Pembina Pipeline (TSX:PPL)(NYSE:PBA) impressed shareholders after delivering record first-quarter results. Its stock was up modestly 1.5% after the stock market open today.

Pembina is a leading Canadian pipeline, midstream, and energy infrastructure company. Its goal is to be a one-stop transportation and services shop for Western Canadian energy producers. This has been playing out very well, especially as energy prices soar in 2022.

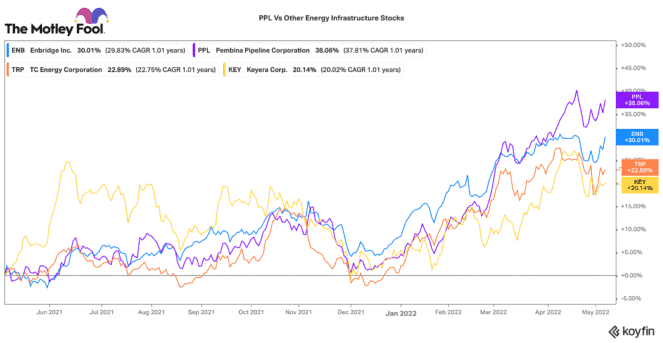

Pembina Pipeline stock has been outperforming energy infrastructure peers

Over the past year, the company has been delivering solid results. This has been reflected in a solid total return of over 25%. While the company has a largely contracted business, it does make a margin spread on energy volumes processed and marketed through its facilities.

Consequently, it gets some upside benefit from higher commodity prices. This is likely why its stock has outperformed other larger energy infrastructure peers like Enbridge and TC Energy.

Strong Q1 Results

Here are some financial highlights from its first quarter:

- Net revenues increased year over year by 15.5% to $1.154 billion.

- Adjusted EBITDA increased 20% to $1.006 billion, a quarterly record.

- Earnings increased 50% to $481 million.

- Earnings per share rose 59% to $0.81.

- Adjusted cash from operations per share improved 20% to $1.27.

All around, it was a very strong quarter for Pembina Pipeline. Despite overall pipeline and facility volumes declining by 3%, the company made up for it in strong market sales of NGL and crude products. In fact, these factors made up over 70% of the gains made in adjusted EBITDA. Its marketing segment grew earnings by 230%, which would explain its outsized contribution to the quarter.

Newly appointed chief executive officer, Scott Burrows had an optimistic take on the quarter:

“Our growing optimism over the future of the Western Canadian Sedimentary Basin (“WCSB”) remains intact and the positive discussions we have been having with customers over the past year are translating into contracting success and long-term commitments for future volumes to support higher utilization of Pembina’s existing asset base as well as accretive and capital efficient new growth projects.”

Scott Burrows, CEO of Pembina Pipeline

Pembina Pipeline raises guidance for 2022

Pembina Pipeline demonstrated its confidence in the business by raising its guidance for 2022. It raised its adjusted EBITDA guidance from $3.35-$3.55 billion to $3.45-$3.6 billion. That represents a 3% increase on the low-end of its guidance range.

Management also affirmed its plans to increase its monthly dividend by 3.6% by the third quarter. During the first quarter, Pembina announced a joint-venture partnership with well-known asset manager KKR. The companies will be combining several processing assets. The deal is expected to create accretive synergies and longer-term growth and development opportunities.

A low-risk combination of income and capital upside

Pembina Pipeline stock continues to provide shareholders an attractive combination of capital returns and outsized dividends. With a monthly dividend of $0.21 per share, this stock is yielding 5.15% today. Most of its assets provide reliable, contracted cash flows. Consequently, risks are limited to a large extent.

However, when energy prices are strong, it gets to benefit by processing, storing, and re-selling energy products. As a result, shareholders get the benefit of low-risk returns with decent upside if energy prices remain elevated. This combination makes Pembina Pipeline a solid Canadian dividend stock pick today.