Canadian tech stocks haven’t been nearly as visible as U.S. tech stocks. There are fewer of them. They’re less global. And they’re way smaller. But recently, there have been some major Canadian success stories. They’re all in different stages of their stories. Yet all have tremendous upside.

Please read on as I share with you three Canadian tech stocks to buy for growth.

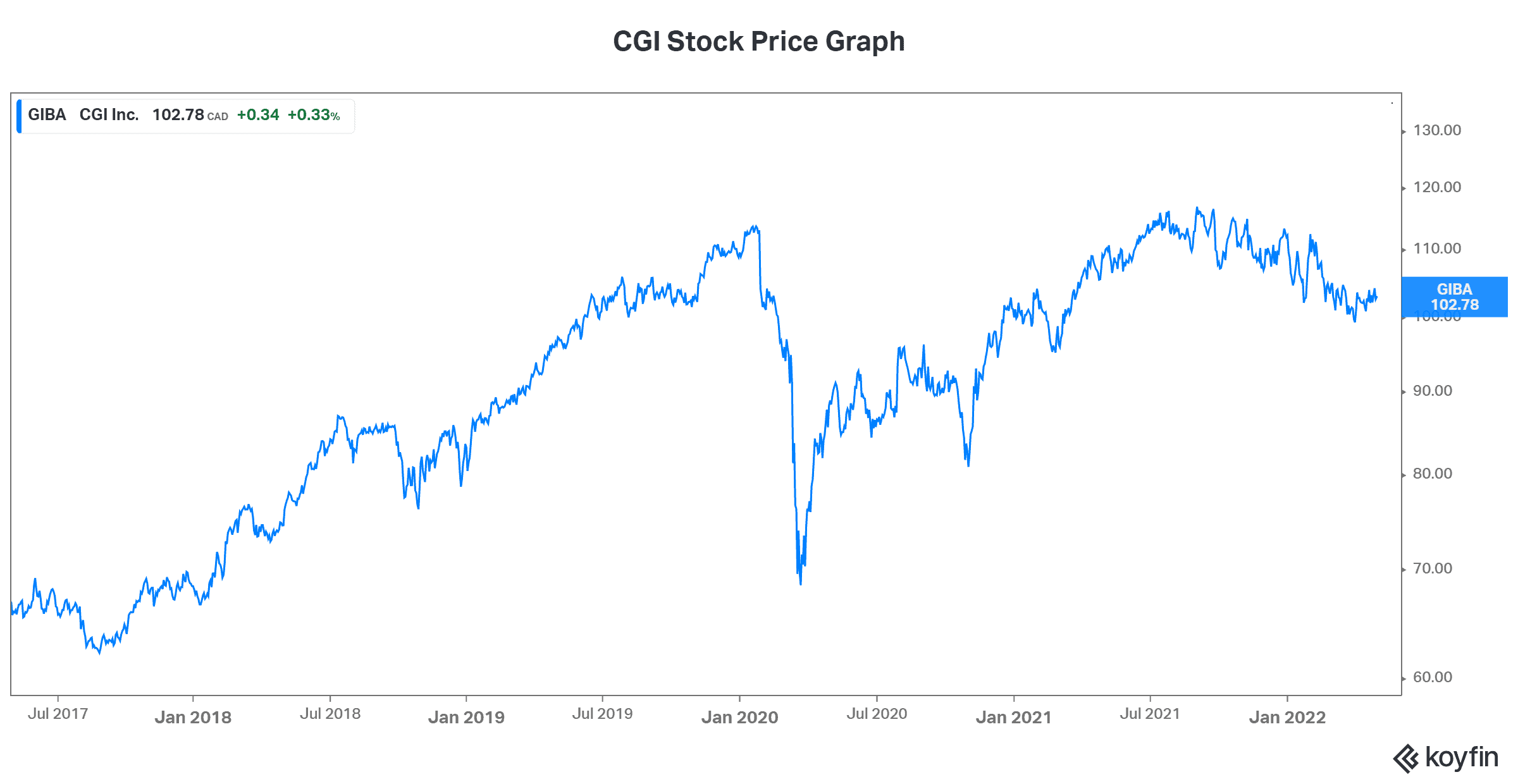

CGI: A Canadian tech stock that’s conquering the world

As for as Canadian tech stocks go, CGI Group (TSX:GIB.A)(NYSE:GIB) is one of the greatest. It’s a leader in the IT and business consulting industry. And is has a global presence that reaches all corners of the world. The company has built this presence from its start back in 1976. This was done through acquisitions as well as organic growth. Today, the company continues to acquire and grow. Essentially, it continues to consolidate its fragmented industry. This is bringing revenues and margins higher as CGI builds more scale and efficiencies.

In fact, CGI’s business is a high-margin one that has been benefiting from the growing demand for digitization services and systems. The world was always moving toward progress. Today, it’s moving toward digitization at a frantic pace. It’s a move that makes sense. It brings companies greater efficiencies. It also brings them greater reach and greater profitability. So, it’s a win-win for CGI and its clients.

Recently, CGI reported stellar quarterly results. These results highlighted why it is, in fact, one of Canada’s best tech names. In short, the quarter was a big success. Revenue rose 10% and EPS rose 14%. Also, margins strengthened significantly. The company is awash in cash, and it continues to see opportunities for further value-enhancing acquisitions.

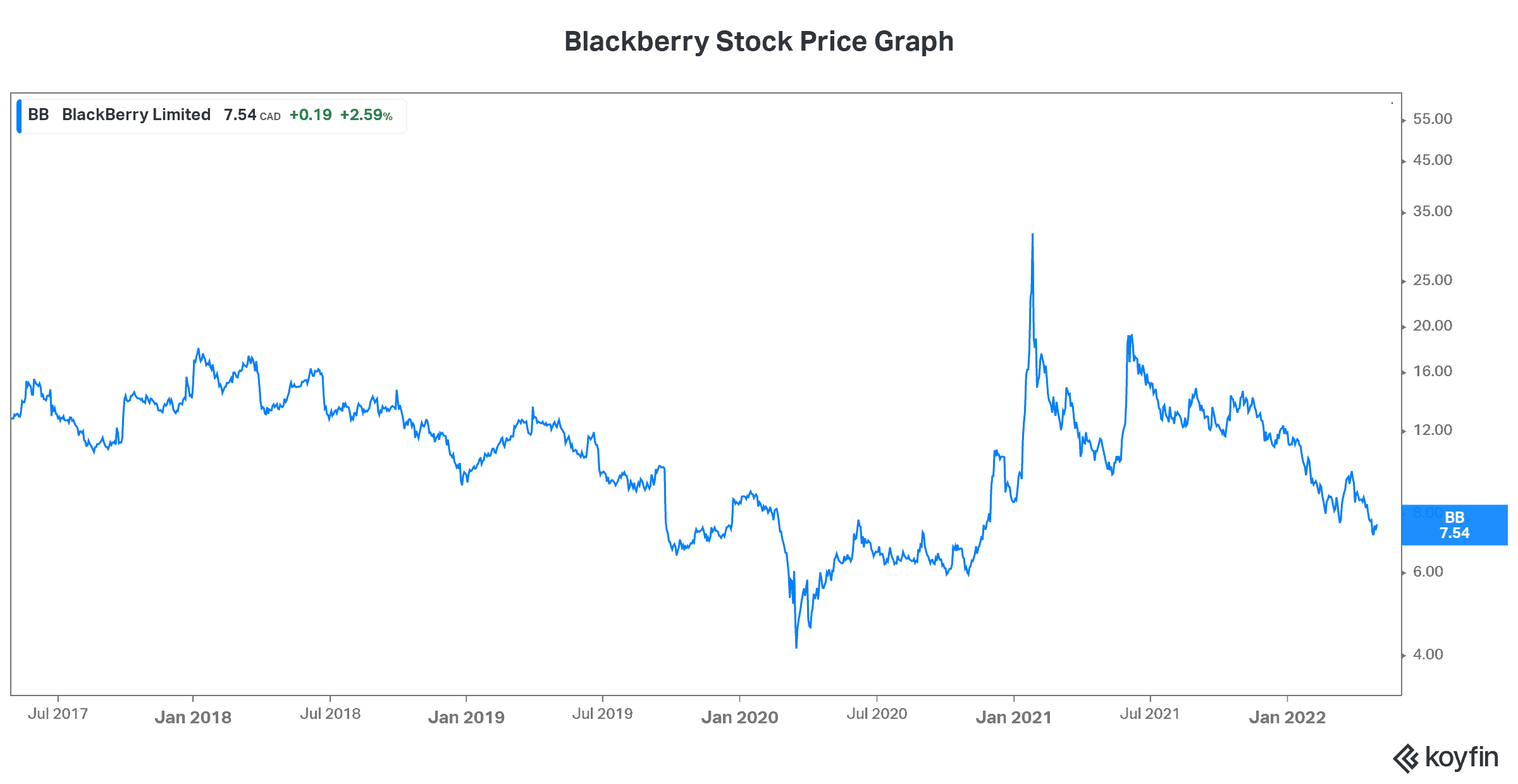

BlackBerry: A tech stock in early stages but with world-class technology

Another Canadian success story is BlackBerry (TSX:BB)(NYSE:BB). BlackBerry’s ride has been far more volatile than other tech stocks, like CGI. However, the potential reward remains huge. Today, BlackBerry stock trades below $8. It’s looking more attractive than ever.

But there are a few things that have stood in BlackBerry’s way. Firstly, this company remains unprofitable. This is to be expected given the fact that the company has completely shifted gears a few years ago. Yet it’s still understandably unsettling for many investors. Secondly, we have BlackBerry’s embedded systems business. It’s BlackBerry’s most exciting business. But it’s still in the early stages. This means that setbacks are to be expected. Yet the growing pains that come with it are difficult.

With BlackBerry stock, I keep my eye on the fact that BlackBerry has won countless awards for its technology. Also, it has life-changing software. BlackBerry’s software enables machine-to-machine connectivity. This is transforming many industries. With its partnership with Google Web Services a year ago, BlackBerry is advancing its IVY auto platform. Management hopes it can have a version of IVY going into production by the end of this year. The market is huge. The potential payoff is tremendous.

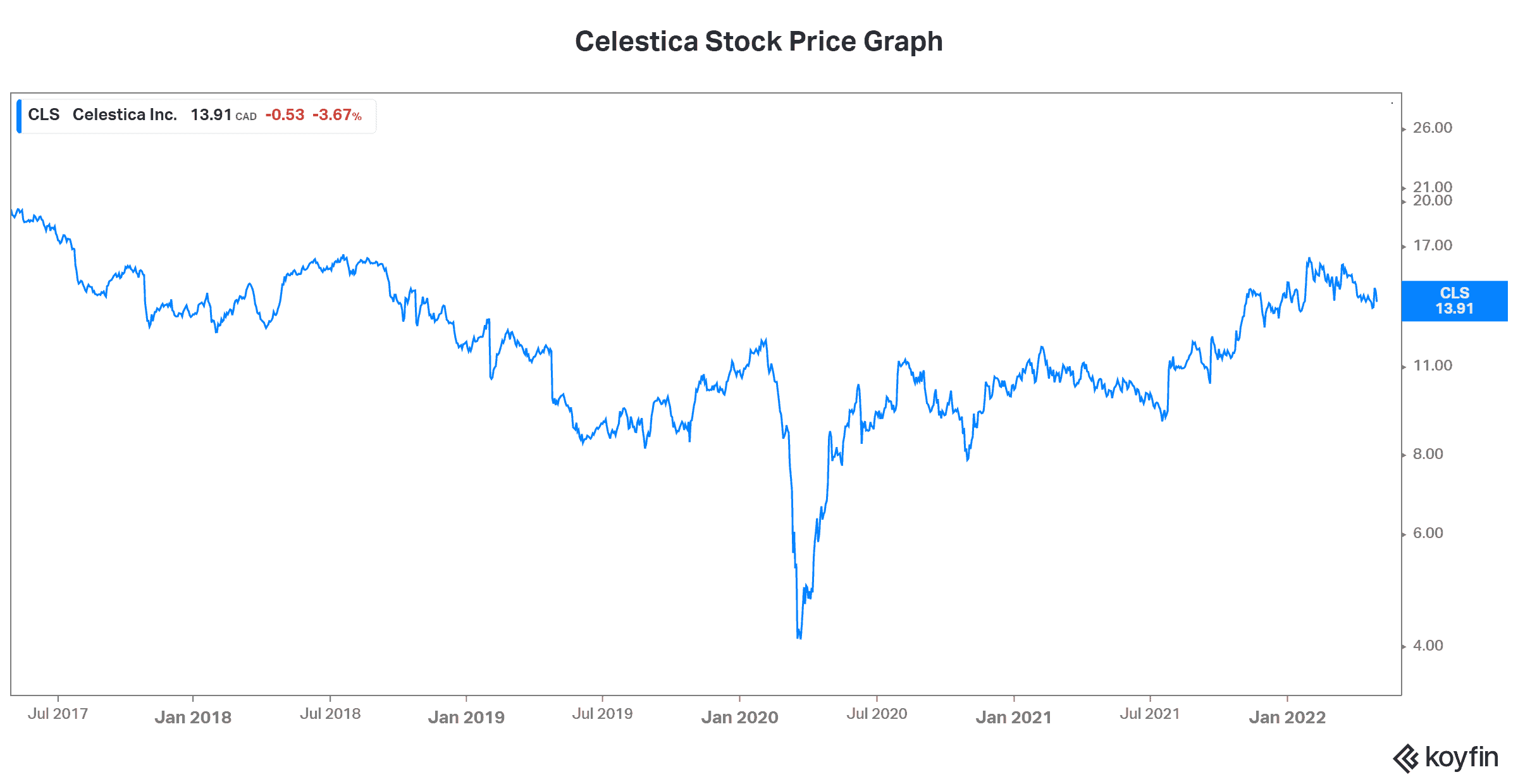

Celestica: An overlooked tech stock positioned for growth

Lastly, Celestica (TSX:CLS)(NYSE:CLS) is one of Canada’s overlooked tech stocks that’s beginning to look more interesting. Celestica is an electronics manufacturing services (EMS) company. This means that it designs and manufactures hardware for the tech industry. Today, it’s benefitting from the growth in everything digital. Yet, its stock price is undervalued. It trades at less than 10 times 2022 expected consensus earnings.

Celestica’s latest results came in above expectations. EPS was $0.39 versus $0.35 expected. Also, revenue increased 27%. Finally, in additional positive news, the company raised its 2022 revenue guidance. It’s now calling for revenue of at least $6.5 billion. Celestica has been overlooked and discounted for so long. I think this is about to change. Valuation and expectations are too low, in my view, and will get re-rated.

Motley Fool: The bottom line

Canadian tech stocks are looking increasingly attractive today. The three mentioned in this article are all attractive for different reasons. But they all offer compelling opportunities for investors. Consider them when you’re looking for growth stock ideas.