Investors priced out of Canada’s red-hot real estate market but wanting exposure to real assets can make do with buying shares of various real estate investment trusts (REITs).

REITs are funds that invest in real estate and pay monthly distributions through the rental/lease income generated. Like stocks, shares in REITs trade on exchanges. These shares can be held in a TFSA and RRSP, allowing for tax-free or tax-deferred distributions

Investors looking to buy REITs can do so directly by purchasing shares of individual ones, or by buying an exchange-traded fund (ETF) that holds a portfolio of them. There are various pros/cons for each approach, so keep reading to find out which one is best suited for you!

The ETF approach

The ETF we will examine today is iShares S&P/TX Capped REIT ETF (TSX:XRE). This ETF is based on the S&P/TSX Capped REIT Index, which tracks the performance of 19 TSX-listed REITs, with each capped at a max weight of 25%. The ETF pays a decent yield of 3.41%.

XRE offers exposure to a portfolio of REITs from all sectors, including residential, office, industrial, healthcare, and retail. If you want the most hands-off approach to REIT investing, XRE is a good pick. The fund is rebalanced for you periodically, and all you need to do is buy shares and reinvest dividends.

There is a downside though — the management expense ratio (MER). This is the percentage fee deducted from the ETF’s net asset value (NAV) over time. XRE has an MER of 0.61%, which means that for every $10,000 invested, the ETF charges a fee of $61 annually.

The stock-picking approach

Investors favouring more risk for a chance at higher returns can also construct their own portfolio of REITs. In this case, I opted for a equal-weighted allocation of the four largest REITs by market cap, each representing a different REIT sub-sector.

- Residential: Canadian Apartment Properties REIT

- Industrial: Granite REIT

- Office: Allied Properties REIT

- Retail: RioCan REIT

This portfolio of four hand-picked REITs produces an average distribution yield of 4.68%. There is no MER to speak of — aside from commissions, if you aren’t using a zero-fee brokerage.

ETF vs. stock picking

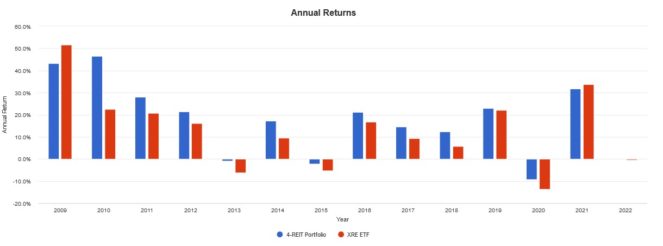

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2008 to present. The equal-weight four-REIT portfolio had better risk-adjusted returns, similar volatility and drawdowns, but a higher CAGR.

Here are the annual returns from 2008 to present. Most years, the equal-weight four-REIT portfolio outperformed the ETF but also fell less during bear markets.

The Foolish takeaway

Investors with a high risk tolerance and the time to keep up with the financial statements of their picks can consider a concentrated portfolio of four REITs. Although their performance is not guaranteed, this approach could lead to better returns and beat the sector if held for the long run. If this approach seems too volatile or time consuming for you, there is nothing wrong with buying a REIT ETF like XRE either. Passive investing is always a good choice.