What could be better than a perpetual stream of passive income for life? I can’t think of too many things better. While there is no such thing as a real “money tree,” high-quality dividend stocks are essentially the same thing.

Passive-income stocks are money trees for life

You plant a little capital into the stock of a great business, and it can yield the fruit of quarterly or monthly dividends year after year. It is even better when these passive-income stocks grow their dividend payouts regularly.

When you find a high-quality business, the best thing to do is to buy, hold it, and do little else. As acclaimed investor, Warren Buffett has famously said, “Our favourite holding period is forever.”

When you find the “money tree” (investment) that produces reliable streams of passive income, why would you swap it in and out? If you are looking for perpetual and growing passive income, here are two incredible Canadian dividend stocks I’d consider owning for life.

Algonquin Power: A top dividend compounder

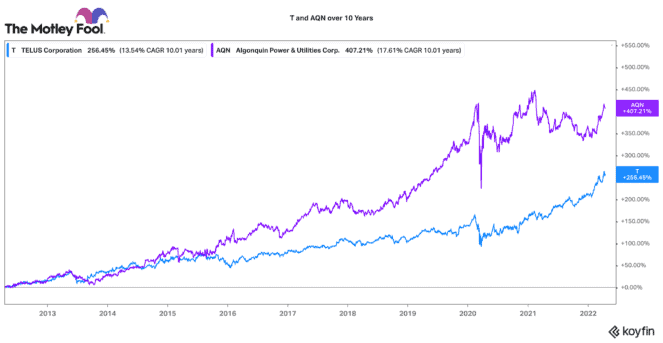

Despite being a boring utility stock, Algonquin Power (TSX:AQN)(NYSE:AQN) has compounded total returns by around 17% a year since 2011. Over the years, Algonquin has done a great job growing current operations and expanding through acquisition.

Today, it operates regulated water, natural gas, and electricity utilities across North America. It also owns a growing portfolio of renewable power assets globally.

Last year, Algonquin grew adjusted EBITDA by 24% and adjusted net earnings per share by 11%. Given the strong results in 2021, it increased its dividend by 10%. Right now, Algonquin pays a substantial 4.3% dividend yield.

The company has a large +$9 billion capital plan. It hopes to grow by 7-9% annually for at least the next five years. Dividend increases will likely replicate its growth profile, so there could be significant passive-income upside. For above industry-average growth and great dividends, this is a passive-income stock to hold and never sell.

TELUS: An ideal stock for long-term passive income

TELUS (TSX:T)(NYSE:TU) is another passive-income stock that has compounded solid returns for long-term shareholders. Over the past 10 years, it has delivered a 13.5% compounded annual total return. In that time, it has grown its dividend by nearly 9% on average.

In fact, its annual dividend rate is more than double what it was in 2012. Given recent investments in fibre optic networks and 5G, TELUS should see earnings and cash flow growth accelerate over the coming few years. TELUS has several technology businesses that could also provide meaningful upside. These are not yet factored into the stock price.

Today, this passive-income stock pays a 3.9% dividend. It is not exactly cheap after a strong run this year. However, it expects to generate significant cash in 2023, so chances are high for substantial dividend growth in the future.

All around, TELUS operates a defensive business that is supported by a very innovative product mix (especially compared to peers). Consequently, it is one passive-income stock shareholders can just buy, hold, and plan to own for forever.