One of the best kept secrets in the last year has been the performance of natural gas stocks. Coming off of many years of dismal performance and a generally depressed industry, they had been all but forgotten. In this article, I would like to try to remind us all of the importance of natural gas. It’s simply undeniable. This reality is finally being reflected in natural gas prices and energy stocks.

Natural gas: Positive long-term fundamentals

There are many factors that have contributed to the resurgence of natural gas prices. For one, the cyclical low period in the mid-2010s resulted in low prices. On top of this, environmental concerns led to fewer investor dollars being allocated to natural gas companies. Years of this led to lower production, lower supply, and, ultimately, the greatest supply/demand imbalance in a long time.

Today, natural gas companies are awash in cash flow. This is essentially resulting in rising dividends and cash payments to shareholders as well as soaring stock prices.

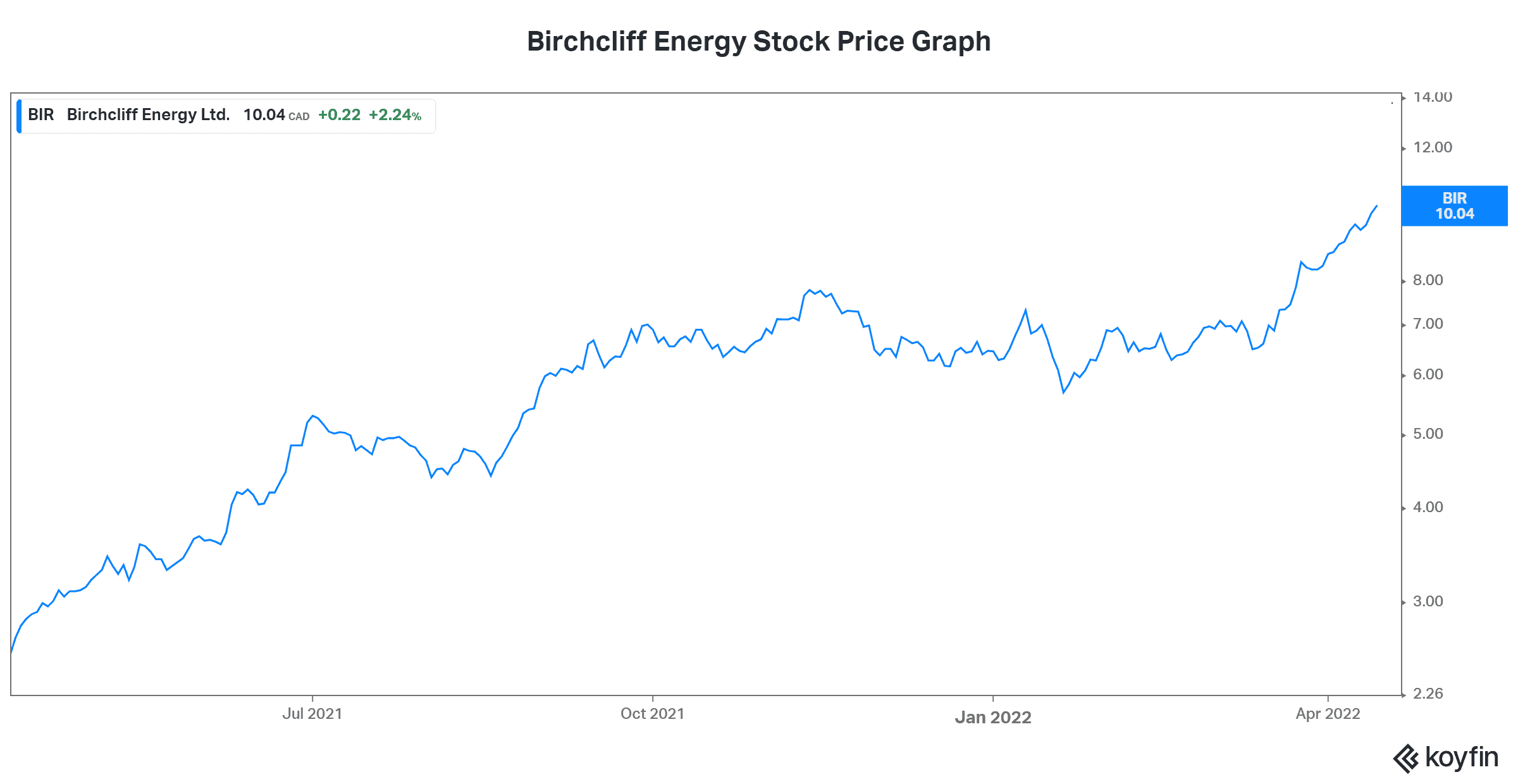

Birchcliff Energy: A natural gas stock that’s up 255%

Birchcliff Energy (TSX:BIR) is a natural gas producer based in prolific basins in Western Canada. In fact, its production is roughly 80% weighted to natural gas. This leaves Birchcliff with significant exposure to these rapidly rising natural gas prices. As you can see in the price graph below, Birchcliff stock has risen 255% in the last year.

This is something of an unexpected comeback, according to many investors. However, it speaks to the true value of natural gas both domestically and globally. For example, the global demand for LNG has been relentless, as Europe faces an energy crisis, and Asian countries try to move away from coal.

For Birchcliff Energy, this spells good times. Record cash flows in 2021 have resulted in a doubling of the dividend and a real cleaning up of the company’s balance sheet. Birchcliff is in better shape than ever today. While operating expenses are creeping higher, cash flow increases of north of 170% are really the story here.

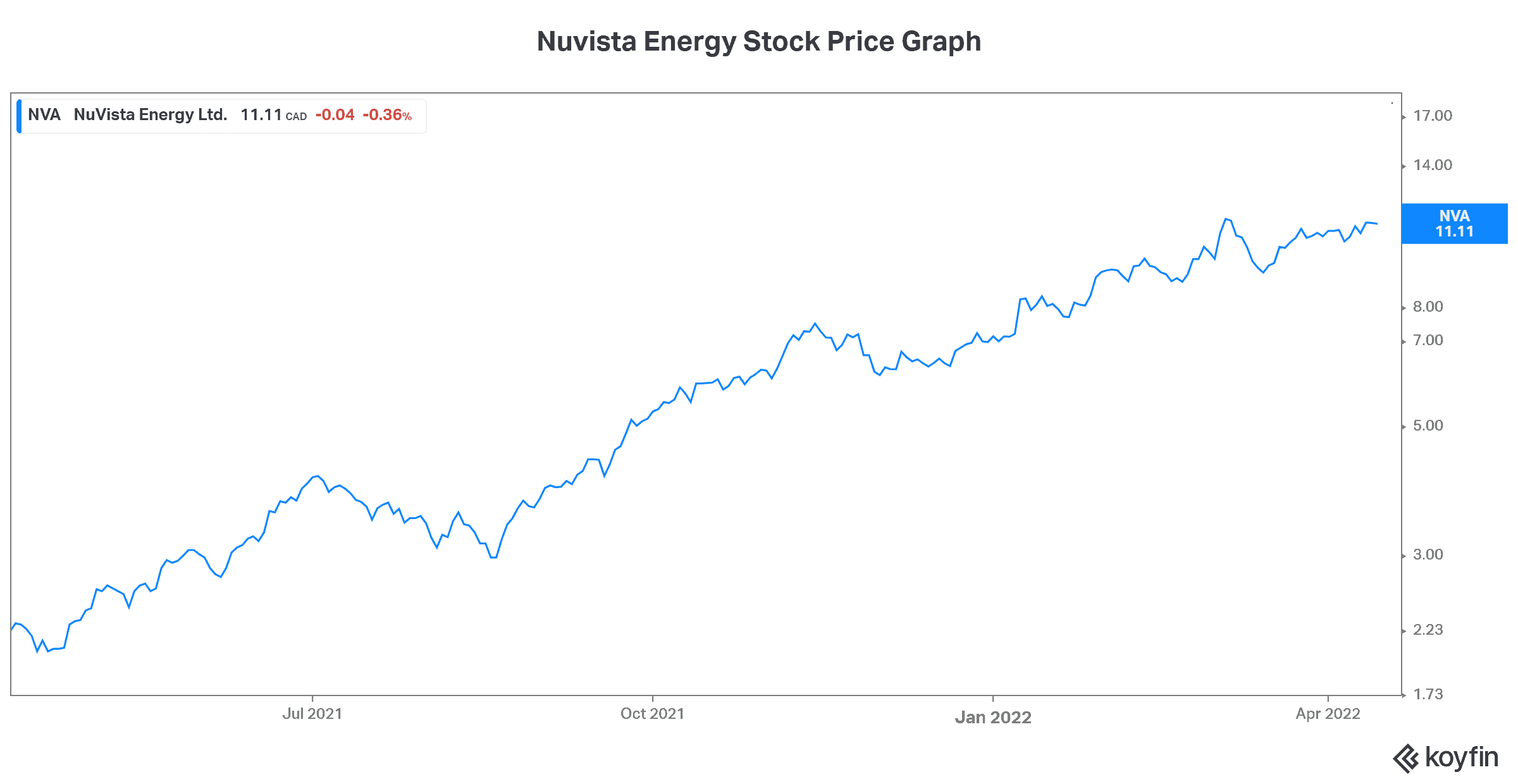

Nuvista Energy: One of the energy stocks that’s up 390%

Nuvista Energy (TSX:NVA) is another quality Canadian natural gas producer that has seen its stock price soar this year. With a 60% natural gas weighting and a growing presence in the prolific Montney region in the Western Canadian Sedimentary Basin, Nuvista’s day has finally come. As the graph below illustrates, Nuvista stock is on a tear.

Once again, underpinning this sharp rise is Nuvista’s booming 2021 financial results. Adjusted cash flows more than doubled, debt is coming down, and shareholder returns are rising. Today, we’re definitely in an upcycle in the natural gas cyclical ride. And Canadian natural gas will be in demand for years to come. This is because Canada has an abundance of cheap, relatively clean natural gas production in a politically safe and agreeable environment. Nuvista is very well positioned.

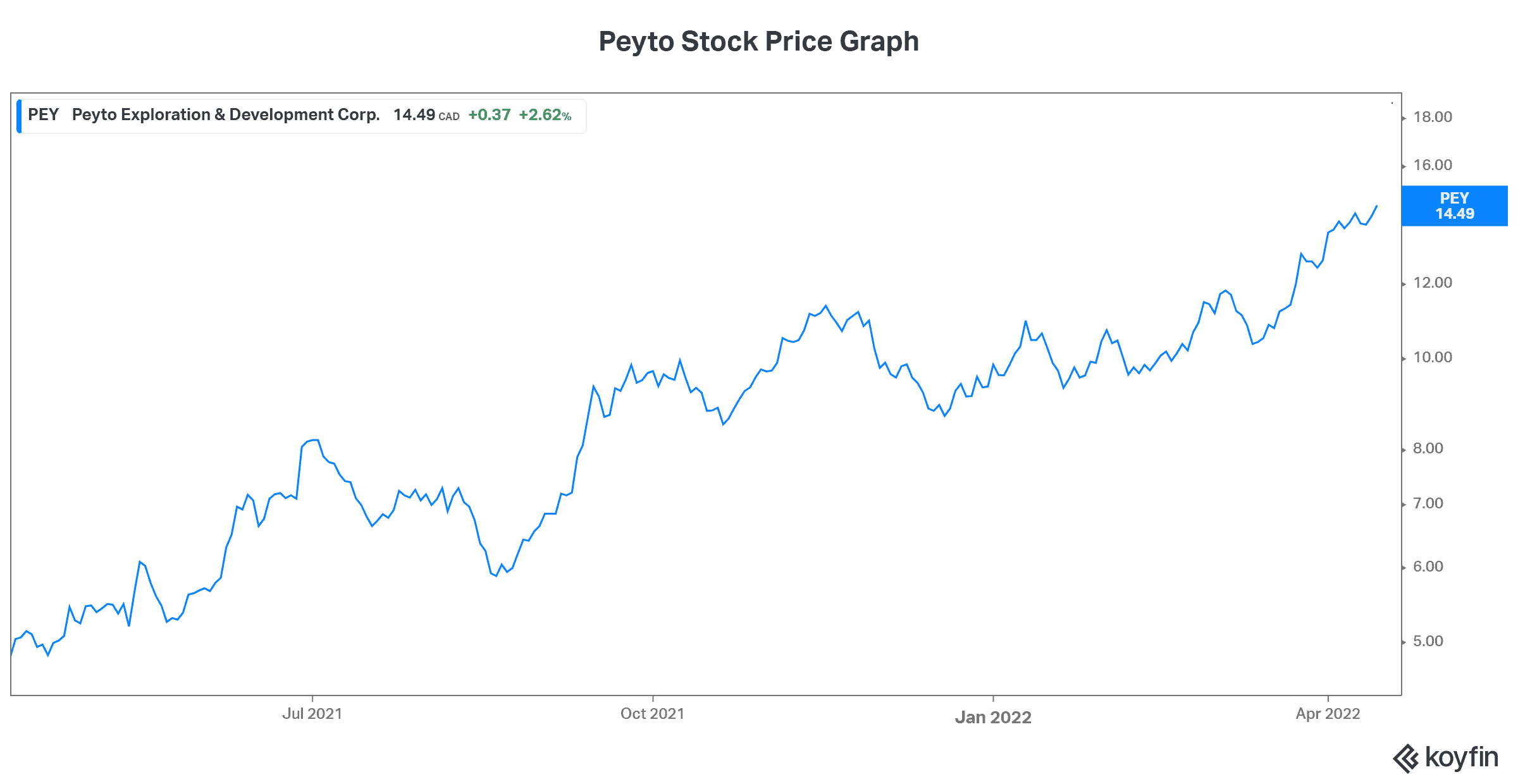

Peyto stock: Canada’s lowest-cost natural gas producer is up 184%

Lastly, we have Peyto Exploration and Development (TSX:PEY). This natural gas producer operates in a very prolific resource basin. This basin is characterized by predictable production profiles, low-risk exploration, and a long reserve life. It’s for these reasons that Peyto stock has been one of my favourite natural gas stocks for quite some time now.

In 2021, Peyto achieved a 121% increase in funds from operations amid a recovering natural gas market and rising production. As a result of this strong cash flow, shareholder returns are rebounding dramatically. For example, Peyto increased its dividend by a full 1,400% from $0.04 per year to $0.60 per year.

Motley Fool: The bottom line

Record cash flows, debt repayment, and dividend increases are the name of the game for energy stocks these days. It’s not too late to buy these three high-quality natural gas stocks listed in this article.