If you are having a hard time affording real estate in Canada, you could consider buying stocks in real estate businesses. There is less upfront capital required, and these stocks are much easier (and affordable) to buy and sell than a traditional real estate property.

REITs are good cash-yielding investments

One option is to buy a real estate investment trust (REIT). This is a publicly traded trust designed to buy and hold properties in a variety of different assets classes (i.e., industrial, retail, multi-family, etc.). Generally, they pay an attractive distribution yield and grow by acquiring or developing real estate properties.

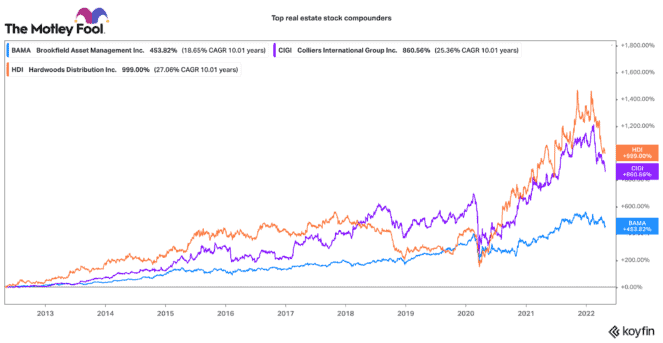

Unconventional real estate stocks have been great capital compounders

However, there are also some unconventional stocks that widely benefit from trends in the real estate world. Many of these are less known, but they have delivered very strong market-beating returns for years. Here are three of my favourite real estate stocks that could build significant compounding wealth over time.

A top real estate stock for long-term returns

Colliers International Group (TSX:CIGI)(NASDAQ:CIGI) is a global provider of commercial real estate solutions. These include brokerage, leasing, financing, investment banking, engineering, and asset management. In essence, it is becoming a one-stop shop for the needs of commercial landlords and developers.

This real estate stock has been an incredible compounder over the years. Since 2012, this stock has compounded at a 25% annual growth rate! It is up 875%! The company has grown by consistently adding various real estate businesses to its platform.

Colliers stock is down 21% this year. At 16 times earnings, it is trading below its five-year average of 18.5. If you have a long time horizon, this is a real estate stock to buy and own for many years to come.

A diversified portfolio anchor

Speaking of great buy-and-hold real estate stocks, Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is attractive today. It is one of the world’s largest alternative asset managers. While it manages everything from infrastructure to insurance, real estate is a large component of its business.

In 2020, it privatized Brookfield Property Partners after the stock crashed on pandemic lockdown measures. BAM picked up these assets at a massive discount to their private market value. With the office and retail property market stabilizing, BAM will likely sell off non-core assets and milk the cash flows from its best-in-class core portfolio.

Over the past 10 years, BAM has steadily compounded total annual returns at an attractive 18% rate. Its stock is down 16% this year and trades at a very attractive 13 times adjusted funds from operation.

A cheap way to play residential real estate

A stock that benefits from the residential property market is Hardwoods Distribution (TSX:HDI). This stock is not well known by the market. Yet, it is one of North America’s largest distributors of architectural building products. It has made several smart acquisitions recently that expand its addressable market, increase its margins, and diversify its product offering.

With interest rates rising, there is certainly some concern about the housing market. Yet across North America, there is massive deficit in new housing supply. Hardwoods is a major supplier to home builders, renovation contractors, and commercial builders, so it stands to benefit long term.

It helps to mention that this stock is incredibly cheap. It only trades for 5.5 times 2022 earnings. For a stock that has been growing earnings by around 30% a year, it is a very attractive opportunity today.