Most Canadian investors have anywhere from 20% to 50% of their portfolios in Canadian stocks. It’s called a home-country bias. Canada is full of mature, blue-chip companies that pay out handsome dividends, and these stocks make excellent long-term holdings.

Notable stocks exhibiting these qualities include Royal Bank of Canada, Enbridge, Canadian National Railway, Fortis, and BCE. Dividend-growth investors often love these stocks for their consecutive decades of dividend payouts and increases. They’re often less volatile than the market as well.

Moreover, Canadians often feel psychologically at ease investing in familiar, well-known brands. Investors derive a sense of comfort from the thought that they understand these stocks easily and interact with their products on a daily basis.

Too much in Canadian stocks?

It might shock you to find out that the Canadian stock market only comprises around 3% of the world’s total stock market capitalization. In the grand scheme of things, the TSX is a drop in the bucket. Compare this to the 55% the U.S. stock market covers.

For this reason, Canadian investors who are overweight domestic stocks might need diversification. While a moderate home-country bias (Vanguard says 20-30%) is beneficial for lowering volatility, improving tax efficiency, and reducing currency risk, any more is likely to be sub-optimal.

Canada vs. the U.S.

The stock markets of different countries are cyclical. None can outperform the others perpetually on end; otherwise, everyone would just invest there and send its valuations sky high. Reversion to the mean does occur. Markets that enjoy bouts of outperformance are just as likely to underperform later.

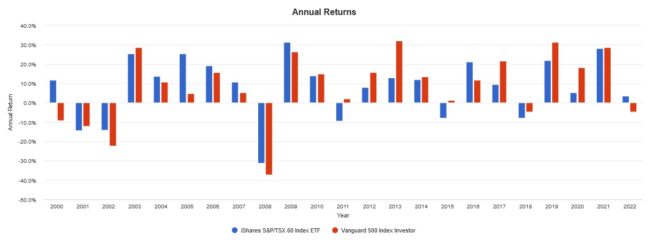

The following backtest plots the returns of the S&P TSX 60 vs. the S&P 500 from 2000 onward on a trailing basis. Both indexes are neck and neck with similar returns, volatility, drawdowns, and best/worst years. Investors buying and holding either would have netted a similar return.

The story changes when we examine their annual returns year by year. We see that from 2004 to 2009, the S&P/TSX 60 outperformed the S&P 500 every single year. From 2017 to 2021, the opposite was true. In this 22-year period, the S&P TSX/60 won 10 times, and the S&P 500 won 12 times.

Why diversify?

The problem many investors face here is a psychological one. Most investors constantly chase performance. If the U.S. market is doing hot, they pile in there. If the Canadian market is soaring, they rotate there. This is market timing. It causes investors to buy high and sell low.

It can be taxing to see your investments and market do poorly, while the other parts of the world perform well. A good investor remembers to diversify and stay the course.

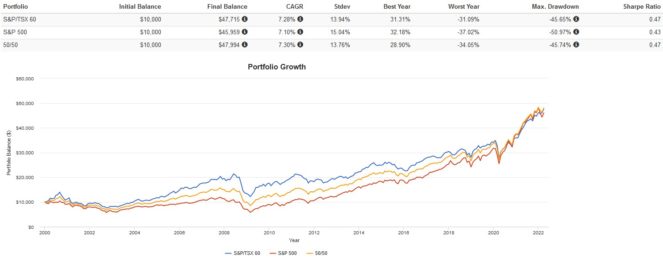

To illustrate my point, let’s see how a 50/50 portfolio of the S&P 500 and the S&P/TSX 60 would have performed compared to either of the two individually.

The 50/50 portfolio smoked both the others, with a better overall return, lower volatility, and better Sharpe ratio. You would have gotten the best of both worlds, ensuring that you never suffered relative bouts of underperformance but not sacrificing any gains either. This is the power of diversification.