Inflation is a growing problem that we, as investors, must grapple with. Just as the central bankers must protect Canada’s economy, we must take action to protect our own personal wealth. In this Motley Fool article, I’ll list three high-yield dividend stocks to buy in order to do this. Not only do these stocks have their high yields in common, but they also have defensive characteristics in common. In fact, they’re among the best dividend stocks in Canada today.

Without further ado, here are the three dividend stocks to buy to fight inflation.

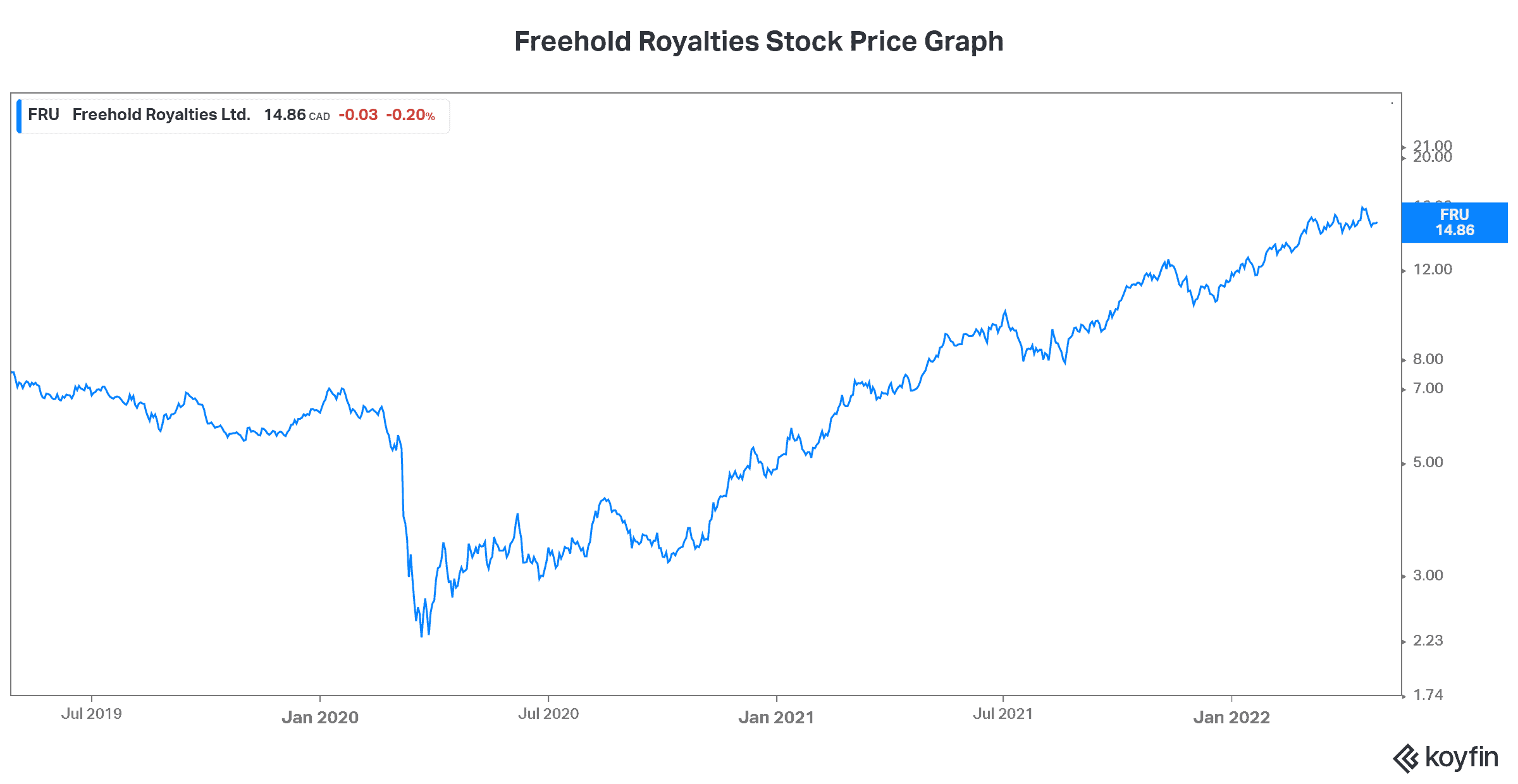

Freehold Royalties: High-yield stocks in the energy sector are golden

As far as energy stocks go, Freehold Royalties (TSX:FRU) is among the safest. It’s a Canadian oil and gas company that’s engaged in the production and development of oil and natural gas. Freehold is different than other energy companies because it’s a royalty. What that means is that there’s less risk involved with this name. Freehold collects royalties from other companies who are actually taking on the exploration and production risks.

So, Freehold stock is currently yielding 6.6%. For investor, it’s a chance to get a very generous yield and to also have exposure to this great oil and cycle up-cycle. In fact, Freehold Royalties stock has provided its shareholders with 85% capital appreciation in the last year. It’s also provided strong dividend growth. With a healthy balance sheet, little capital expenditures, and a strong oil and gas markets, we can feel safe and protected from inflation with Freehold.

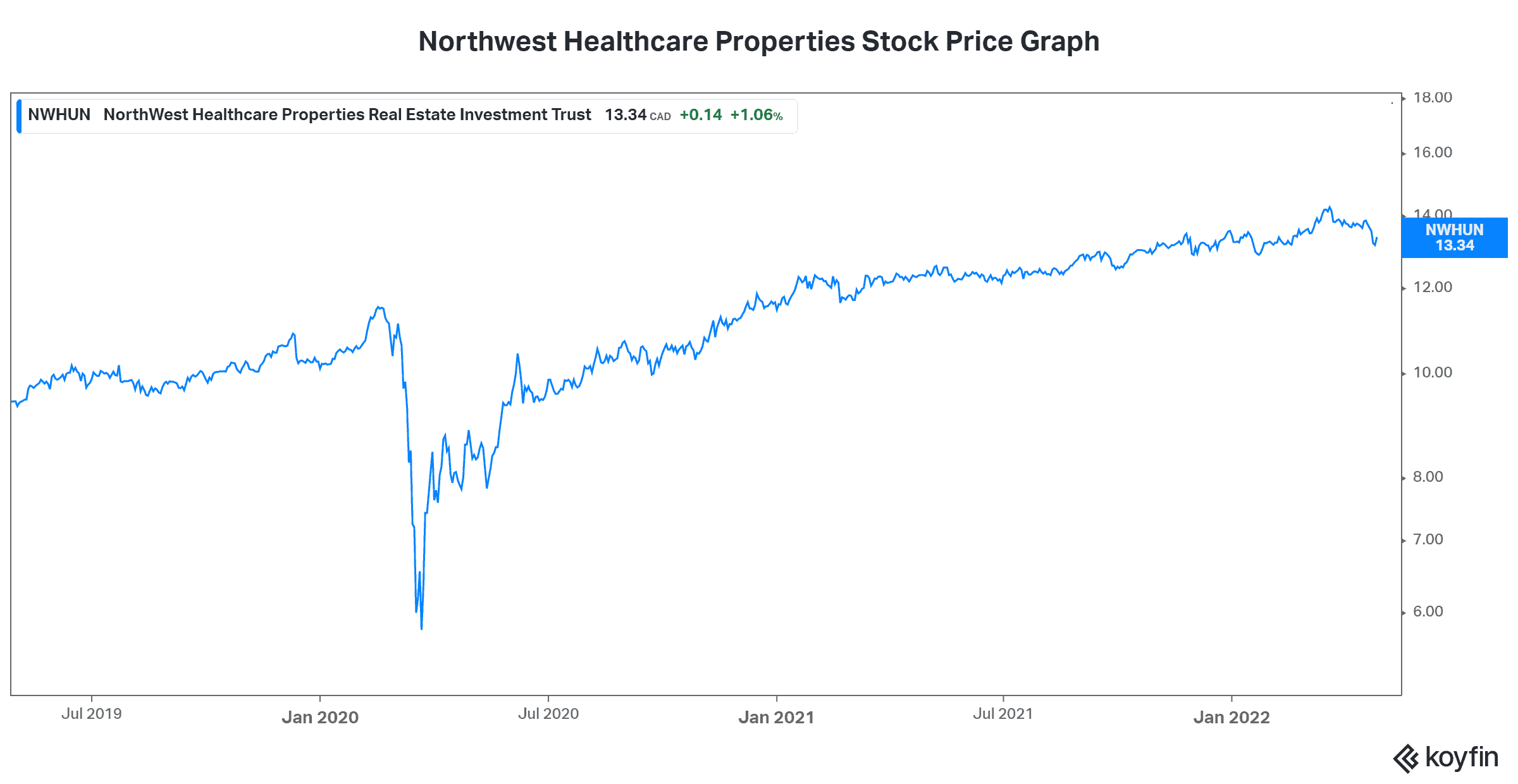

Northwest Healthcare Properties REIT: A dividend stock with a 6% yield

Next up is Northwest Healthcare Properties REIT (TSX:NWH.UN). Northwest is a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global healthcare real estate. The fact that the trust’s real estate assets are all in the healthcare industry has many implications. Most importantly, it makes Northwest a very defensive holding. Simply put, cash flows generated are steady and stable.

The healthcare sector is very sheltered from economic woes, which may be coming sooner rather than later. Healthcare spending must go on regardless of inflation, consumer spending, etc. So, investing in this 6% yielder is a very effective way to fight inflation and protect our wealth.

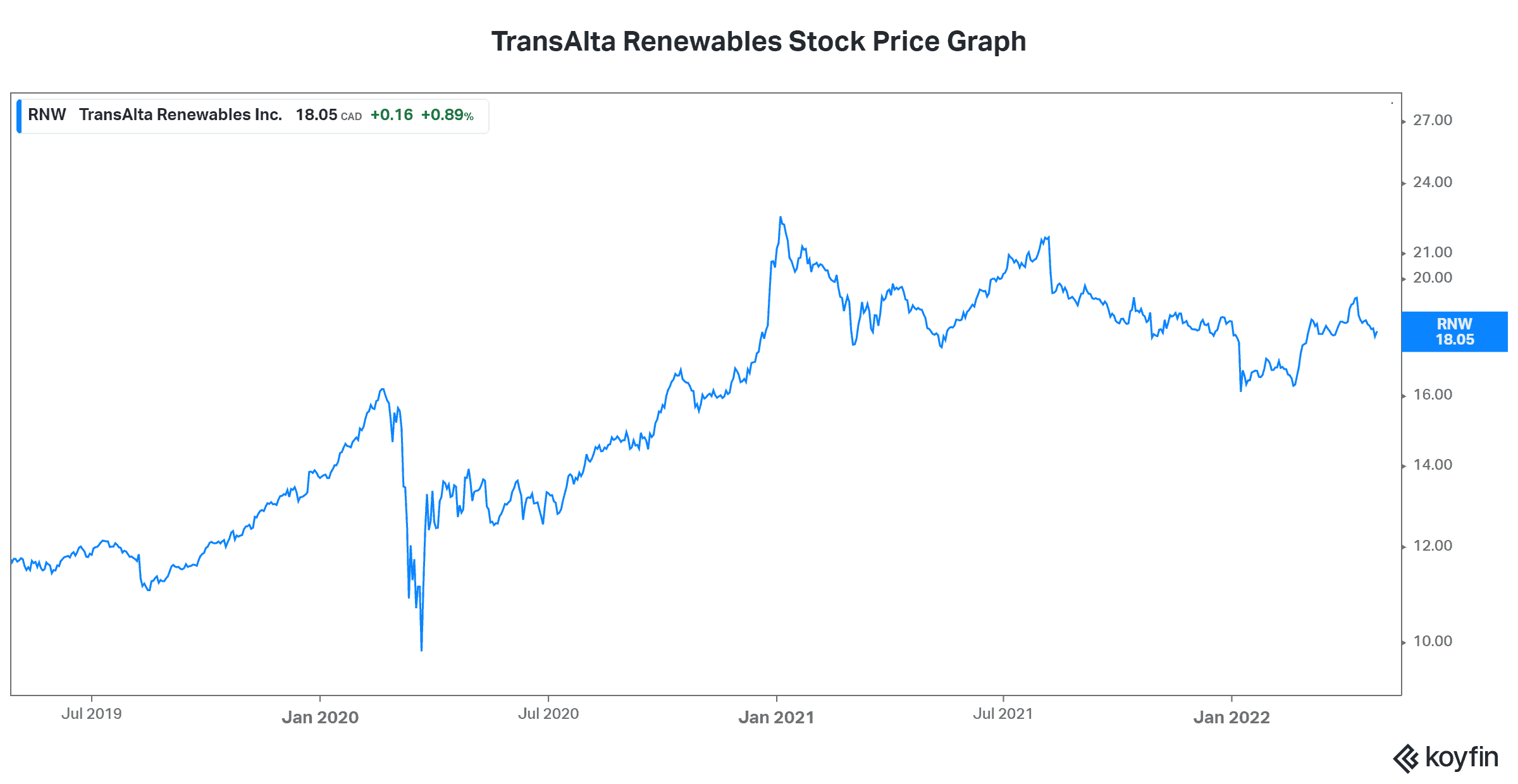

TransAlta Renewables: A renewables stock with a 5.25% yield

Lastly, TransAlta Renewables (TSX:RNW) is another stock that will prove to be effective in our fight against inflation. As an owner of renewable and natural gas power-generation facilities, TransAlta Renewables is an essential business. It’s also a business that’s benefitting from the long-term secular move to renewable energy. I therefore conclude that this company is highly defensive and highly effective at protecting investor wealth.

Looking at fundamentals, TransAlta’s returns are not that high, but the balance sheet is healthy, and cash flows are strong. TransAlta can be expected to be a great protector of shareholder wealth over the long term. Its 5.25% yield is backed by its steady business and the resulting steady cash flows.

Motley Fool: The bottom line

Fighting inflation is a topic that’s top of mind these days, and rightly so. In fact, we need to invest carefully to preserve our wealth, reduce downside, and hopefully gain as much upside as possible. High-yield dividend stocks such as the three listed in this article are a good place to start. They’re among the best dividend stocks in Canada today.