There are plenty of high-quality Canadian stocks to buy in the real estate sector, but if you’re an investor strictly looking for growth, not every investment will be the best.

Some real estate stocks will offer more growth potential than others, not just because they have a better strategy or more attractive assets, but because they pay a much smaller dividend.

In general, companies are always compromising on how much money to pay to investors and how much capital to retain and invest in growth. This is why larger, more established businesses with long track records will typically offer slower growth but a more attractive dividend.

Meanwhile, the best growth stocks on the market will usually pay no dividend at all, and if they do, the yield will be extremely low.

So, if you’re looking to find some of the best real estate stocks to buy for long-term growth, here are two impressive REITs to consider today.

A top residential REIT

One of the best Canadian growth stocks over the last decade has been InterRent REIT (TSX:IIP.UN). For years, the residential REIT has grown its portfolio and the value of its assets rapidly, taking advantage of a hot Canadian housing market.

Lately, though, due to a pullback in the stock market and the fact that interest rates are rising rapidly, InterRent stock has sold off, and by much more than many other Canadian real estate stocks.

It’s worth noting that the stock does have a significant amount of variable rate debt as well as other debt maturing in the coming years. However, these are short-term headwinds impacting the stock. And for years, InterRent has proven it can be one of the best and most consistent long-term investments.

So, while the growth stock trades cheap and the real estate industry faces some short-term headwinds, it’s certainly one of the best stocks to buy now.

At the end of the day, while the stock may be volatile in the short term, it owns residential housing properties — one of the most defensive sectors there is. Not to mention, with the stock so cheap today, the distribution InterRent offers currently provides investors with a respectable 2.5% yield.

One of the best long-term growth stocks in the real estate sector

In addition to InterRent, another exceptional Canadian REIT to buy if you’re looking for top-notch growth stocks is Granite REIT (TSX:GRT.UN). And while the stock is not quite as cheap as InterRent, in this market environment, when you have the chance to buy it at a discount, it’s certainly a significant opportunity.

Granite is a massive REIT with over 120 income-producing properties along with another 12 development properties in its portfolio. These assets are well diversified too, located in Canada, the United States, and Europe.

And while the stock would have growth potential anyway, considering the rapidly rising demand for warehouse space, it’s also been executing well and finding high-quality tenants, such as Amazon, to lease its properties.

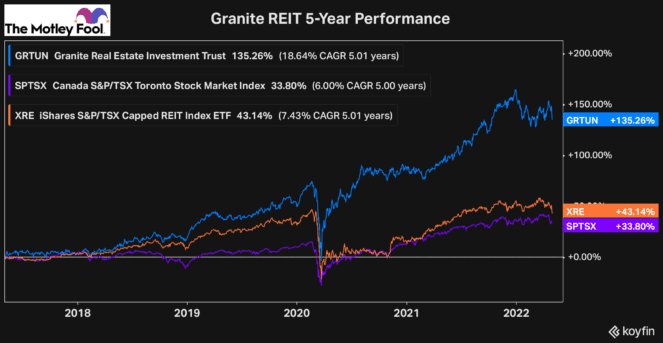

So, it’s not surprising that it’s outperformed both the TSX and many of its peers quite significantly over the last five years.

And even though it’s an investment you’re buying predominantly for its growth potential, it does offer a current yield of 3.3% as well as 11 consecutive annual distribution increases. So, it’s a Dividend Aristocrat, much like InterRent.

Therefore, if you’re looking to buy real estate stocks for long-term growth, Granite is not only one of the best to buy, but it’s also sold off in recent months, giving investors the chance to buy it at a discount.