It doesn’t take much scouring these days to find a lot of doom and gloom out there.

Skyrocketing inflation that just won’t quit, Russia’s invasion of Ukraine, Bank of Canada interest rate hikes … the list goes on.

As a result, most of the major market indexes in the U.S. are down 10-20% and many investors’ portfolios have a whole lot of red in them right now.

It’s times like these that investors can feel like throwing up their hands in frustration and simply saying “to heck with it all.”

It’s time for me to lay it on the line

I consider myself to be a bottom-up investor.

This involves ignoring much of the macro talk and market predictions that get bantered about, and simply trying to find great businesses that I think provide an excellent opportunity to provide capital appreciation in the coming years.

I can’t predict when market declines like the one we’re experiencing now will occur, but I do know that declines like this feel horrible no matter what we do to prepare for them.

As Mike Tyson once said (in one of the greatest quotes ever), “everybody has a plan until they get punched in the face.”

Not only does our net worth fall along with the market, but the whole thing is magnified into far more of a catastrophe than it actually is by the media throngs and commentators that live for this kind of occurrence.

It gives me shivers just thinking about it (the media, that is).

As for the 10-20% decline? Not so much.

I know it feels horrible, but I’m about to show you a picture and tell you a story that’s going to get me — and hopefully you — through this period of chaos. For me, it’s a sort of happy place – not unlike the picture they told my wife to focus on at the hospital as she was giving birth to our first daughter (although it turned out an anesthetic haze was her happy place).

Here it is:

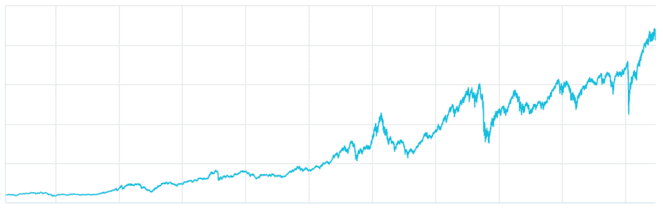

Fools, this is a picture of the S&P/TSX Composite Index dating back to January 1971. I realize there aren’t any labels, or a title, but there’s a reason for that. I feared they would cloud the picture.

There are two things to focus on:

- The upward sloping trajectory of the chart.

- The massive declines that have occurred, but were subsequently erased by simply riding them out.

We preach long-term investing in Fool Canada’s flagship investing service, Stock Advisor Canada, and this chart is the reason why.

Very few pundits accurately predict the massive sell-offs that are bound to occur, and fewer still (as in: no one) accurately predict them all. Because these declines are relatively unexpected, they cause panic, fear, and often lead to investors making horrible decisions, like liquidating at the point of maximum fear and locking in massive losses – potentially never to return to investing again.

But if you expect that these massive pullbacks will occur – because they always do — it reduces (not eliminates) the chances of panicking. And if you realize that the natural trajectory of the market is upward-sloping, a long-term mentality becomes the only strategy that effectively deals with these inevitable declines.

Let’s illustrate with a story…

John and the Index Fund

Consider a fictional investor named John. John plunked down $10,000 into an S&P/TSX Composite Index fund on June 5, 1995 (let’s assume he didn’t pay any fees, for the sake of simplicity).

John then quickly forgot that he ever made this purchase.

If John had been paying attention, he would have realized that five years after he made his initial investment, his egg had more than doubled, standing at $21,686.

Surely he’d have been tickled by this development. Instead, he had no idea.

By Oct. 9, 2002 and one massive, Nortel-fueled tech wreck later, John’s egg had cracked and stood at just $12,760. That’s a hair-loss-inducing decline of close to $10,000 in a little more than two years.

John’s stomach would surely have been in knots, at best. Instead, he had no idea.

Fast-forward to June 5, 2008, 13 years after the initial purchase was made. John’s investment had recovered nicely from the tech wreck, simply by him doing nothing, and now stood at $33,568.

A happy dance would have been in order. Instead, he had no idea.

In less than a year, that $33,568 became $16,953 as the financial crisis treated Mr. Market like a piñata.

Rather than John feeling battered and bruised and perhaps doing something rash — you guessed it — he had no idea.

Though it’s been somewhat of an arduous road, sprinkled with all the bad things mentioned in the opening, and then some, today, John’s holding would once again amount to a little more than $37,000 – more than doubling from those financial crisis lows.

By doing nothing – and I do mean nothing – except investing in the broad Canadian market and letting the underlying tow of the upward-sloping trajectory do its thing over the long term, John made a pretty nice chunk of cash.

This, Fools, is how to handle market pullbacks, and why we’re such proponents of long-term investing and the ability that it provides to generate handsome risk-adjusted returns.

It might seem counterintuitive, but doing nothing is often the best course of action.

Invest in Great Businesses and Hold Them Forever

If you MUST tinker and would like to prepare for the inevitable market crashes that are going to occur, allow me to make a suggestion: ensure that each position you currently own is one you’d be happy to own for 5 years.

Perhaps more importantly, ensure that each stock holding is a company that is sure to survive the next 5 years, no matter what gets thrown at it.

Which is to say, fill your portfolio with businesses that have low financial risk, generate ample and consistent cash flows, and sport an appealing competitive position.

My final suggestion? If the idea of finding quality businesses and investing in them for the medium to long-term is appealing to you, why not check out Stock Advisor Canada?

My team and I have been recommending Canadian and U.S. stocks since 2013, and we’re beating the market by nearly 2x in that time.

We recommend two new stocks every month with detailed analysis, and I think you’ll find it’s an excellent bang for your buck.

To your wealth,

Iain Butler, CFA

Chief Investment Adviser, Motley Fool Canada