It’s been over two years now since the pandemic first began impacting stocks, and there are still a handful of companies feeling the effects. And with Canada continuing to make good progress in living with the pandemic, procuring more tests as well as newly approved treatments for the virus, investors can have confidence when looking for the top recovery stocks to buy.

It’s not just restrictions that are being dropped, allowing these businesses to operate at full capacity. In a lot of cases, there is a tonne of pent-up demand from consumers, creating an even bigger opportunity for investors.

If you’ve been interested in finding which recovery stocks are the best to buy, here are some of the best to consider today.

Entertainment venues have tonnes of pent-up demand

One of the most popular recovery stocks which has struggled to gain any ground, despite seeing a strong recovery in its operations, is Cineplex (TSX:CGX). Cineplex is most known for its movie theatre business. However, the company also owns popular entertainment venues.

All of these businesses were severely impacted by both shutdowns and indoor capacity restrictions. With many restrictions being dropped and eased this year, plus the fact that Cineplex stock is still cheap, it’s one of the best recovery stocks to buy for value investors.

Trading at a forward enterprise value (EV) to EBITDA of just 7.9 times, it’s considerably cheap. Plus, when you consider that over the next couple of years, its EBITDA should grow considerably, it certainly offers value today.

If Cineplex was to earn the same EBITDA that it did prior to the pandemic, it would be trading at an EV/EBITDA ratio below 6.5 times. Therefore, over the next couple of quarters, as long as the stock doesn’t suffer any setbacks, it should offer a tonne of upside.

Restaurant stocks are some of the best recovery stocks to buy now

In addition to Cineplex, restaurant stocks are another industry to find some of the best recovery stocks that you can buy.

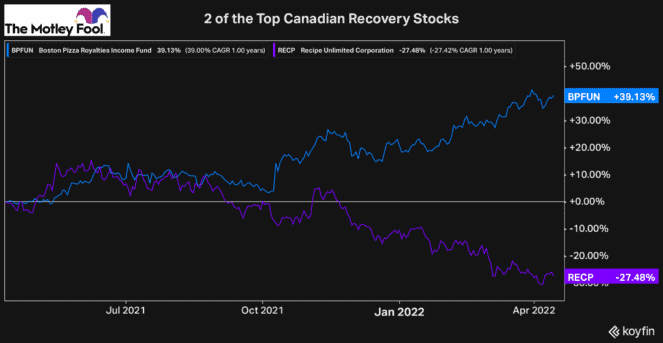

For example, over the last year, Boston Pizza Royalties has already seen a strong recovery and increased its distribution. Despite this recovery, it still does offer value. However, one stock that’s even cheaper is Recipe Unlimited (TSX:RECP).

Recipe is another restaurant stock that was impacted severely by the pandemic, far more than Boston Pizza was. However, in recent quarters, it’s been making a noticeable comeback, yet as you can see by its chart, the stock has continued to sell off.

In just the last three quarters, its trailing 12-month revenue has increased by more than 25%. Furthermore, its trailing 12-month revenue today is only 19% below where it was just prior to the pandemic, and analysts expect most of that will be made back this year.

With the stock trading at a forward price-to-earnings (P/E) ratio of 9.5 times, Recipe is one of the best recovery stocks to buy for value investors. In the years leading up to the pandemic, its forward P/E ratio was closer to 14 times.

Therefore, Recipe Unlimited is a stock you’ll certainly want to keep on your watchlist.