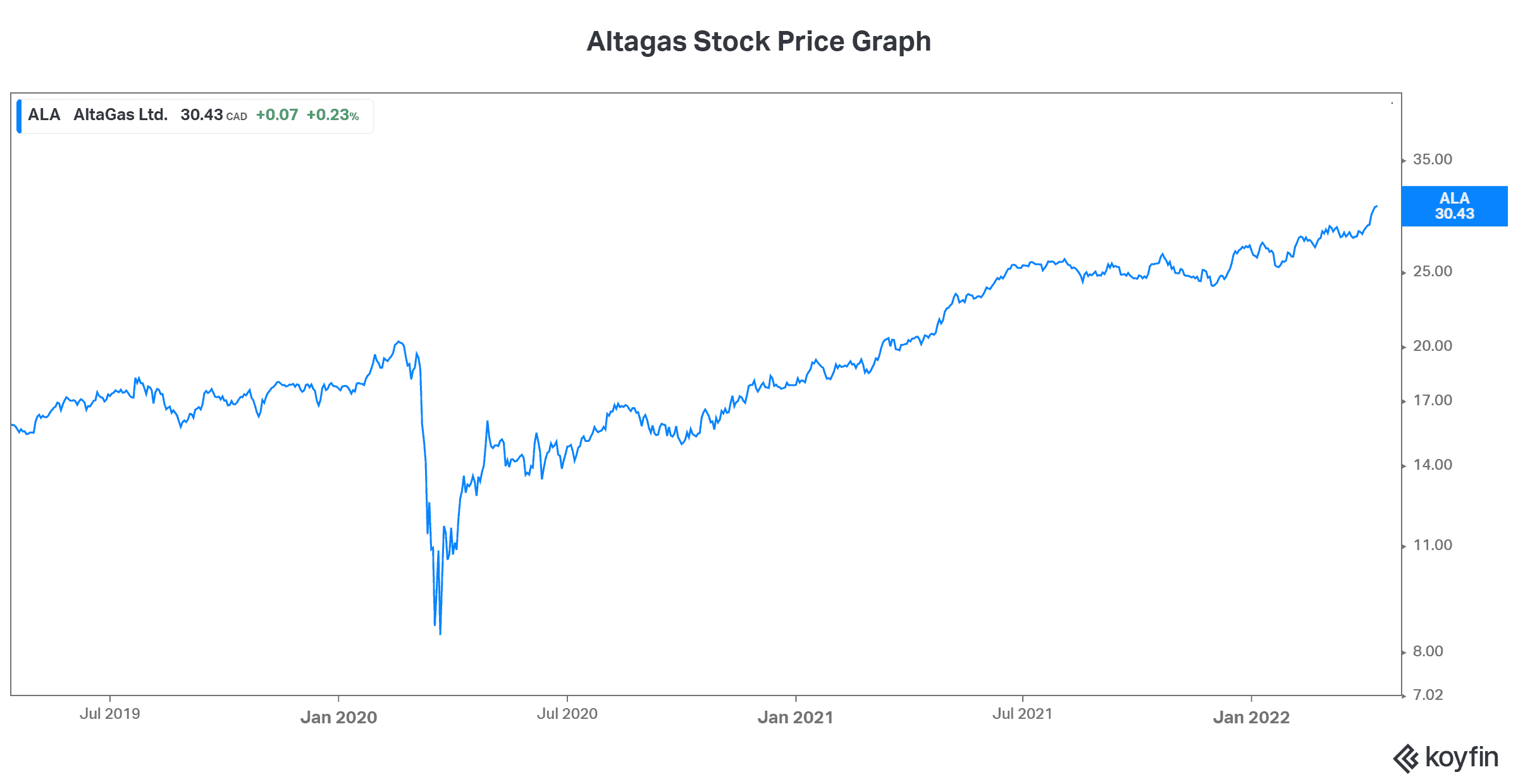

AltaGas (TSX:ALA) is a great beginner’s stock. This is because it has two business segments that complement each other. The first segment is the utilities segment, which is a stable, defensive business accounting for roughly 50% of EBITDA. It provides the company with relatively risk-free income. It provides investors with secure dividend income and peaceful, stress-free nights.

The other segment is the midstream segment. This segment is made up of assets in the energy infrastructure world. For example, AltaGas owns and operates natural gas storage facilities and pipelines. It also owns liquefied natural gas (LNG) assets and export facilities. It is this business that is providing AltaGas with exceptional growth. Natural gas prices are rising rapidly. Global demand for Canadian natural gas and natural gas by-products is skyrocketing. AltaGas is reaping the rewards.

At this time, AltaGas is yielding 3.5%, and the stock has soared 45% in the last year. It’s not too late to buy though, as this company’s offering is in high demand.

Top dividend stock Fortis has a bright future

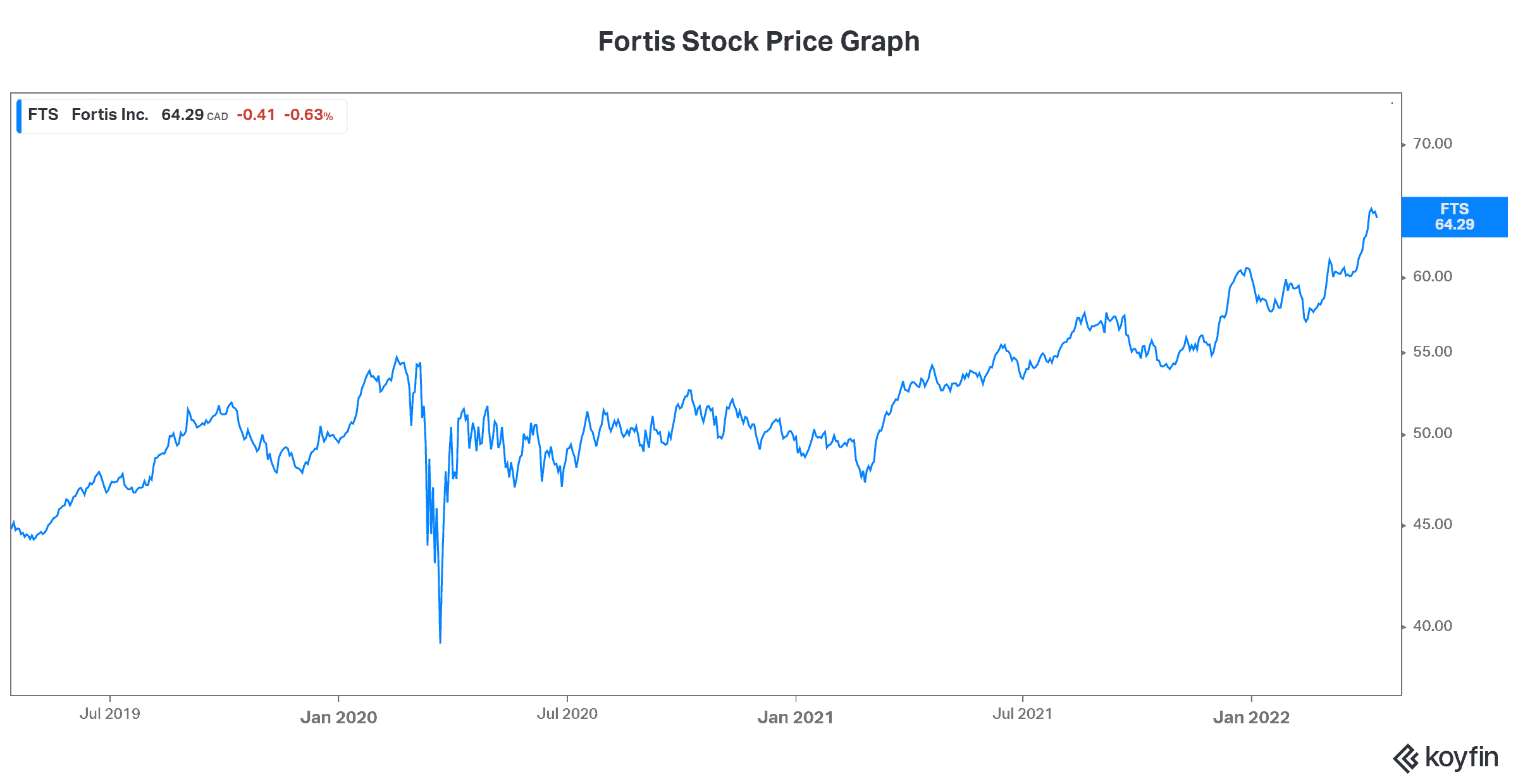

Fortis (TSX:FTS)(NYSE:FTS) is a leading North American regulated gas and electric utility company. It’s also another great stock for beginner investors. This is because of Fortis’s predictability, stability, and steady growth. In fact, Fortis has really benefitted from its growing utilities business over the last few decades. As a reflection of this, we can just look to the fact that its dividend has grown for 48 consecutive years. This makes it one of the top dividend stocks out there.

Fortis stock is currently yielding a respectable 3.3%. Like many TSX stocks, Fortis has rallied significantly over the last year — up 17%. You can see from the price graph above that this has been a good time for Fortis stock. In short, Fortis is another steady utilities company that offers all the predictability and steady growth that any beginner investor could desire.

BCE stock: A telecom stock yielding 5%

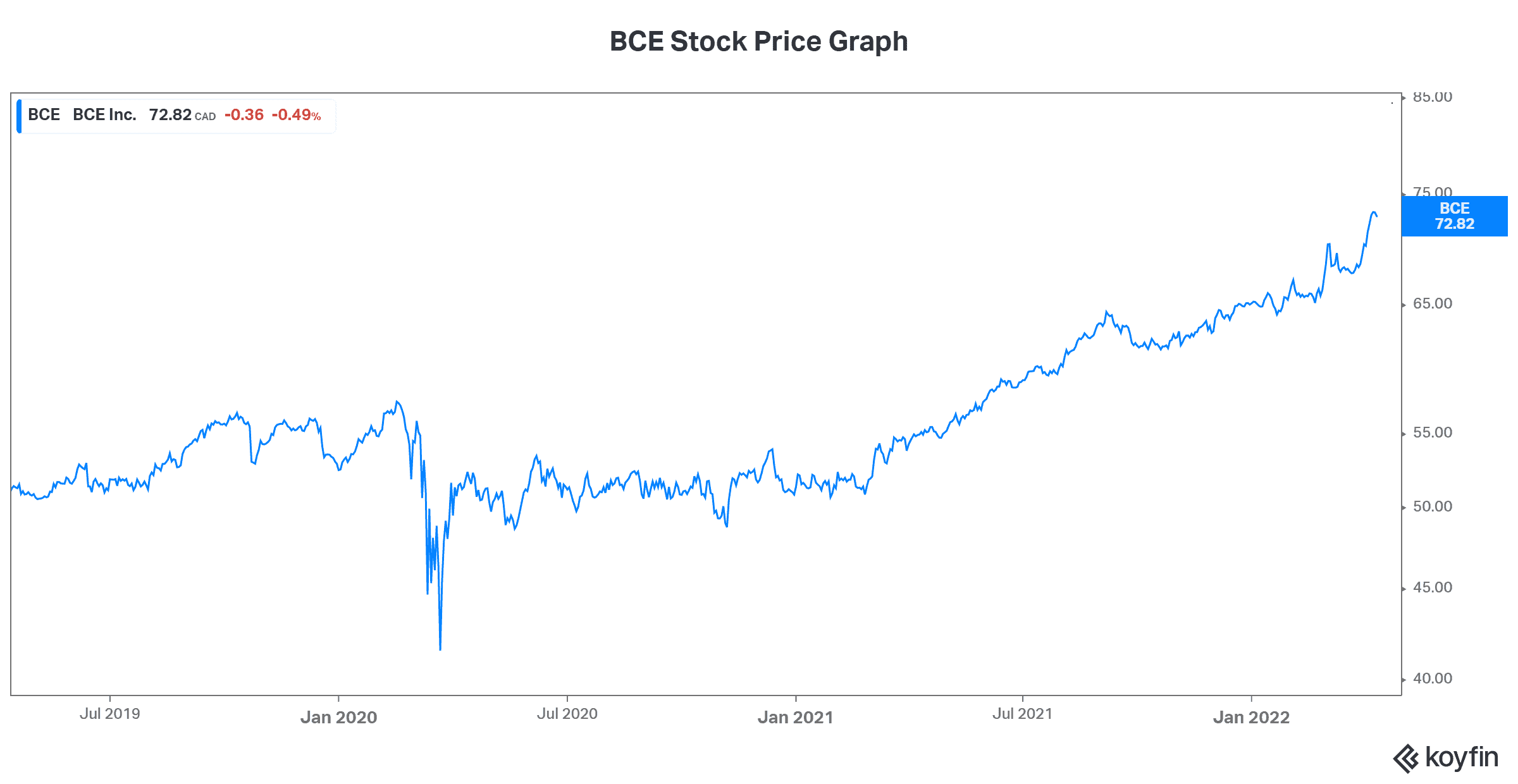

BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom services company. BCE’s business is steady, stable, and defensive. It’s characterized by strong cash flows and a strong balance sheet. It’s also characterized by its leading position in the Canadian telecom world. These are the reasons why BCE is a top stock — not to mention its dividend yield. How can a company that’s so financially and competitively strong yield 5%? A high yield for a company so strong is a great opportunity. I think that this is an anomaly that won’t last forever.

BCE has 13 consecutive years of a 5% or higher dividend-growth rate. Today, BCE is an ideal stock for beginner investors, as this stock can take you through a relatively peaceful introduction to the stock market while providing generous dividend income.

Motley Fool: The bottom line

In this article, I aim to demystify the investing experience a little by introducing three dividend stocks that are pillars of stability. They all offer defensive exposure to the stock market along with generous dividends to ease the way for beginner investors.